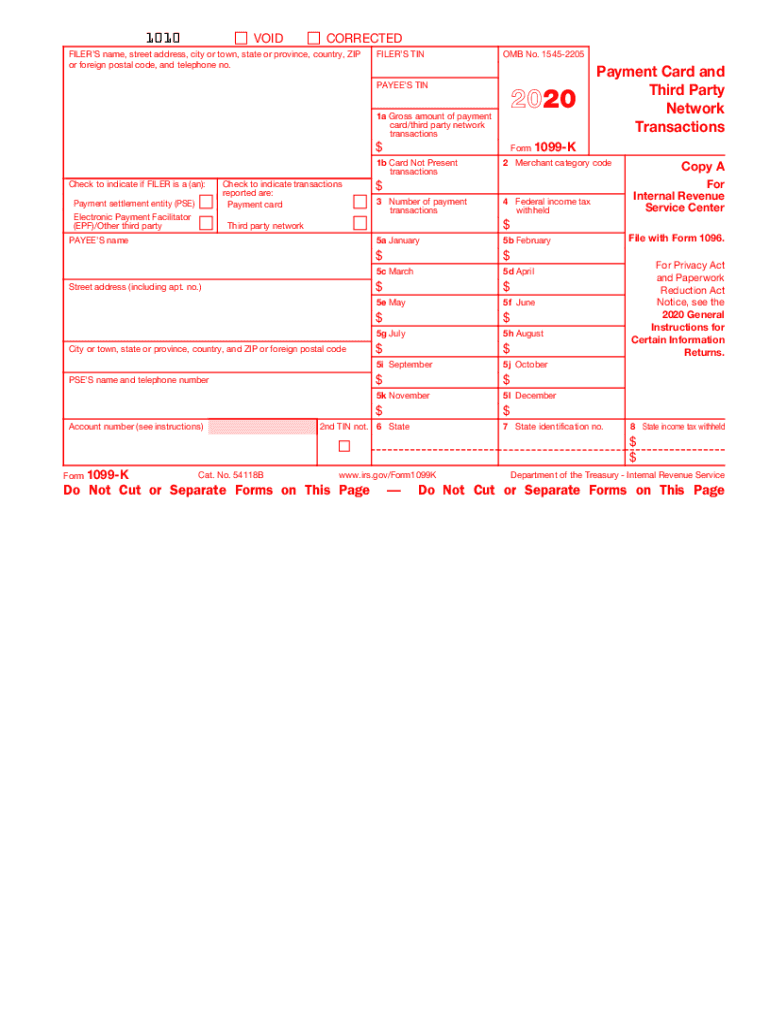

What is Form 1099-K?

Form 1099-K (Payment Card and Third Party Network Transactions) is used by PSE (payment settlement entities) to give a written account of online payment transactions processed by these entities. It requires credit card companies and third-party processors such as PayPal (1099 k PayPal) and eBay (1099 K eBay) to report the payment transactions they process on behalf of retailers. Retailers will receive forms from each payment settlement entity receiving payments in settlement of payment transactions. The 1099-K Form provides information about the gross amount of the payment transactions that must be reported.

Who receives 1099-K form?

Every retailer who accepts online credit card payments will receive Form 1099-K at the end of the year if the sales volume through credit card companies is:

- Over $600/year (with no minimum number of transactions) for returns for calendar years after 2020

- Over $20,000/year (with over 200 transactions) for returns for calendar years prior to 2021.

What information is included in 1099-K?

Form 1099-K includes the following information: the payee’s TIN, name, address, and the gross amount of reportable payment transactions broken into 12 months for the calendar year.

What to do if I receive IRS 1099 K Form in 2021?

Review your online payment receipts and make sure the information in Form 1099-K is accurate. Then, include this information in your tax return forms in the appropriate lines.

Is 1099-K accompanied by others forms?

You receive Form 1099-K from third-party merchants (payment settlement entities) where your transactions were managed. Use the information from this form to prepare for the upcoming tax season. Report your 1099-K payments on Schedule C on a separate revenue line. You can check your total business income by comparing the total revenue on Schedule C to your profit and loss statement from your accounting system. Many companies still produce a 1099-MISC form used before implementing the 1099 K. Keep detailed records so you can deduct any payments reported on the 1099-MISC.

When do I receive Form 1099 K?

You should receive copies of Form 1099-K by the end of January. Report transaction information to the IRS by the last day of February.