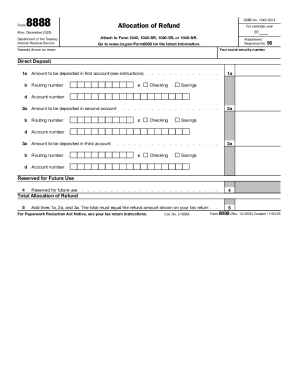

IRS 8888 2019 free printable template

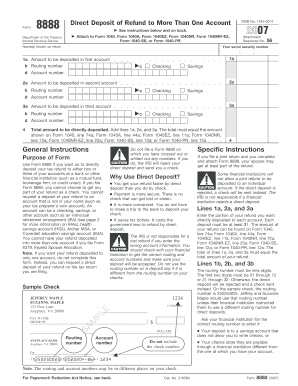

Instructions and Help about IRS 8888

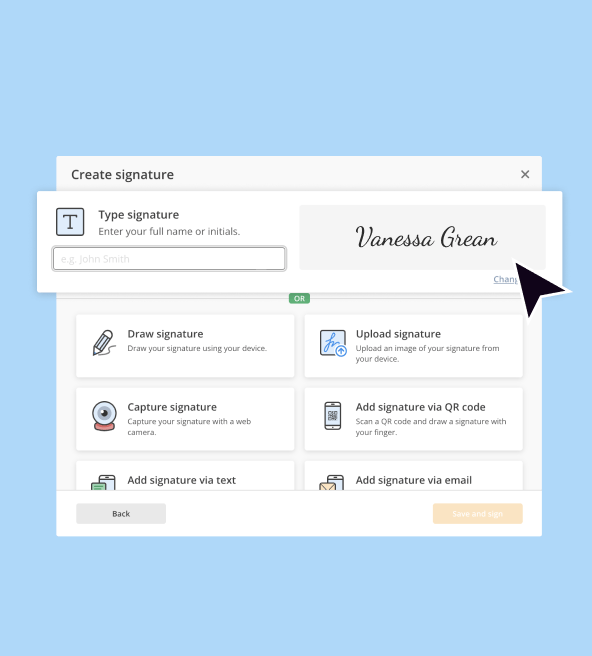

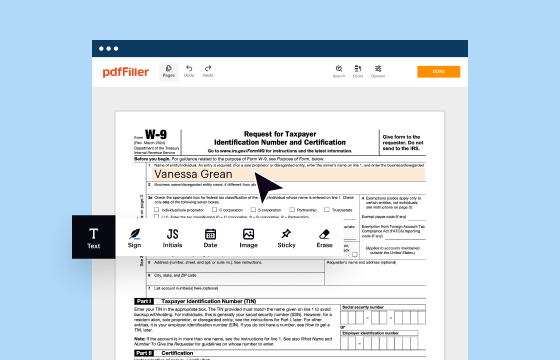

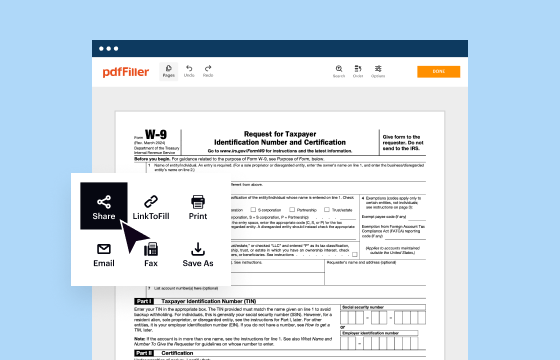

How to edit IRS 8888

How to fill out IRS 8888

About IRS 8 previous version

What is IRS 8888?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8888

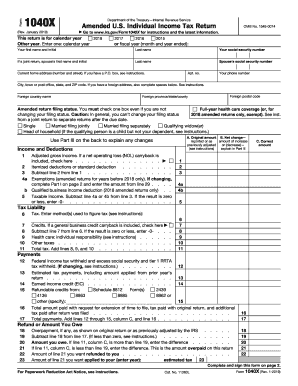

What should I do if I discover an error on my submitted IRS 8888 form?

If you notice mistakes on your IRS 8888 after submission, you can correct them by filing an amended return. This process involves completing Form 1040-X, which allows you to adjust information as per IRS guidelines. Ensure you follow the correct steps, as mistakes can delay processing and refunds.

How can I track the status of my IRS 8888 submission?

To verify the receipt and processing of your IRS 8888 submission, use the IRS 'Where’s My Refund?' tool available on their website. This tool provides real-time updates on your filing status and refund timelines, helping you stay informed throughout the process.

What legal considerations should I keep in mind when filing IRS 8888?

When filing IRS 8888, it’s important to understand the acceptability of e-signatures based on IRS regulations. Maintain data security by using reputable e-filing software, and be aware of the record retention period, which typically lasts for three years from the date of your filing.

Are there any common errors when filing IRS 8888 that I should avoid?

Common errors include incorrect Social Security Numbers, mismatched names, and forgetting to sign the form. To avoid these mistakes, double-check all details for accuracy before submission and consider using e-filing for automatic validation checks.

What should I do if I receive a notice from the IRS regarding my IRS 8888 submission?

If you receive a notice or letter from the IRS concerning your IRS 8888, carefully read the communication to understand the issue. Gather necessary documentation and respond promptly, providing any requested information to resolve the matter efficiently.

See what our users say