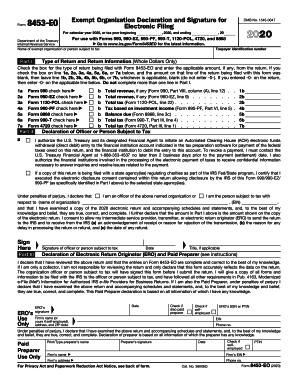

IRS 8453-EO 2019 free printable template

Show details

You can send us comments from www.irs.gov/FormComment. Or you can write to the Internal Revenue Service Tax Forms and Publications Division 1111 Constitution Ave. NW IR-6526 Washington DC 20224. Don t send Form 8453-EO to this address. Instead see How To File on this page. For details see Form 8879-EO IRS e-file Signature Authorization for an Exempt Organization. Future Developments For the latest information about developments related to Form 8453-EO and its instructions such as legislation...enacted after they were published go to www.irs.gov/Form8453EO. Therefore not considered filed unless either Form 8453-EO is signed by an organization officer scanned into a PDF file and transmitted with the return or The return is filed through an ERO and Form 8879-EO is used to select a PIN that is used to electronically sign the return. The officer s signature allows the IRS to disclose to the ISP ERO and/or transmitter An acknowledgment that the IRS has accepted the organization s The...reason s for a delay in processing the return or refund. Date Signature of officer Sign Here Title I declare that I have reviewed the above organization s return and that the entries on Form 8453-EO are complete and correct to the best of my knowledge. If I am only a collector I am not responsible for reviewing the return and only declare that this form accurately reflects the data on the return. The organization officer will have signed this form before I submit the return. I will give the...officer a copy of all forms and information to be filed with the IRS and have followed all other requirements in Pub. An ERO may sign the Form 8453-EO by rubber stamp mechanical device or computer software program. The alternative method of signing must include either a facsimile of the individual ERO s signature or of the ERO s printed name. Use of PTIN Paid preparers. Anyone who is paid to prepare the organization s return must enter their PTIN in Part III. The PTIN entered must have been...issued after September 27 2010. For information on applying for and receiving a PTIN see Form W-12 IRS Paid Preparer Tax Identification Number PTIN Application and Renewal or visit www.irs.gov/PTIN. EROs who aren t paid preparers. I further declare that the amount in Part I above is the amount shown on the copy of the organization s electronic return. I consent to allow my intermediate service provider transmitter or electronic return originator ERO to send the organization s return to the IRS...and to receive from the IRS a an acknowledgement of receipt or reason for rejection of the transmission b the reason for any delay in processing the return or refund and c the date of any refund. Date Signature of officer Sign Here Title I declare that I have reviewed the above organization s return and that the entries on Form 8453-EO are complete and correct to the best of my knowledge. The declaration of officer must be signed and dated by The president vice president treasurer assistant...treasurer chief accounting officer or Any other organization officer authorized to sign the organization s return. If this return contains instructions to the IRS to provide a copy ies of the return to a state agency ies regulating charities as part of the IRS Fed/State program the checkbox in Part II must be checked. ERO and Paid Preparer Note. If the return is filed online through an ISP and/or transmitter not using an ERO don t complete the ERO s Use Only section in Part III. ERO s...signature. A paid preparer if any must sign Form 8453-EO in the space for Paid Preparer Use Only.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8453-EO

How to edit IRS 8453-EO

How to fill out IRS 8453-EO

Instructions and Help about IRS 8453-EO

How to edit IRS 8453-EO

To edit IRS 8453-EO, you can utilize pdfFiller's editing tools. These tools allow you to modify text, add signatures, and insert necessary information seamlessly. Follow these steps to edit the form:

01

Upload the IRS 8453-EO form to pdfFiller.

02

Select the edit option to make changes in the form fields.

03

Save the edited version for your records.

How to fill out IRS 8453-EO

Filling out IRS 8453-EO involves several steps. This form is used by tax-exempt organizations that choose to file their annual information return electronically. The following steps indicate how to correctly complete the form:

01

Begin with entering the organization's name and Employer Identification Number (EIN).

02

Provide the name of the person authorized to sign the return.

03

Specify whether the organization is filing for the first time or if it has previously filed.

04

Indicate the types of tax return that the organization is submitting.

About IRS 8453-EO 2019 previous version

What is IRS 8453-EO?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8453-EO 2019 previous version

What is IRS 8453-EO?

IRS 8453-EO is an electronic signature authorization form specifically designed for tax-exempt organizations. This form is used to authenticate electronic filings of certain forms, generally the Form 990 series, which report information about the organization’s activities.

What is the purpose of this form?

The purpose of IRS 8453-EO is to allow electronic filing of forms while ensuring that the organization maintains an official record of authorization. This formalizes the electronic submission process and confirms that the information provided is true and accurate to the best of the signer’s knowledge.

Who needs the form?

IRS 8453-EO is required for tax-exempt organizations that file forms electronically, including the Form 990 or Form 990-EZ. Organizations that choose electronic submission must complete this form to affirm their authorization for the electronic filing of these returns.

When am I exempt from filling out this form?

Organizations do not need to fill out IRS 8453-EO if they are filing paper versions of their Form 990 series returns. Additionally, if a tax-exempt organization has not opted for electronic filing procedures, the form is not necessary.

Components of the form

The IRS 8453-EO consists of several key components: the organization's information, the authorized signer’s details, and the sections that specify the tax returns being filed. Each component must be accurately completed to ensure compliance with IRS guidelines.

What are the penalties for not issuing the form?

Failure to complete or submit IRS 8453-EO when filing electronically can result in penalties. The IRS may impose fines for late submissions or may not accept the electronic filing at all, which could lead to delays in processing the tax returns for the organization.

What information do you need when you file the form?

When filing IRS 8453-EO, you will need the organization's name, EIN, and the name and signature of the authorized individual. Additionally, information about the specific tax return being filed is required to ensure the accuracy of submissions.

Is the form accompanied by other forms?

IRS 8453-EO is typically accompanied by Form 990 or Form 990-EZ when filed electronically. It serves as the authorization for the electronic submission of these specific forms, confirming that the information provided is accurate and complete.

Where do I send the form?

If you are filing your return electronically, IRS 8453-EO does not need to be mailed physically. Instead, it is submitted electronically through authorized e-file providers using designated IRS e-filing systems.

See what our users say