IRS 1041-T 2019 free printable template

Show details

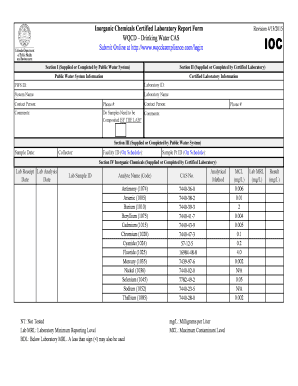

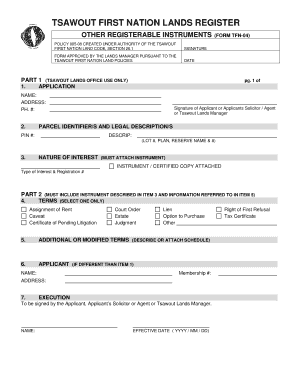

Otherwise file Form 1041-T separately. Filing Form 1041-T with Form 1041 doesn t change the due date for filing Form 1041-T. The fiduciary files Form 1041-T to make the election. Once made the election is irrevocable. How To File Attach Form 1041-T to Form 1041 U.S. Income Tax Return for Estates and Trusts only if you are making the election with Form 1041. Cat. No. 64305W Date Form 1041-T 2018 Page 2 General Instructions Line 1 Section references are to the Internal Revenue Code. See When To...File below for the due date for filing Form 1041-T. CAUTION When To File For the election to be valid a trust or decedent s estate must file Form 1041-T by the 65th day after the close of the tax year as shown at the top of the form. If the due date falls on a Saturday Sunday or legal holiday file on the next business day. Be sure to include it on Form 1041 Schedule B line 10. Future Developments For the latest information about developments related to Form 1041-T and its instructions such as...legislation enacted after they were published go to www.irs.gov/Form1041T. 19 min. Learning about the law or the form. Preparing the form. Copying assembling and sending the form to the IRS 4 min. If you have comments concerning the accuracy of these time estimates or suggestions for making Form 1041-T simpler we would be happy to hear from you. Form 1041-T Allocation of Estimated Tax Payments to Beneficiaries Under Code section 643 g Go to www.irs.gov/Form1041T for the latest information....Department of the Treasury For calendar year 2018 or fiscal year beginning Internal Revenue Service Name of trust or decedent s estate Fill In Fiduciary s Name and Address Only if You Are Filing This Form Separately and Not With Form 1041. For a 2018 calendar year Period Covered File the 2018 form for calendar year 2018 and fiscal years beginning in year fill in the tax year space at the top of the form. If you are located in Please mail to the Connecticut Delaware District of Columbia Georgia...Illinois Indiana Kentucky Maine Maryland Massachusetts Michigan New Hampshire New Jersey New York North Carolina Ohio Pennsylvania Rhode Island South Carolina Tennessee Vermont Virginia West Virginia Wisconsin Kansas City MO 64999 Alabama Alaska Arizona Arkansas California Colorado Florida Hawaii Idaho Iowa Kansas Louisiana Minnesota Mississippi Missouri Montana Nebraska Nevada New Mexico North Dakota Oklahoma Oregon South Dakota Texas Utah Washington Wyoming You can t allocate to a beneficiary...tax withheld from income such as withholding from lottery or other gambling winnings or from salary or pension payments reported on Form 1041. OMB No* 1545-1020 2018 and ending Employer identification number Name and title of fiduciary Telephone number optional Number street and room or suite no. If a P. O. box see instructions. City state and ZIP code If you are filing this form for the final year of the estate or trust check this box Total amount of estimated taxes to be allocated to...beneficiaries. Enter here and on Form 1041 line 25b Allocation to beneficiaries a No* d Amount of estimated tax payment allocated to beneficiary c Beneficiary s identifying number b Beneficiary s name and address e Proration percentage Total from additional sheet s.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1041-T

How to edit IRS 1041-T

How to fill out IRS 1041-T

Instructions and Help about IRS 1041-T

How to edit IRS 1041-T

To edit the IRS 1041-T tax form, start by obtaining the form in PDF format. Use pdfFiller’s tools to upload the document and utilize the editing features. You can fill in your information directly on the form, ensuring accuracy and ease of completion. Once you have made the necessary edits, save the document for future reference or submission.

How to fill out IRS 1041-T

Filling out the IRS 1041-T requires attention to detail. Begin by downloading the form from the IRS website or accessing it via pdfFiller. Follow these steps to complete the form:

01

Enter the name and address of the estate or trust.

02

Provide the Employer Identification Number (EIN).

03

List the distributions made to beneficiaries.

04

Confirm whether the distributions are taxable.

05

Sign and date the form before submission.

Ensure all fields are complete before finalizing the form to avoid processing delays.

About IRS 1041-T 2019 previous version

What is IRS 1041-T?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1041-T 2019 previous version

What is IRS 1041-T?

IRS 1041-T is a tax form used for reporting distributions to beneficiaries of an estate or trust. It specifically informs the IRS about the amount of income distributed, which impacts the beneficiaries’ individual tax liabilities. This form is essential for managing the tax responsibilities of an estate or trust.

What is the purpose of this form?

The IRS 1041-T serves to report distributions of income to beneficiaries and ensures proper taxation. The form enables the IRS to track how much taxable income is passed on to beneficiaries, which is critical for tax compliance and transparency.

Who needs the form?

The form must be filed by fiduciaries of estates or trusts that distribute income to one or more beneficiaries. If the estate or trust has made distributions during the tax year, it is required to complete the IRS 1041-T, regardless of the amount distributed.

When am I exempt from filling out this form?

You may be exempt from filing the IRS 1041-T if there were no distributions made to beneficiaries during the tax year. Additionally, if the estate or trust does not have any taxable income, the form may not be necessary. However, it is important to document these exemptions properly.

Components of the form

The IRS 1041-T includes various sections, such as the identity of the trust or estate, the recipients of the distributions, and information on the income reported. Each component must be filled out accurately to ensure compliance with IRS regulations and avoid penalties.

Due date

The IRS 1041-T is due on the 15th day of the fourth month following the close of the tax year. For most estates and trusts that follow the calendar year, this means the due date is April 15. It is crucial to meet this deadline to avoid potential fines.

What are the penalties for not issuing the form?

Failing to issue or file the IRS 1041-T can result in significant penalties. The IRS may impose fines based on the duration of the delay and the amount of tax owed. Therefore, it is essential to complete and submit the form on time to avoid unnecessary financial repercussions.

What information do you need when you file the form?

When filing the IRS 1041-T, you will need the estate or trust's name, address, EIN, and detailed records of all distributions made to beneficiaries. Additionally, information on taxable and non-taxable amounts is required to accurately complete the form.

Is the form accompanied by other forms?

Yes, the IRS 1041-T may need to be filed alongside the IRS Form 1041, the U.S. Income Tax Return for Estates and Trusts. Depending on the specific situation, additional forms might also be necessary, such as Form 1099 for reporting beneficiary income.

Where do I send the form?

The completed IRS 1041-T must be sent to the IRS at the address designated for estate and trust returns. This address may vary based on your location, so it is important to check the IRS website for the correct mailing address based on your state or region.

See what our users say