Get the free Client Credit Card Pre-Authorization Form OPTIONS PA ...

Show details

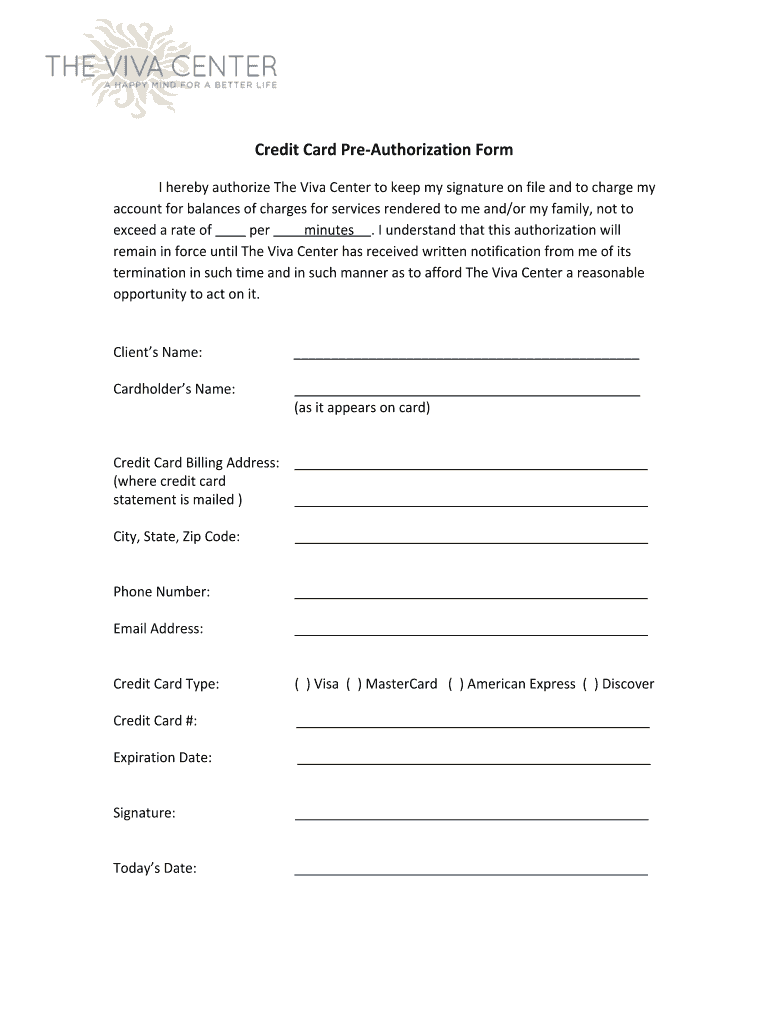

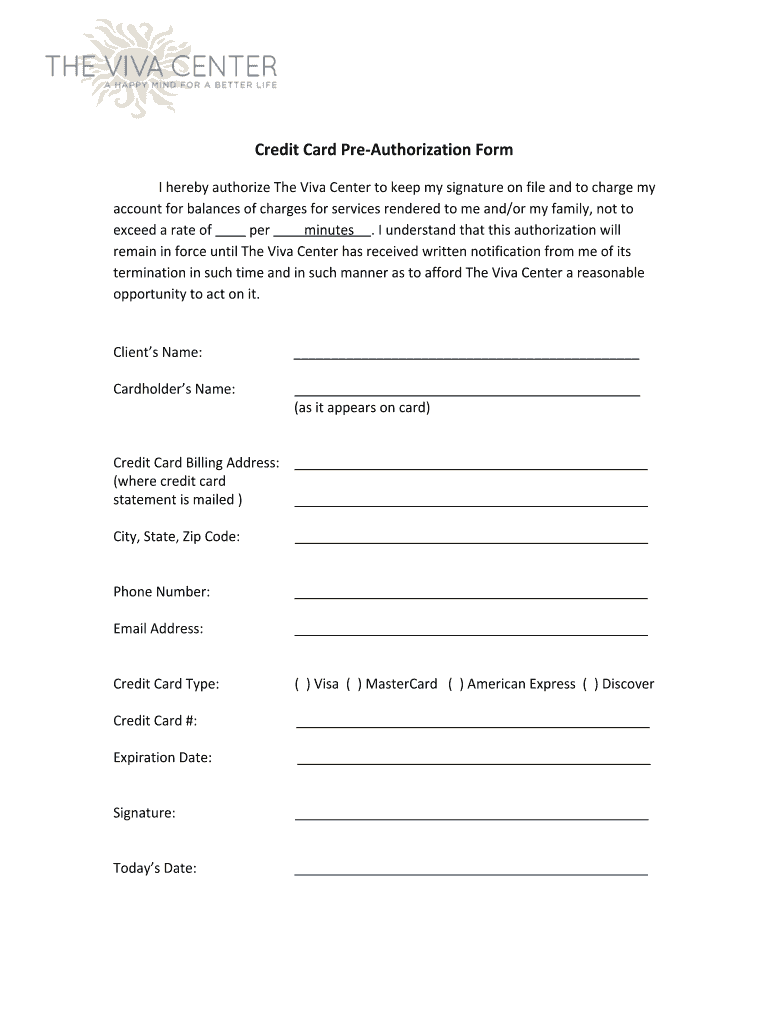

Credit Card PreAuthorization Form I hereby authorize The Viva Center to keep my signature on file and to charge my account for balances of charges for services rendered to me and/or my family, not

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign client credit card pre-authorization

Edit your client credit card pre-authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your client credit card pre-authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing client credit card pre-authorization online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit client credit card pre-authorization. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out client credit card pre-authorization

How to fill out client credit card pre-authorization

01

Start by gathering all the necessary information and documentation from the client, such as their full name, contact details, and credit card details.

02

Ensure that the credit card has sufficient funds to cover any potential charges or fees before proceeding with the pre-authorization.

03

Use a secure and reputable payment gateway or POS system to process the pre-authorization. Enter the required details, including the amount to be pre-authorized and the client's credit card information.

04

Verify the client's identity by requesting additional identification documents or asking security questions if necessary.

05

Clearly communicate the terms and conditions of the pre-authorization to the client, including the duration of the hold and any potential charges that may be incurred if the pre-authorization is released or cancelled.

06

Once the pre-authorization is successfully processed, inform the client about the amount that has been pre-authorized and provide them with a receipt if applicable.

07

Monitor the pre-authorization hold to ensure its accuracy and release the hold promptly once the transaction or service has been completed, or as per the agreed-upon time frame.

08

In the event of any disputes or issues, follow the established protocols and procedures to resolve them effectively and fairly.

Who needs client credit card pre-authorization?

01

Various businesses and service providers may require client credit card pre-authorization to mitigate potential risks and ensure payment security. Examples of industries that commonly utilize client credit card pre-authorization include:

02

- Hotels and hospitality establishments, to cover potential room charges, additional services, or damages.

03

- Car rental companies, to protect against damage to the rented vehicle or additional charges.

04

- Airlines, to secure reservations and guarantee payment for services like ticket upgrades or baggage fees.

05

- Service-based businesses, such as spas, salons, and fitness clubs, to secure appointments and cover potential no-show fees.

06

- Online merchants, to protect against fraudulent purchases or chargebacks.

07

- Event organizers or ticketing agencies, to secure ticket reservations and prevent potential ticket scalping.

08

In summary, any business or service provider that wants to ensure payment security and protect against potential losses or liabilities may require client credit card pre-authorization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify client credit card pre-authorization without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including client credit card pre-authorization. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in client credit card pre-authorization?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your client credit card pre-authorization and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the client credit card pre-authorization form on my smartphone?

Use the pdfFiller mobile app to fill out and sign client credit card pre-authorization. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is client credit card pre-authorization?

Client credit card pre-authorization is the process of obtaining approval from a credit card issuer before a transaction takes place.

Who is required to file client credit card pre-authorization?

Merchants or businesses that wish to ensure payment for goods or services using a client's credit card.

How to fill out client credit card pre-authorization?

To fill out client credit card pre-authorization, merchants need to obtain authorization from the client to process the payment and collect necessary credit card information.

What is the purpose of client credit card pre-authorization?

The purpose of client credit card pre-authorization is to ensure that funds are available for payment and protect merchants from potential payment issues.

What information must be reported on client credit card pre-authorization?

Client's name, credit card number, expiration date, security code, and amount to be authorized.

Fill out your client credit card pre-authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Client Credit Card Pre-Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.