Get the free Business Overdraft - Start Your Application Online ...

Show details

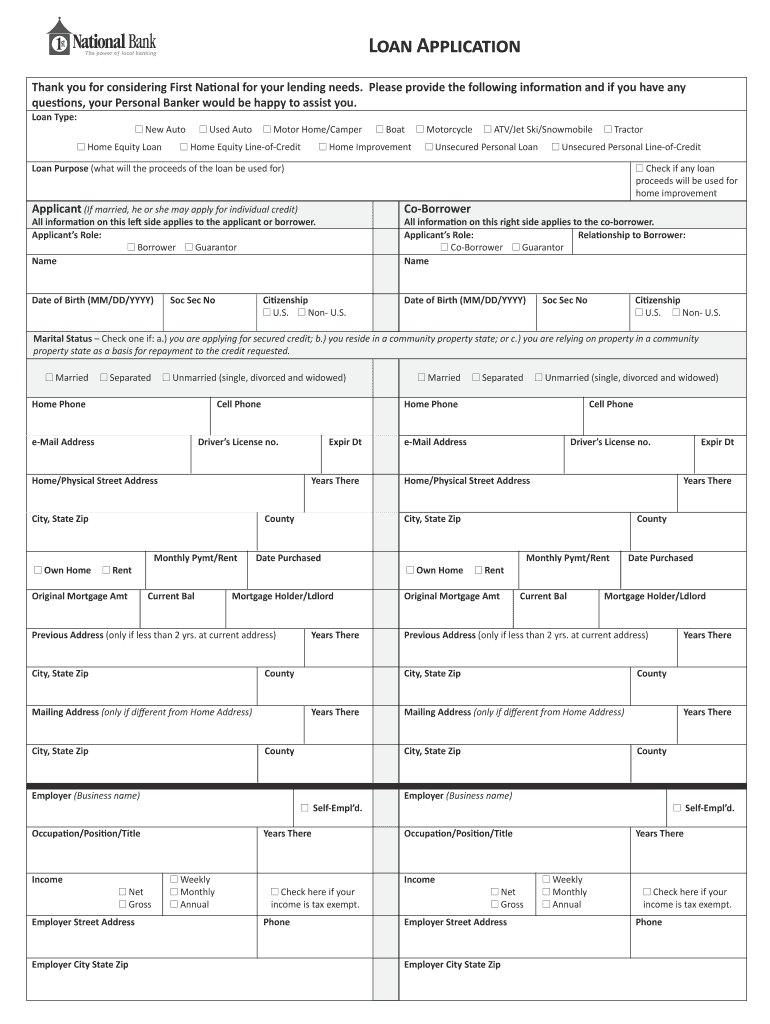

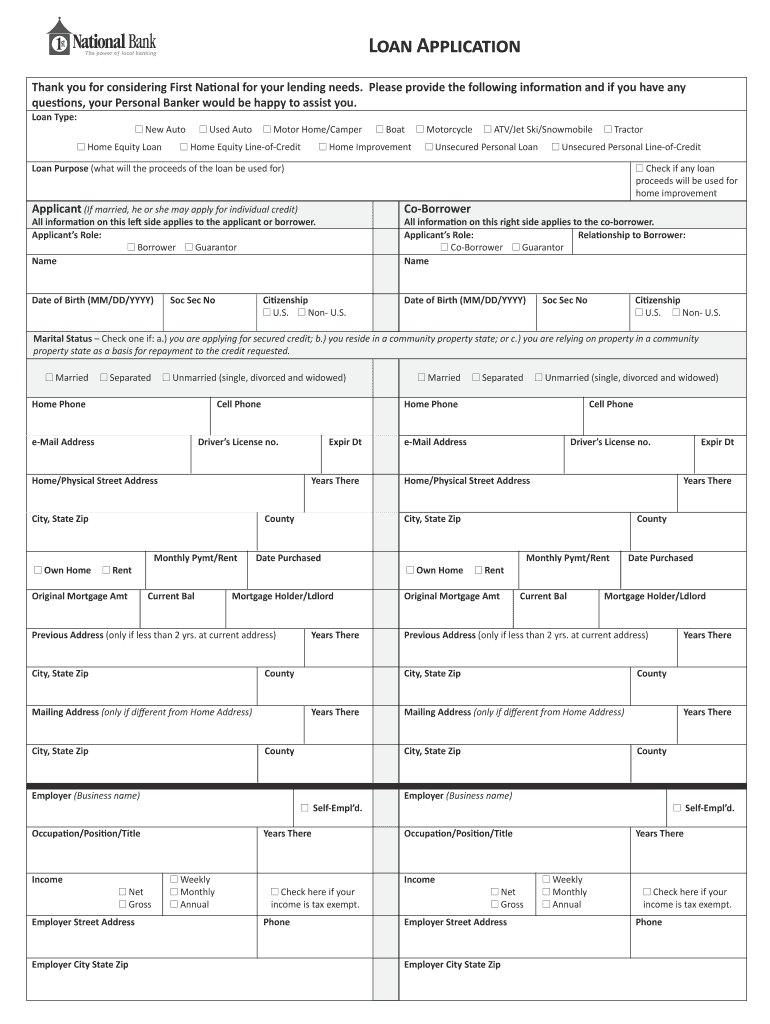

Loan Application

Thank you for considering First National for your lending needs. Please provide the following information and if you have any

questions, your Personal Banker would be happy to assist

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business overdraft - start

Edit your business overdraft - start form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business overdraft - start form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business overdraft - start online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business overdraft - start. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business overdraft - start

How to fill out business overdraft - start

01

To fill out a business overdraft, you need to follow these steps:

02

Understand the purpose: Determine why you need a business overdraft and the specific requirements for your business.

03

Choose the right bank: Research different banks and compare their interest rates, fees, and terms for business overdrafts.

04

Gather required documents: Prepare necessary documents such as proof of business ownership, financial statements, and identification documents.

05

Schedule a meeting: Contact the chosen bank and schedule a meeting with a representative to discuss the overdraft application process.

06

Provide necessary information: During the meeting, provide information about your business, its financial history, and the amount you need as an overdraft.

07

Fill out the application: Complete the application form provided by the bank, ensuring accurate and detailed information.

08

Submit required documents: Along with the application form, submit all the required documents to support your business's financial credibility.

09

Wait for approval: The bank will review your application and documents to determine if you qualify for a business overdraft.

10

Follow up: If necessary, follow up with the bank to inquire about the status of your application and any additional requirements.

11

Understand the terms: Once approved, carefully read and understand the terms and conditions of the business overdraft, including interest rates, repayment duration, and any penalties for non-compliance.

12

Utilize the overdraft responsibly: Use the overdraft funds wisely for your business's financial needs and make timely repayments to avoid additional charges or negative impacts on your credit rating.

Who needs business overdraft - start?

01

Business overdrafts are beneficial for various individuals and organizations, including:

02

Small businesses and startups: Often, these businesses face cash flow challenges and may need additional funds to manage their day-to-day expenses, purchase inventory, or cover unexpected expenses.

03

Seasonal businesses: Businesses that experience fluctuations in sales volume due to seasonal demands may require an overdraft to maintain their operations during slower periods.

04

Businesses with irregular income: If your business receives income irregularly or depends on sporadic payments, a business overdraft can provide the necessary financial buffer to bridge gaps between payments.

05

Businesses with unexpected expenses: Unanticipated expenses can arise in any business, and having an overdraft allows you to cover these costs without disrupting your cash flow.

06

Business owners seeking flexibility: A business overdraft provides flexible access to funds, allowing you to withdraw as needed without applying for additional loans or credit facilities.

07

Businesses looking to expand: If your business is looking to expand its operations, invest in new equipment, or hire additional staff, a business overdraft can provide the necessary capital to support growth.

08

Remember to consult with a financial advisor or professional to determine if a business overdraft is suitable for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute business overdraft - start online?

pdfFiller has made filling out and eSigning business overdraft - start easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the business overdraft - start electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your business overdraft - start in minutes.

Can I edit business overdraft - start on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share business overdraft - start from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is business overdraft - start?

A business overdraft is a short-term loan that can help a business cover unexpected expenses or manage fluctuations in cash flow.

Who is required to file business overdraft - start?

Businesses that have a line of credit or overdraft facility with a financial institution are required to file business overdraft - start.

How to fill out business overdraft - start?

To fill out business overdraft - start, businesses need to provide details about the amount borrowed, interest rate, repayment terms, and any fees associated with the overdraft.

What is the purpose of business overdraft - start?

The purpose of a business overdraft is to provide short-term financing for businesses to manage cash flow challenges or unexpected expenses.

What information must be reported on business overdraft - start?

Businesses must report details about the overdraft facility, including the amount borrowed, interest rates, repayment terms, and any fees incurred.

Fill out your business overdraft - start online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Overdraft - Start is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.