Get the free us rs

Show details

Oxfords DAILY us rs mo yea o f n iINFO50Line ads 50p/word. (min. 10) + VAT Box ads 1012/cm. (min. 3 cm) +Fatwa.daily info.co.issue No. 8527Next issue: Tue 22nd July. Deadline: 10am, Mon 21st July.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us rs

Edit your us rs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us rs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us rs online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit us rs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us rs

How to fill out US Rs:

01

Start by gathering all the necessary information such as your personal details, employment history, and educational background.

02

Open the US Rs form and carefully read through the instructions to ensure you understand each section.

03

Begin filling out the form by providing your name, address, and contact information in the designated fields.

04

Proceed to the employment history section and include details of your previous jobs, including the dates of employment, company names, and job titles.

05

If applicable, provide information about your educational background, including the names of schools attended and degrees earned.

06

Make sure to review and double-check all the information you have entered to ensure accuracy and completeness.

07

If you have any questions or need assistance while filling out the US Rs form, consider reaching out to a professional or referring to the provided instructions.

Who needs US Rs?

01

US citizens: Any US citizen who is seeking employment or applying for educational opportunities may need to fill out US Rs. This includes individuals who are looking for job opportunities within the country or applying to educational institutions within the US.

02

Non-US citizens: Non-US citizens who are legally authorized to work in the United States may also need to fill out US Rs as part of their employment application process. This can include individuals who hold permanent residency (green card holders), individuals on work visas, or individuals seeking to change their immigration status.

03

Educational institutions: US Rs may also be required by educational institutions to evaluate an applicant's qualifications and academic background. This includes universities, colleges, and other educational establishments that require detailed information about an applicant's education and employment history.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

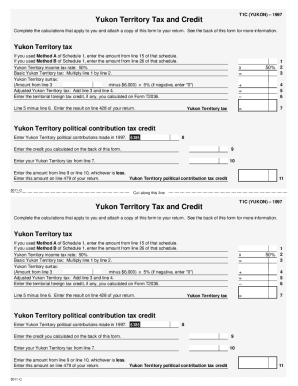

What is us rs?

US RS stands for United States Revenue Service. It is the tax agency responsible for collecting federal taxes in the United States.

Who is required to file us rs?

Individuals or entities that have taxable income in the United States are required to file US RS.

How to fill out us rs?

US RS forms can be filled out online on the official website of the United States Revenue Service or through a tax preparation software.

What is the purpose of us rs?

The purpose of US RS is to ensure that individuals and entities pay their fair share of taxes to fund government services and programs.

What information must be reported on us rs?

US RS forms typically require information on income, deductions, credits, and tax payments.

How can I edit us rs from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including us rs, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send us rs to be eSigned by others?

When your us rs is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit us rs on an Android device?

With the pdfFiller Android app, you can edit, sign, and share us rs on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your us rs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Rs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.