Get the free wage rates affected when the wage determination for the - US ... - transportation ky

Show details

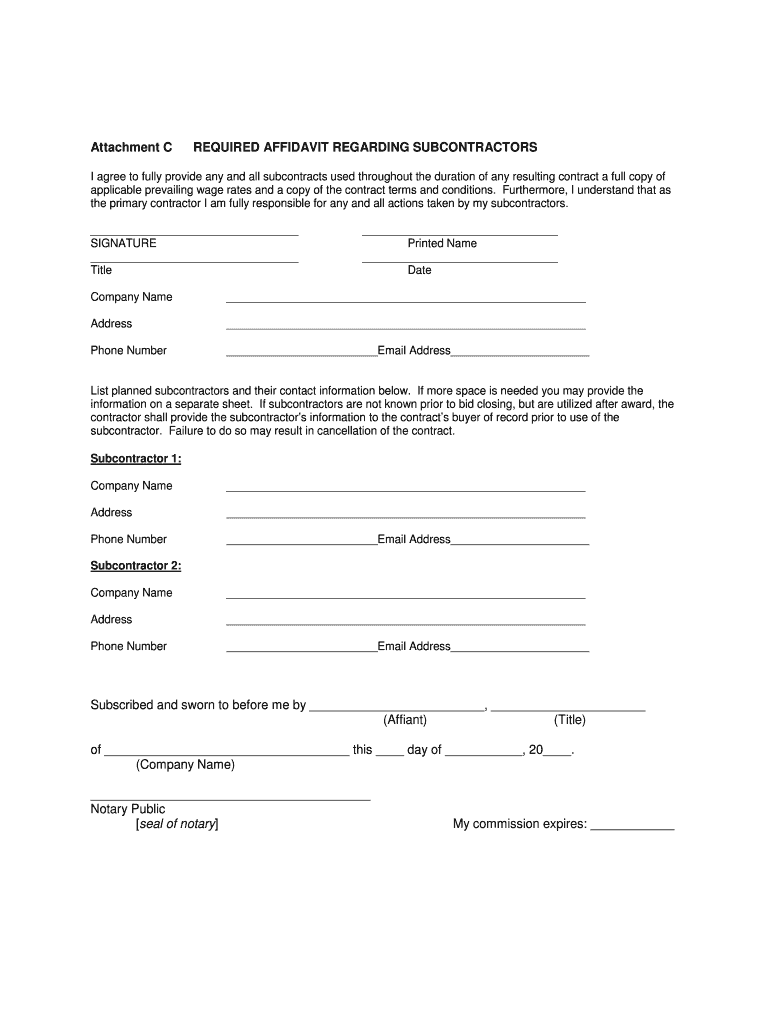

Attachment REQUIRED AFFIDAVIT REGARDING SUBCONTRACTORS agree to fully provide any and all subcontracts used throughout the duration of any resulting contract a full copy of applicable prevailing wage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wage rates affected when

Edit your wage rates affected when form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wage rates affected when form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wage rates affected when online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wage rates affected when. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wage rates affected when

How to fill out wage rates affected when

01

To fill out wage rates affected when, follow these steps:

02

Determine the type of wage rate you need to fill out (e.g. hourly rate, weekly rate, monthly rate).

03

Identify the factors that affect the wage rate, such as changes in minimum wage laws or company policies.

04

Gather the necessary information, including the previous wage rate and the applicable changes or adjustments.

05

Calculate the new wage rate by applying the relevant changes to the previous rate.

06

Fill out the appropriate forms or documents required by your employer or the relevant labor authorities.

07

Review the filled-out form for accuracy and completeness.

08

Submit the completed form to the designated person or department responsible for wage rate adjustments.

09

Keep a copy of the filled-out form for your records.

10

Monitor any further updates or changes regarding wage rates affected when to ensure compliance and timely adjustments.

11

Remember to consult with your employer or HR department if you have any specific questions or concerns regarding filling out wage rates affected when.

Who needs wage rates affected when?

01

Wage rates affected when may be needed by the following individuals or entities:

02

- Employers or business owners who need to adjust employee wages due to changes in laws, policies, or economic factors.

03

- Human Resources (HR) departments responsible for managing employee compensation and ensuring compliance.

04

- Employees who require information on how their wages may be affected by various factors.

05

- Labor authorities or government agencies involved in monitoring and regulating wage rates.

06

Having accurate and up-to-date information on wage rates affected when is essential for fair compensation practices, compliance with labor laws, and informed decision-making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in wage rates affected when?

The editing procedure is simple with pdfFiller. Open your wage rates affected when in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I fill out wage rates affected when on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your wage rates affected when, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete wage rates affected when on an Android device?

Complete your wage rates affected when and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is wage rates affected when?

Wage rates are affected when there are changes in the minimum wage, cost of living adjustments, or any other factors that impact how much an employee is paid.

Who is required to file wage rates affected when?

Employers are required to file wage rates affected when there are changes that impact the wages of their employees.

How to fill out wage rates affected when?

Employers can fill out wage rates affected when by updating their payroll system, informing employees of any changes, and ensuring compliance with any new regulations.

What is the purpose of wage rates affected when?

The purpose of wage rates affected when is to ensure that employees are paid fairly and accurately based on any changes that may impact their wages.

What information must be reported on wage rates affected when?

Employers must report any changes in minimum wage, cost of living adjustments, or other factors that impact the wages of their employees.

Fill out your wage rates affected when online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wage Rates Affected When is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.