Get the free Difference Between Claims-Made and Occurrence Policies

Show details

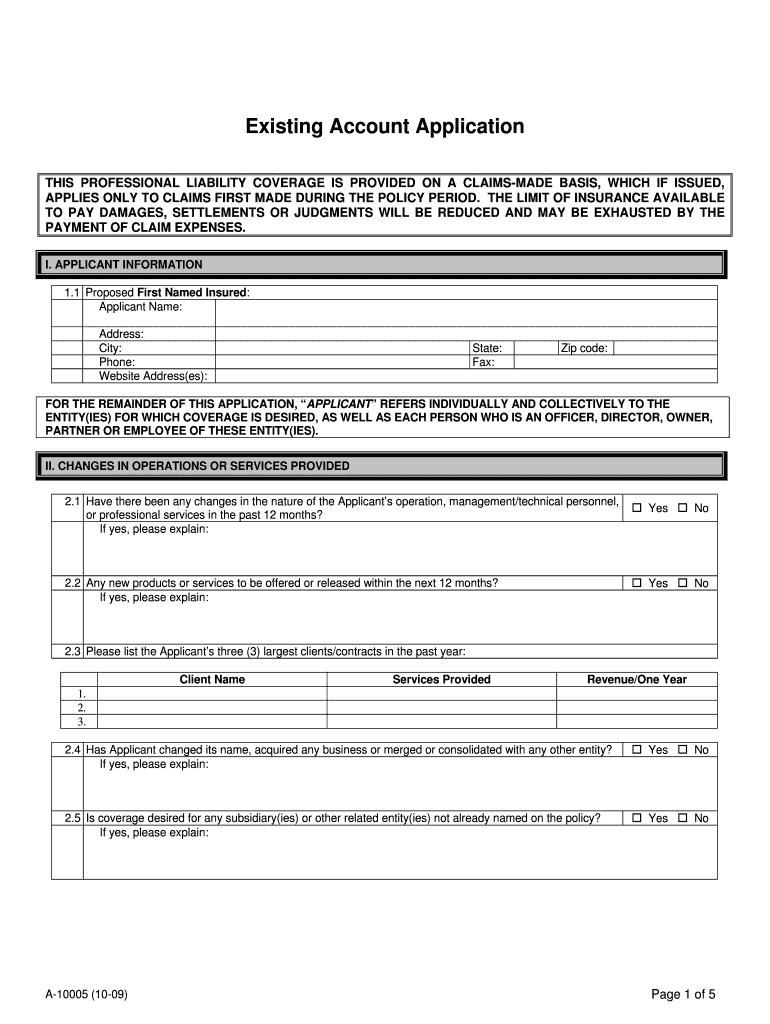

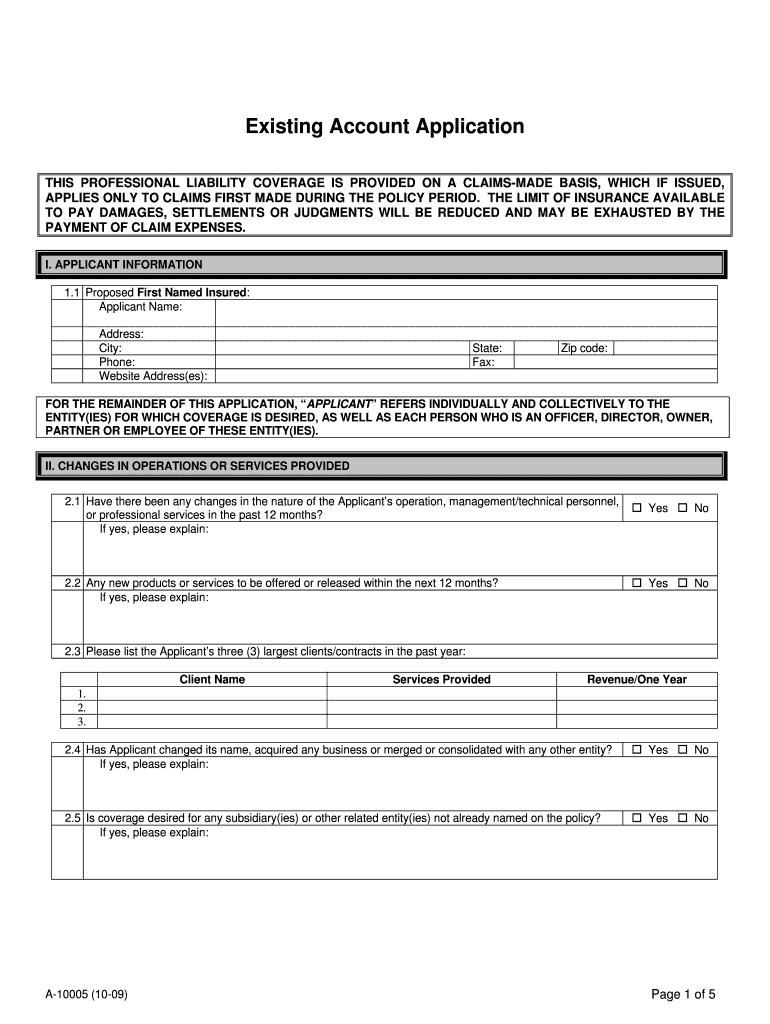

Existing Account Application

THIS PROFESSIONAL LIABILITY COVERAGE IS PROVIDED ON A CLASSMATE BASIS, WHICH Is ISSUED,

APPLIES ONLY TO CLAIMS FIRST MADE DURING THE POLICY PERIOD. THE LIMIT OF INSURANCE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign difference between claims-made and

Edit your difference between claims-made and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your difference between claims-made and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing difference between claims-made and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit difference between claims-made and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out difference between claims-made and

How to fill out difference between claims-made and

01

To fill out the difference between claims-made and occurrence insurance policies, follow these steps:

02

Understand the concept: Claims-made policies cover only claims made during the policy period, while occurrence policies cover claims made for incidents that occurred during the policy period, regardless of when the claim is filed.

03

Review policy terms: Read the terms of the insurance policies to understand the coverage, limitations, and exclusions for both claims-made and occurrence policies.

04

Evaluate your risk exposure: Assess the nature of your business or activity to determine the potential risks and frequency of claims.

05

Consider the cost: Compare the premiums and costs associated with claims-made and occurrence policies to determine the affordability and value for your specific needs.

06

Consult with an insurance expert: Seek guidance from an insurance professional or broker who can provide personalized advice based on your specific circumstances.

07

Make an informed decision: Based on your evaluation, choose the insurance policy type that best suits your risk profile and financial capabilities.

08

Fill out the application: Once you have decided on the policy type, complete the application form by providing accurate information about your business, activities, and requested coverage.

09

Submit the application: After completing the form, submit it to the insurance company or agent along with any supporting documents or fees that may be required.

10

Review the policy: Once approved, carefully review the issued policy to ensure it accurately reflects the coverage and terms you agreed upon.

11

Keep documentation: Maintain a copy of the policy, including any endorsements or amendments, for future reference or in case of any disputes or claims.

Who needs difference between claims-made and?

01

The difference between claims-made and occurrence insurance policies is relevant to:

02

- Individuals or businesses seeking professional liability insurance, such as doctors, lawyers, architects, or consultants.

03

- Companies or organizations that face potential liabilities or risks associated with their operations.

04

- Entities involved in activities that may lead to claims or lawsuits, such as construction, healthcare, legal services, or manufacturing.

05

- Individuals or businesses with a history of claims or lawsuits and need specific coverage for future occurrences.

06

- Insurance professionals, brokers, or agents who need to understand the differences between policies to provide appropriate recommendations to their clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find difference between claims-made and?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the difference between claims-made and. Open it immediately and start altering it with sophisticated capabilities.

How do I execute difference between claims-made and online?

With pdfFiller, you may easily complete and sign difference between claims-made and online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit difference between claims-made and online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your difference between claims-made and to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is difference between claims-made and?

Claims-made insurance coverage is a type of policy that only covers claims made during the policy period, regardless of when the event actually occurred. Occurrence-based insurance coverage, on the other hand, covers events that occurred during the policy period, regardless of when the claim is made.

Who is required to file difference between claims-made and?

Insurance policy holders or their designated representatives are required to file the difference between claims-made and occurrence-based insurance coverage.

How to fill out difference between claims-made and?

To fill out the difference between claims-made and occurrence-based insurance coverage, policy holders must accurately report the policy type and details of any claims made within the policy period.

What is the purpose of difference between claims-made and?

The purpose of difference between claims-made and is to clarify the coverage provided by the insurance policy and ensure that claims are handled in a timely and accurate manner.

What information must be reported on difference between claims-made and?

Policy holders must report the type of insurance coverage (claims-made or occurrence-based) and any claims filed during the policy period.

Fill out your difference between claims-made and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Difference Between Claims-Made And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.