Get the free 3r

Show details

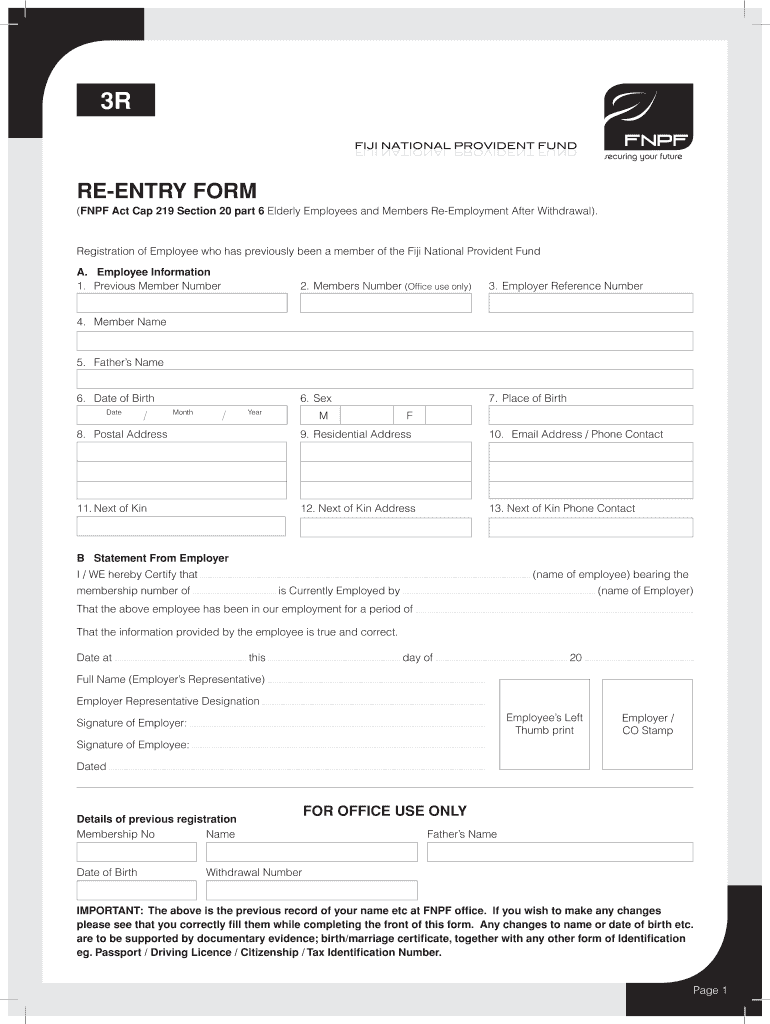

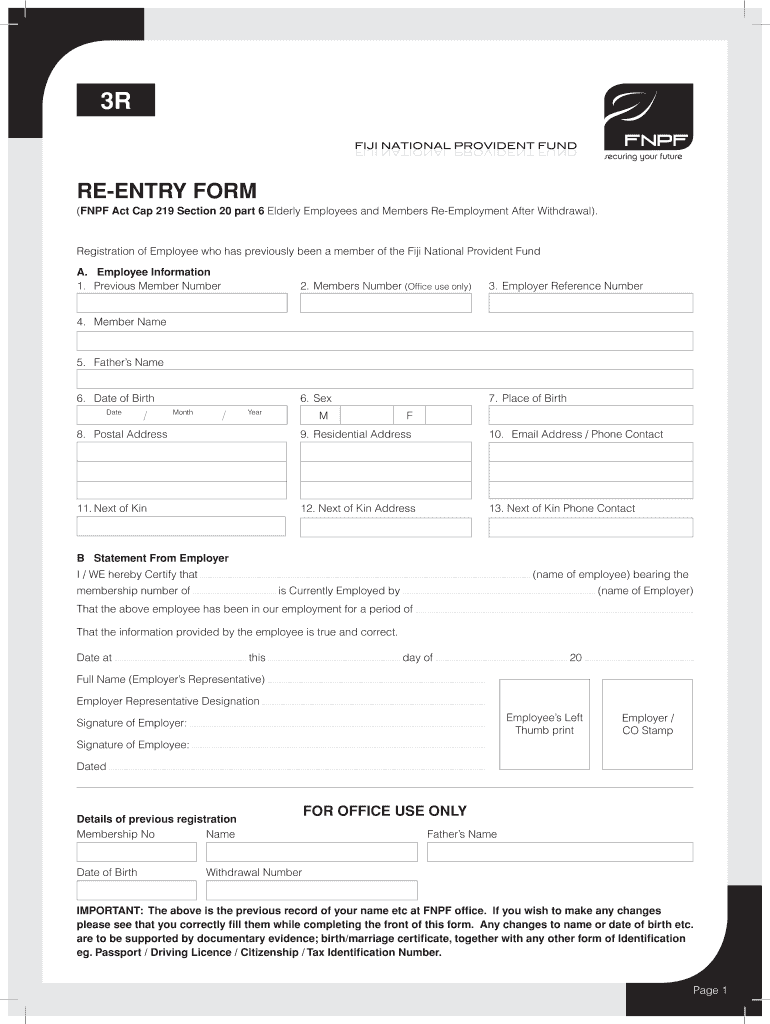

Este formulario se utiliza para la re-registro de empleados que han sido miembros del Fondo Nacional de Providencia de Fiji que desean reincorporarse después de haber realizado una retirada.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiji national provident fund forms

Edit your 3r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

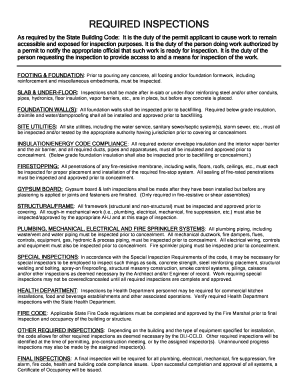

Editing fnpf forms online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fnpf forms. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3r

How to fill out 3r

01

Gather all the necessary information required for filling out the 3R form.

02

Begin by entering your personal details, including your name, address, and contact information.

03

Provide the specific information related to the reason for completing the 3R form.

04

Attach any supporting documents if required.

05

Review the form for accuracy and completeness before submission.

06

Submit the completed 3R form as per the specified guidelines.

Who needs 3r?

01

Individuals who need to report a change in circumstances.

02

Businesses that need to apply for a regulatory adjustment.

03

Organizations looking to update their registration information with relevant authorities.

Fill

form

: Try Risk Free

People Also Ask about

What is the 3R in English?

The 3Rs stand for Reduce, Reuse, Recycle.

What are the 3 R words?

Reduce, Reuse, Recycle – these three 'R' words are an important part of sustainable living, as they help to cut down on the amount of waste we have to throw away. It's Really simple! Reduce the amount of waste you produce. Reuse items as much as you can before replacing them.

What does 3Rs mean in English?

3R (Reduce, Reuse, Recycle)

What do 3Rs stand for?

The 3R Initiative aims to promote the "3Rs" (reduce, reuse and recycle) globally so as to build a sound-material-cycle society through the effective use of resources and materials.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 3r?

3R refers to a specific tax form required for reporting certain financial information to the relevant tax authorities.

Who is required to file 3r?

Individuals or entities that meet specific tax criteria or thresholds established by the tax authorities are required to file Form 3R.

How to fill out 3r?

To fill out Form 3R, you need to gather the required financial information, complete the form accurately according to the instructions, and submit it by the designated deadline.

What is the purpose of 3r?

The purpose of Form 3R is to provide tax authorities with detailed information regarding financial activities for tax assessment and compliance.

What information must be reported on 3r?

Form 3R typically requires information such as income, deductions, credits, and other financial details relevant to tax liability.

Fill out your 3r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fnpf Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.