Get the free Roth 457 Accounts - New York State Deferred Compensation ...

Show details

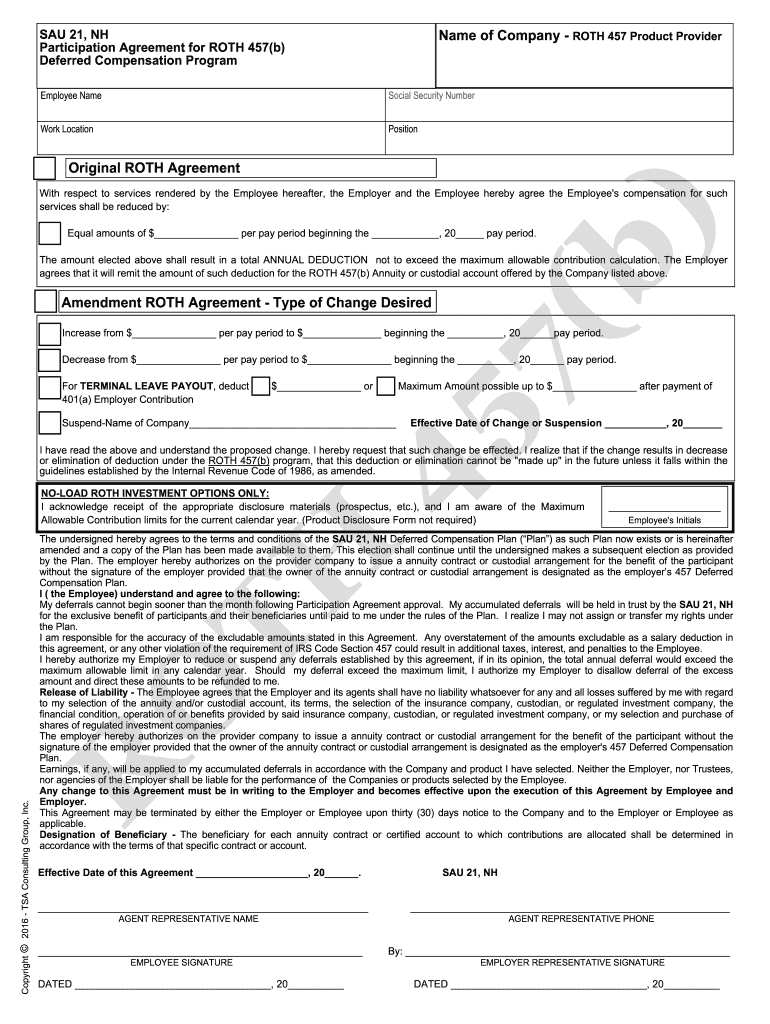

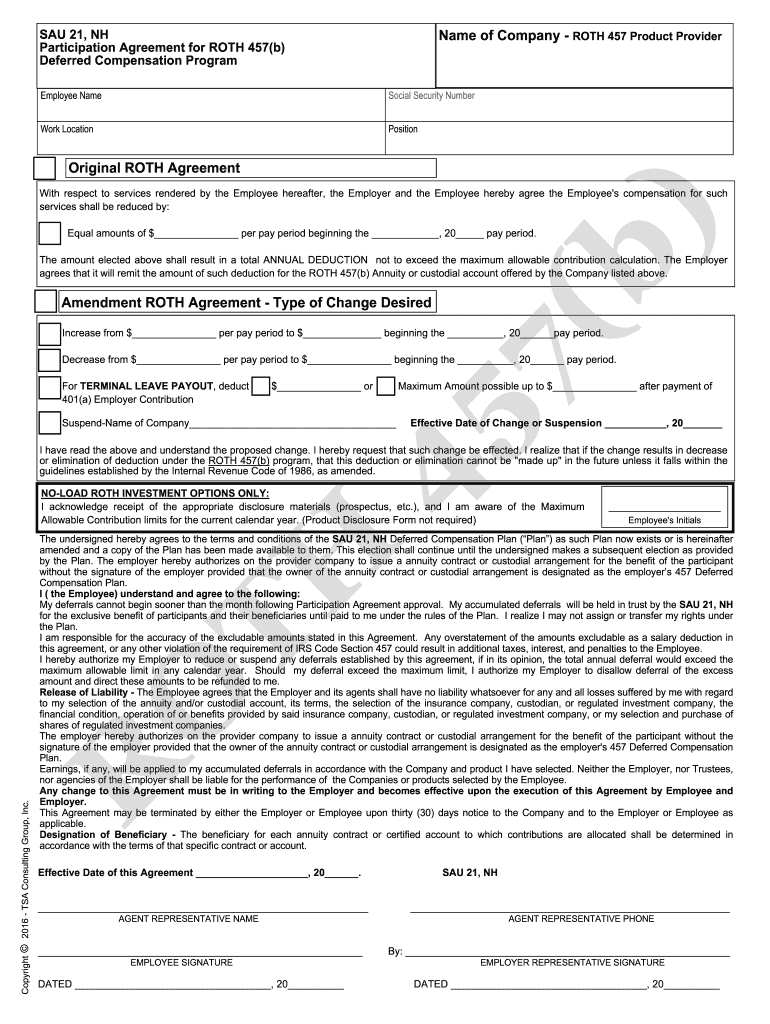

SAU 21, NH Participation Agreement for ROTH 457(b) Deferred Compensation Programmed of Company ROTH 457 Product ProviderEmployee Asocial Security NumberWork LocationPositionOriginal ROTH Agreement)With

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth 457 accounts

Edit your roth 457 accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth 457 accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing roth 457 accounts online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit roth 457 accounts. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth 457 accounts

How to fill out roth 457 accounts

01

Determine your eligibility: To be eligible for a Roth 457 account, you must work for a governmental employer that offers this type of retirement plan.

02

Obtain the necessary forms: Contact your employer or plan administrator to obtain the required forms to open a Roth 457 account.

03

Fill out the enrollment form: Carefully complete the enrollment form, providing personal information such as your name, address, and Social Security number.

04

Choose your contribution amount: Decide how much you want to contribute to your Roth 457 account. Make sure to consider any contribution limits set by the IRS.

05

Allocate your contributions: If your plan offers investment options, allocate your contributions among the available investment options based on your risk tolerance and investment goals.

06

Review and submit the forms: Double-check all the information you provided on the forms and submit them to your employer or plan administrator.

07

Monitor and manage your account: Keep track of your contributions, investment performance, and any changes or updates to your account. Regularly review your investment allocations to ensure they align with your financial goals.

Who needs roth 457 accounts?

01

Individuals who are employed by governmental agencies: Roth 457 accounts are specifically designed for employees of state and local governments, as well as certain nonprofit organizations.

02

Those looking for tax-free withdrawals in retirement: Roth 457 accounts allow for tax-free withdrawals in retirement, making them beneficial for individuals who expect to be in a higher tax bracket when they retire.

03

Employees who want to diversify their retirement savings: Roth 457 accounts can be used alongside other retirement accounts, such as 401(k) or IRA, to diversify one's retirement savings portfolio.

04

Individuals who value flexibility: Roth 457 accounts offer flexibility in terms of contribution amounts and withdrawal options, providing individuals with more control over their retirement savings.

05

Employees aiming for higher contribution limits: Compared to traditional Roth IRAs, Roth 457 accounts have higher contribution limits, allowing individuals to potentially save more for retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send roth 457 accounts for eSignature?

Once your roth 457 accounts is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for the roth 457 accounts in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your roth 457 accounts in minutes.

How do I fill out roth 457 accounts using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign roth 457 accounts. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is roth 457 accounts?

Roth 457 accounts are retirement savings accounts that are funded with after-tax dollars and offer tax-free withdrawals in retirement.

Who is required to file roth 457 accounts?

Employees of state and local governments, as well as certain non-profit organizations, are typically eligible to contribute to Roth 457 accounts.

How to fill out roth 457 accounts?

To fill out Roth 457 accounts, individuals need to elect a specific contribution amount from their paycheck to go towards the account.

What is the purpose of roth 457 accounts?

The purpose of Roth 457 accounts is to provide a tax-advantaged way for individuals to save for retirement.

What information must be reported on roth 457 accounts?

Information such as contribution amounts, investment gains or losses, and account distributions must be reported on Roth 457 accounts.

Fill out your roth 457 accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth 457 Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.