Get the free Investment Basics: What You Should Know - Castro, Thresher ...

Show details

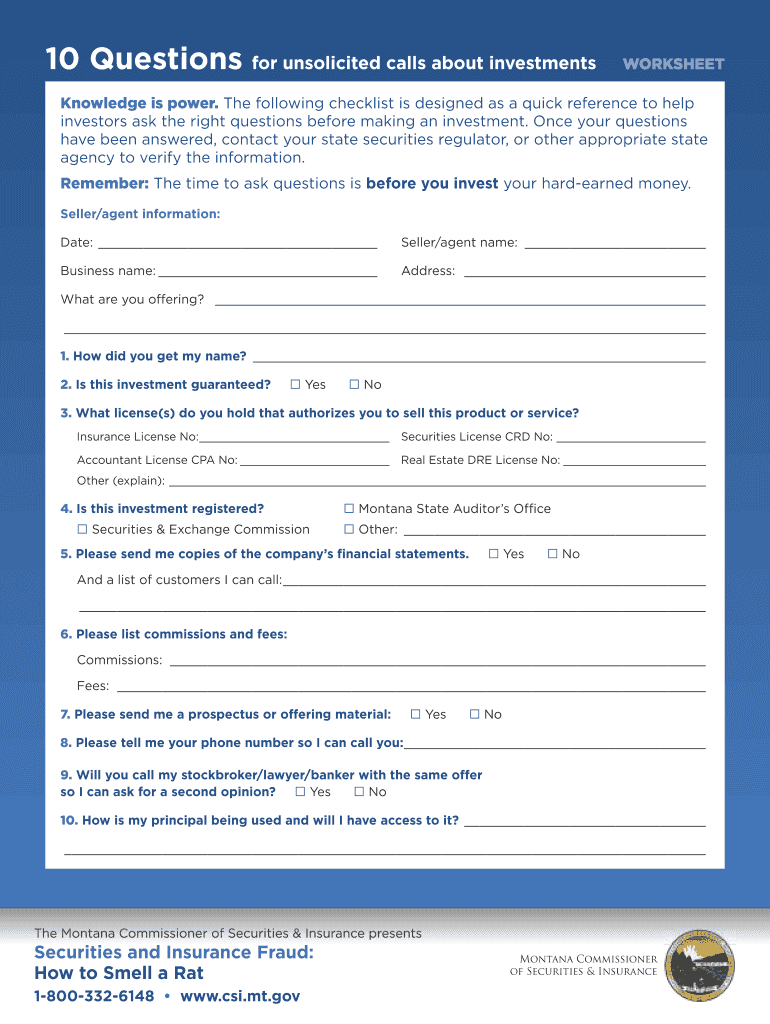

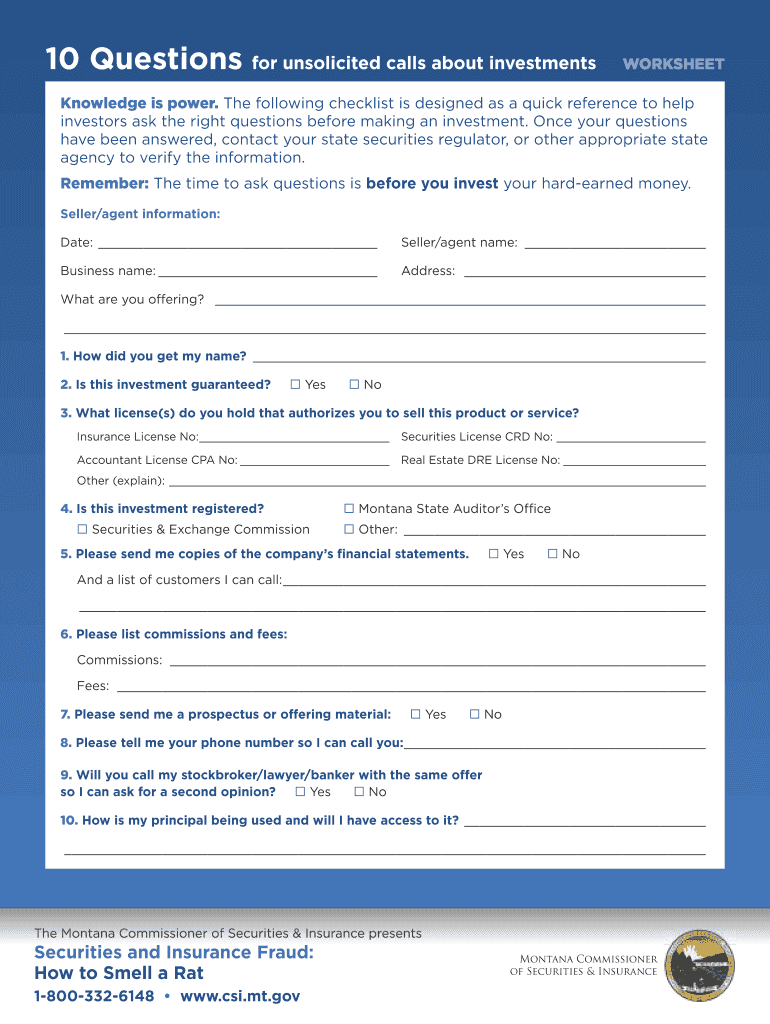

10 Questions for unsolicited calls about investmentsKnowledge is power. The following checklist is designed as a quick reference to help investors ask the right questions before making an investment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment basics what you

Edit your investment basics what you form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment basics what you form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investment basics what you online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit investment basics what you. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment basics what you

How to fill out investment basics what you

01

To fill out investment basics, follow these steps:

02

Research and gather information about different investment options and strategies.

03

Determine your financial goals and risk tolerance.

04

Analyze your current financial situation, including income, expenses, and debt.

05

Create a budget to allocate funds for investment purposes.

06

Consult with a financial advisor or investment professional to get personalized advice.

07

Decide on the specific investments you want to make, such as stocks, bonds, mutual funds, or real estate.

08

Open an investment account with a reputable financial institution or brokerage firm.

09

Fill out the necessary paperwork to open the account, providing accurate personal and financial information.

10

Fund your investment account by transferring money from your bank account or depositing a check.

11

Monitor and review your investments regularly to stay informed and make adjustments as needed.

12

Stay informed about market trends, economic changes, and any news that may affect your investments.

13

Continuously educate yourself about investment strategies and consider seeking professional guidance whenever necessary.

Who needs investment basics what you?

01

Anyone who wants to grow their wealth and achieve financial goals can benefit from learning investment basics.

02

Specifically, individuals who have some disposable income and are willing to take calculated risks may find investment basics useful.

03

Investment basics can be helpful for beginners who are new to investing and want to understand the fundamental concepts.

04

Entrepreneurs, business owners, and professionals looking to diversify their income streams can also benefit from investment basics.

05

Ultimately, anyone who wishes to make informed financial decisions and potentially earn returns on their money can benefit from investment basics.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify investment basics what you without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like investment basics what you, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send investment basics what you for eSignature?

Once you are ready to share your investment basics what you, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my investment basics what you in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your investment basics what you and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is investment basics what you?

Investment basics refer to the fundamental principles and concepts of investing, such as understanding risk, diversification, and the importance of setting financial goals.

Who is required to file investment basics what you?

Anyone who is interested in investing or managing their finances should have knowledge of investment basics.

How to fill out investment basics what you?

You can learn about investment basics through online resources, books, seminars, or by consulting with a financial advisor.

What is the purpose of investment basics what you?

The purpose of investment basics is to help individuals make informed decisions about their finances, understand the risks involved in investing, and achieve their financial goals.

What information must be reported on investment basics what you?

Information such as financial goals, risk tolerance, investment timeline, and diversification strategy should be considered in investment basics.

Fill out your investment basics what you online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Basics What You is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.