Get the free No ANNUAL AUDITED REPORT PART III - SEC.gov

Show details

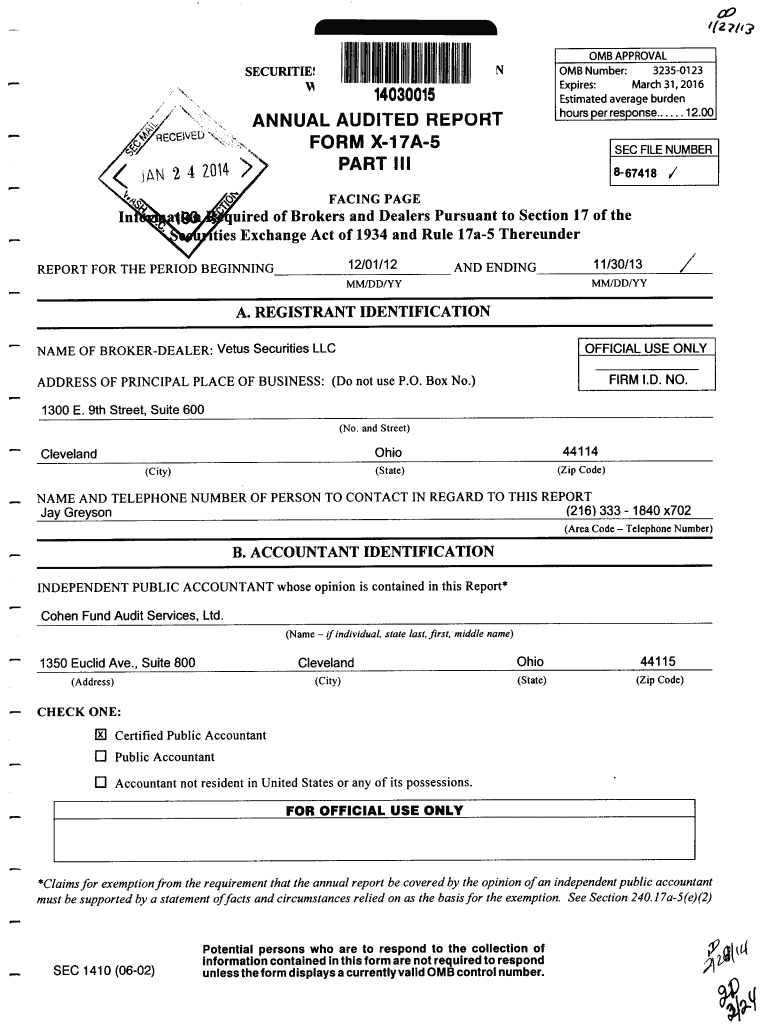

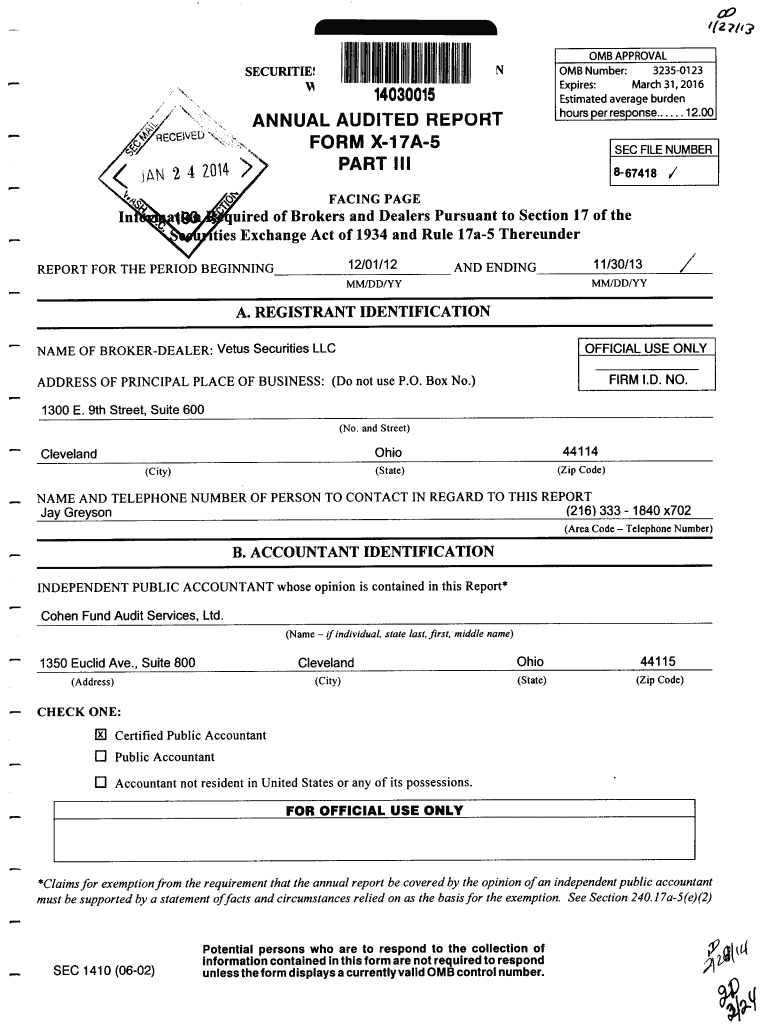

//20 MB APPROVAL

IIIOIHNH1IIIHHIIllII HNIll0MB NumberIIExpires14030015ANNUAL AUDITED REPORTFORMaverageresponseperSEC23312016burdenEstimated

hoursX17A5PART323501

March12.00FILENUMBERIII867418PAGEFACING

moored

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no annual audited report

Edit your no annual audited report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no annual audited report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing no annual audited report online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit no annual audited report. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out no annual audited report

How to fill out no annual audited report

01

Start by gathering all the necessary financial information and documents for the reporting period.

02

Review the guidelines and requirements provided by the regulatory authorities regarding the no annual audited report.

03

Use the provided template or format to structure the report.

04

Begin by providing a detailed introduction about the organization or business, including its background and purpose.

05

Include a section to present the financial information for the reporting period, such as the income statement, balance sheet, and cash flow statement.

06

Ensure that all the financial information is accurately recorded and supported by relevant documentation.

07

Analyze and interpret the financial data to highlight significant findings or trends.

08

Include any additional information or disclosures required by the regulatory authorities.

09

Review and double-check the report for accuracy and completeness.

10

Once satisfied, submit the completed no annual audited report to the appropriate regulatory authorities within the specified deadline.

Who needs no annual audited report?

01

Small businesses or organizations that meet the criteria for exemption from annual audits, as determined by the regulatory authorities.

02

Companies or entities with low annual revenue or limited financial resources that cannot afford or find it unnecessary to undergo an audit.

03

Non-profit organizations that operate on a smaller scale and have minimal financial activities.

04

Start-ups or recently established businesses in their early stages of operation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send no annual audited report to be eSigned by others?

When you're ready to share your no annual audited report, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I edit no annual audited report on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit no annual audited report.

How do I complete no annual audited report on an Android device?

Complete your no annual audited report and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is no annual audited report?

No annual audited report is a report that is not required to be audited by an independent auditor.

Who is required to file no annual audited report?

Certain small businesses or organizations may be exempt from having to file an audited report.

How to fill out no annual audited report?

Fill out the necessary information as specified by the regulatory authority or governing body.

What is the purpose of no annual audited report?

The purpose is to provide financial information to stakeholders without the added cost of an audit.

What information must be reported on no annual audited report?

Basic financial information such as income, expenses, and assets may be required.

Fill out your no annual audited report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Annual Audited Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.