Get the free Deducting Mortgage Interest FAQs - TurboTax Tax Tips & Videos

Show details

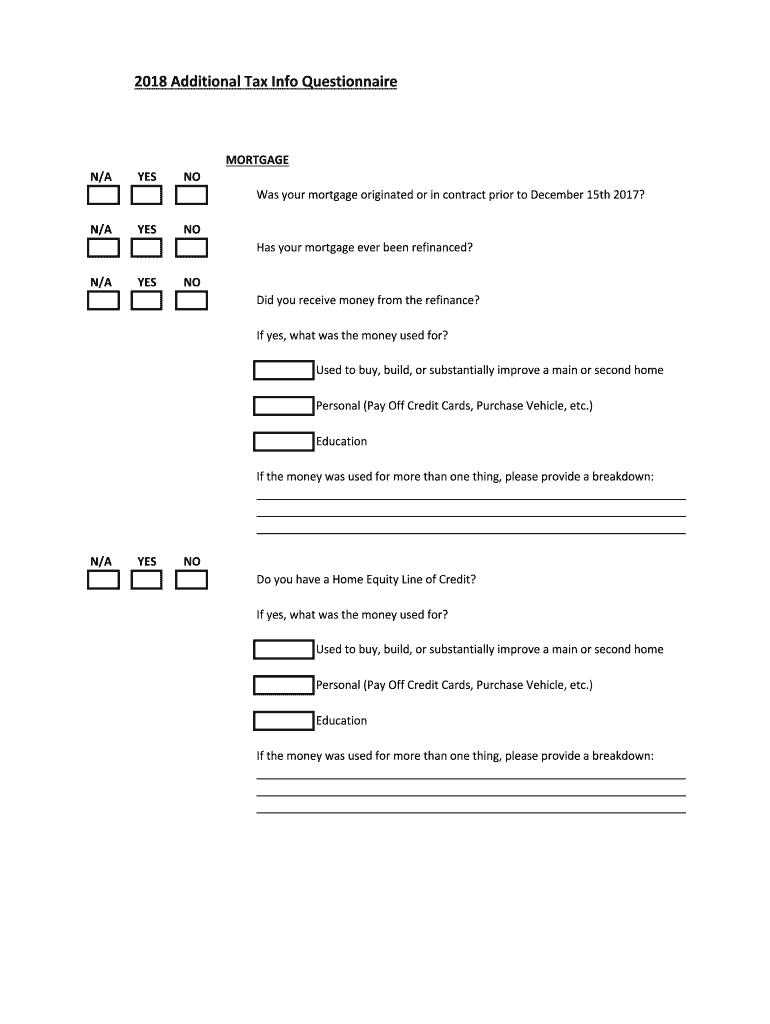

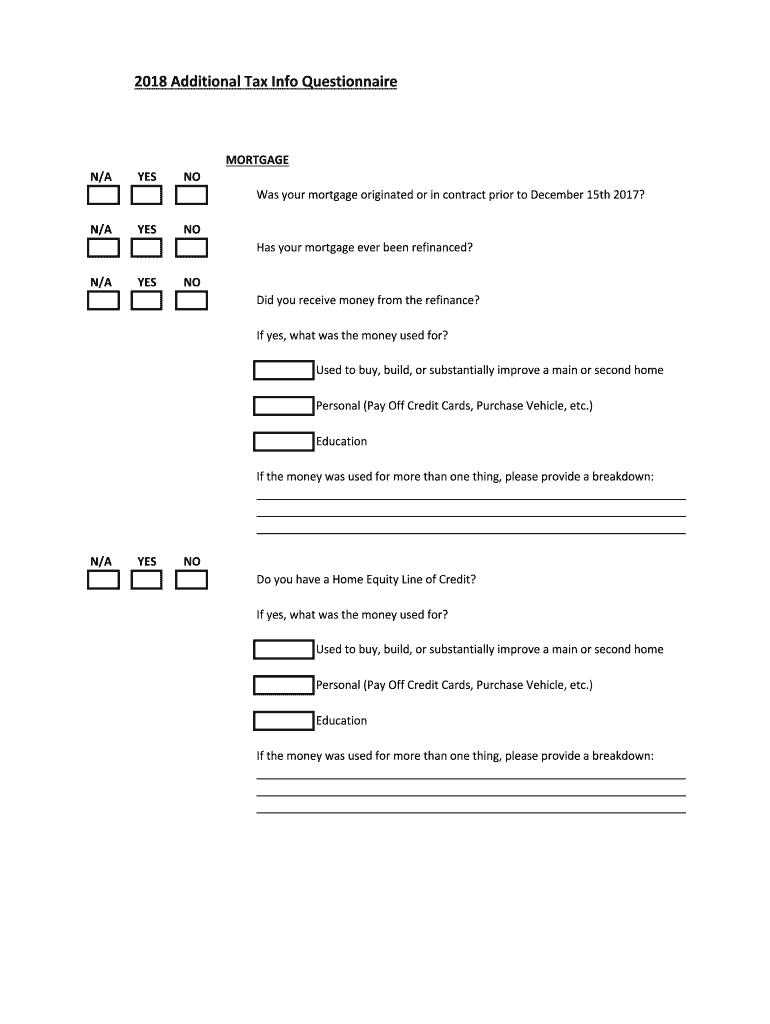

2018 Additional Tax Info QuestionnaireMORTGAGE N/AYES Now Was your mortgage originated or in contract prior to December 15th 2017? N/AYES NO Has your mortgage ever been refinanced? N/AYES Now Did

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deducting mortgage interest faqs

Edit your deducting mortgage interest faqs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deducting mortgage interest faqs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deducting mortgage interest faqs online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deducting mortgage interest faqs. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deducting mortgage interest faqs

How to fill out deducting mortgage interest faqs

01

Gather all necessary documents such as mortgage statements, Form 1098 from your lender, and any additional documentation related to your mortgage interest.

02

Determine if you qualify for the mortgage interest deduction. Generally, you must have a qualified mortgage on a qualified home and you must itemize your deductions on your tax return.

03

Enter the mortgage interest on Schedule A (Form 1040), line 8.

04

Follow the instructions provided by the IRS to calculate the deductible amount of your mortgage interest.

05

Fill out any additional required forms or schedules as instructed by the IRS.

06

Review your completed tax return and ensure accuracy before filing.

07

Submit your tax return either electronically or by mail, depending on your preferred method.

08

Keep copies of all submitted documents and forms for your records in case of any future audits or inquiries.

Who needs deducting mortgage interest faqs?

01

Anyone who has a mortgage on a qualified home and itemizes their deductions on their tax return may need to refer to deducting mortgage interest FAQs. These FAQs can provide valuable information on how to correctly claim the mortgage interest deduction and ensure compliance with the IRS guidelines. It is especially important for individuals who rely on this deduction to reduce their taxable income and save on their overall tax liability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit deducting mortgage interest faqs from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including deducting mortgage interest faqs. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I edit deducting mortgage interest faqs on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing deducting mortgage interest faqs, you need to install and log in to the app.

Can I edit deducting mortgage interest faqs on an iOS device?

Create, edit, and share deducting mortgage interest faqs from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is deducting mortgage interest faqs?

Deducting mortgage interest FAQs provide information and guidance on how to deduct mortgage interest on your tax return.

Who is required to file deducting mortgage interest faqs?

Individuals who have paid mortgage interest on a qualified home during the tax year are required to file deducting mortgage interest FAQs.

How to fill out deducting mortgage interest faqs?

To fill out deducting mortgage interest FAQs, you will need to provide information about your mortgage lender, the amount of mortgage interest paid, and other related details.

What is the purpose of deducting mortgage interest faqs?

The purpose of deducting mortgage interest FAQs is to allow taxpayers to deduct the interest paid on their mortgage from their taxable income, potentially reducing their tax liability.

What information must be reported on deducting mortgage interest faqs?

The information reported on deducting mortgage interest FAQs typically includes the name and address of the mortgage lender, the amount of mortgage interest paid, and any other relevant details.

Fill out your deducting mortgage interest faqs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deducting Mortgage Interest Faqs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.