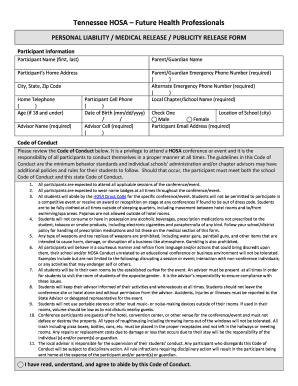

Get the free Tax assistant Jobs in Singapore, Job VacanciesJobStreet ...

Show details

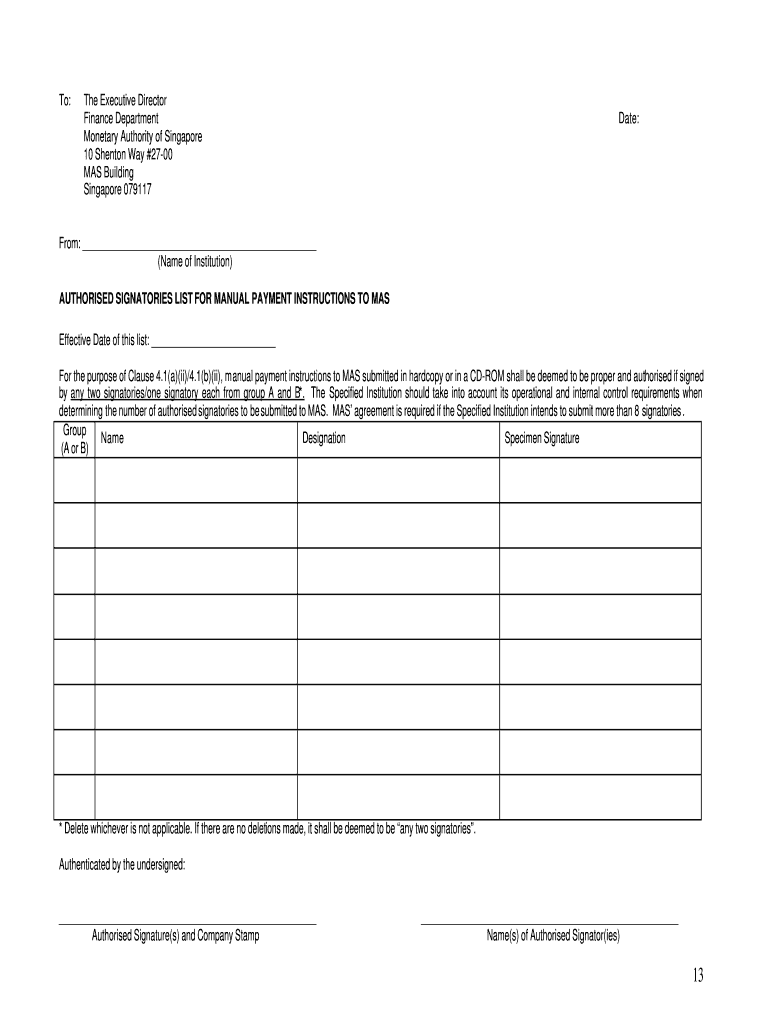

To:The Executive Director Finance Department Monetary Authority of Singapore 10 Shelton Way #2700 MAS Building Singapore 079117Date:From: (Name of Institution) Authorized SIGNATORIES LIST FOR MANUAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax assistant jobs in

Edit your tax assistant jobs in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax assistant jobs in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax assistant jobs in online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax assistant jobs in. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax assistant jobs in

How to fill out tax assistant jobs in

01

Gather all necessary documents, such as W-2 forms and receipts.

02

Research and understand the specific tax assistant job requirements and qualifications.

03

Prepare and update your resume or CV, highlighting relevant skills and experience.

04

Apply for tax assistant jobs by submitting your application, either online or in person.

05

Prepare for interviews by practicing common interview questions and researching the company.

06

Attend any requested interviews or assessments and showcase your suitability for the role.

07

Follow up with the employer after the interview to express your continued interest and inquire about the status of your application.

08

Upon receiving a job offer, review the terms and conditions, negotiate if necessary, and accept or decline the offer.

09

Complete any required onboarding or orientation processes, including filling out necessary paperwork.

10

Begin your tax assistant job and ensure you fulfill all responsibilities and duties with accuracy and professionalism.

Who needs tax assistant jobs in?

01

Individuals or businesses who want assistance in completing their tax returns accurately and efficiently.

02

Accounting firms or tax preparation companies that require additional support during the tax season.

03

Organizations or individuals who need help with financial record-keeping and tax compliance throughout the year.

04

Individuals or businesses who are not familiar with tax laws and regulations and need guidance in navigating them.

05

Individuals or businesses who aim to minimize their tax liability and optimize their financial strategies.

06

Those who are looking to build a career in the field of finance or accounting and want to gain practical experience in tax-related tasks.

07

Small business owners or self-employed individuals who need assistance in understanding and fulfilling their tax obligations.

08

Individuals who want to ensure accuracy in their tax filings and avoid penalties or legal issues related to incorrect or incomplete information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax assistant jobs in for eSignature?

When you're ready to share your tax assistant jobs in, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in tax assistant jobs in without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing tax assistant jobs in and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit tax assistant jobs in on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share tax assistant jobs in from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is tax assistant jobs in?

Tax assistant jobs involve providing support and assistance to taxpayers in preparing and filing their taxes.

Who is required to file tax assistant jobs in?

Anyone who earns income in a given year is required to file tax assistant jobs in order to report their earnings and calculate the amount of tax owed.

How to fill out tax assistant jobs in?

Tax assistant jobs can be filled out either manually using paper forms or electronically through tax software programs.

What is the purpose of tax assistant jobs in?

The purpose of tax assistant jobs is to accurately report income, deductions, and credits in order to determine the taxpayer's tax liability.

What information must be reported on tax assistant jobs in?

Tax assistant jobs typically require reporting of income from all sources, including wages, interest, dividends, and capital gains, as well as deductions and credits that may reduce the tax owed.

Fill out your tax assistant jobs in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Assistant Jobs In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.