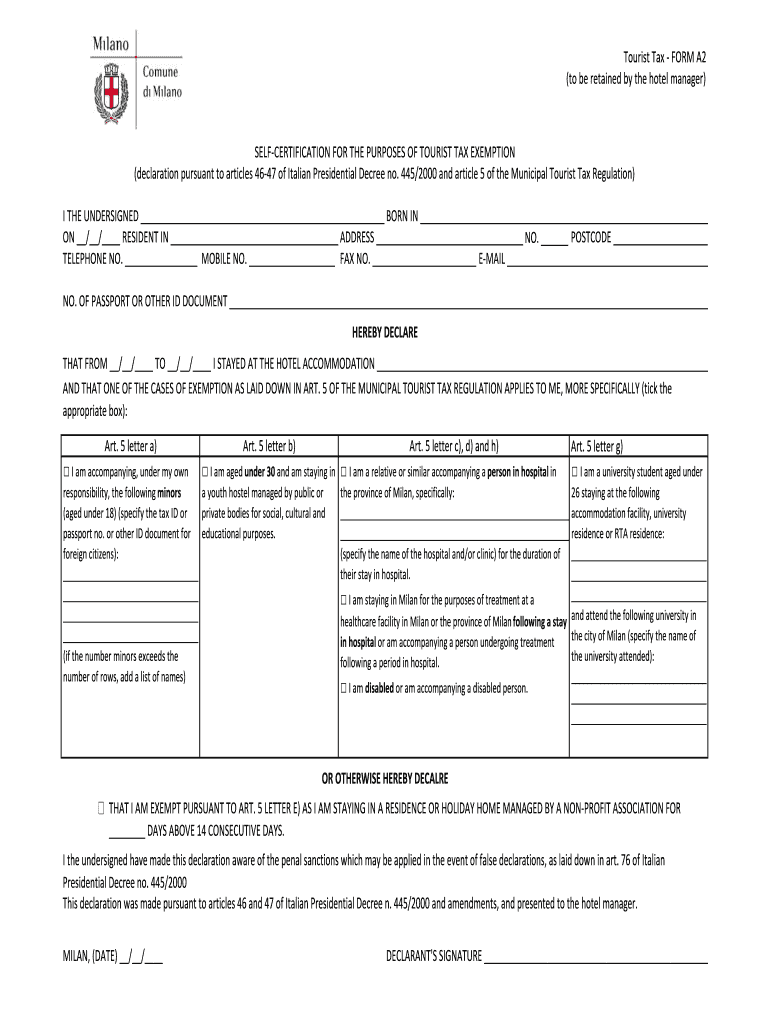

Get the free Tourist Tax - FORM A2 SELF-CERTIFICATION FOR THE PURPOSES OF ...

Show details

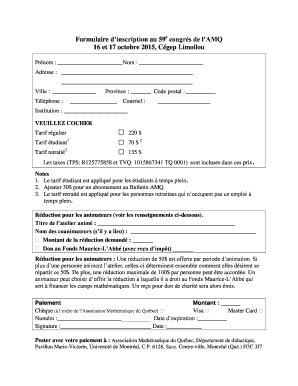

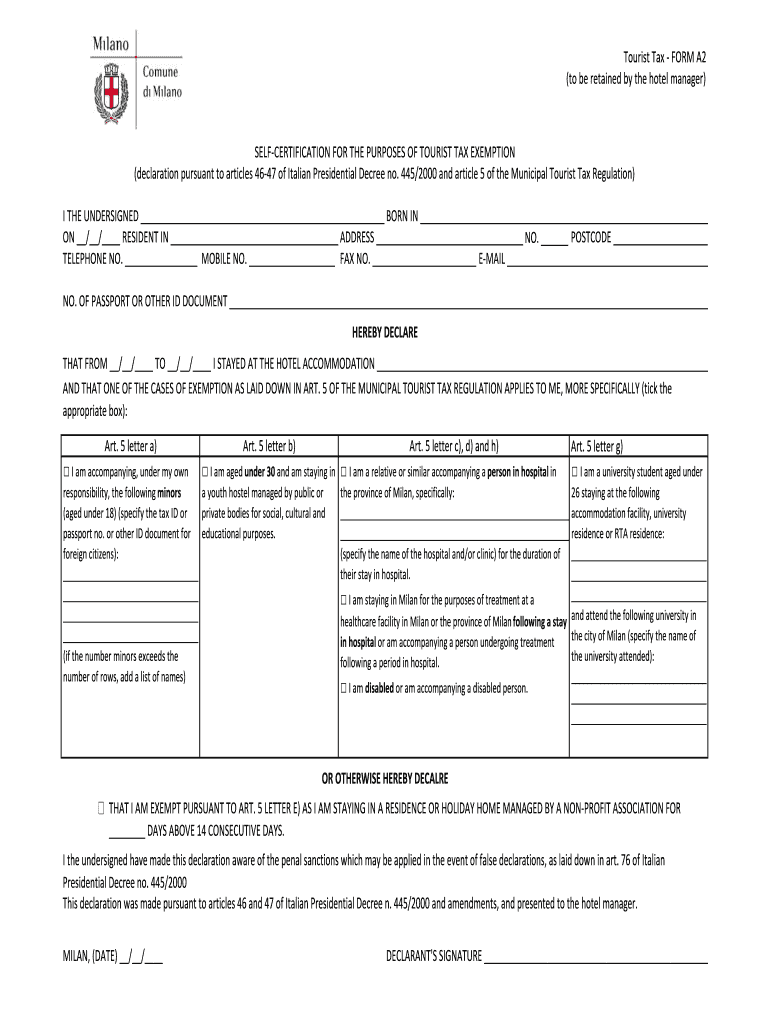

Tourist Tax FORM A2 (to be retained by the hotel manager)RECERTIFICATION FOR THE PURPOSES OF TOURIST TAX EXEMPTION (declaration pursuant to articles 4647 of Italian Presidential Decree no. 445/2000

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tourist tax - form

Edit your tourist tax - form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tourist tax - form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tourist tax - form online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tourist tax - form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tourist tax - form

How to fill out tourist tax - form

01

To fill out the tourist tax form, follow these steps:

02

Locate and obtain a copy of the tourist tax form. This form is typically available online on the official website of the destination country or at tourist information centers.

03

Start by providing your personal information such as your full name, address, contact details, and nationality.

04

Fill in your travel details, including the dates of your arrival and departure, the purpose of your visit, and the accommodation you will be staying at.

05

Calculate the amount of tax owed based on the guidelines provided on the form. This usually depends on the duration of your stay and the type of accommodation.

06

Make sure to include any supporting documents or receipts required, such as proof of accommodation booking or payment.

07

Review the completed form to ensure all the information is accurate and complete.

08

Sign and date the form, acknowledging that the provided information is true and correct.

09

Submit the form as instructed on the form itself or on the official website. Some destinations may require you to mail or hand-deliver the form, while others may have an online submission portal.

10

Keep a copy of the filled-out form for your records.

11

If applicable, make the necessary payment for the tourist tax as specified on the form.

12

Check for any additional requirements or steps specific to the destination country or region you are visiting.

Who needs tourist tax - form?

01

The tourist tax form is needed by individuals who are visiting certain countries or regions and are required to pay a specific tax for tourism purposes.

02

The exact requirements and conditions may vary depending on the destination, but generally, the following individuals may need to fill out the tourist tax form:

03

- International tourists or visitors staying in accommodations such as hotels, resorts, or rental properties

04

- Business travelers visiting for tourism-related purposes

05

- Individuals attending conferences, exhibitions, or other events

06

- Visitors staying beyond a certain duration specified by the destination country

07

- Certain categories of travelers exempt from the tax, such as children, diplomats, or individuals visiting for medical treatment

08

It is advisable to check the specific regulations of the destination country or region you are planning to visit to determine if you need to fill out the tourist tax form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tourist tax - form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your tourist tax - form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in tourist tax - form?

With pdfFiller, the editing process is straightforward. Open your tourist tax - form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete tourist tax - form on an Android device?

Complete tourist tax - form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is tourist tax - form?

The tourist tax - form is a document used to report and pay taxes on tourism-related activities.

Who is required to file tourist tax - form?

Any individual or business involved in tourism-related activities is required to file the tourist tax - form.

How to fill out tourist tax - form?

The tourist tax - form can be filled out either online or in paper form. It requires information about the taxpayer's tourism activities and income.

What is the purpose of tourist tax - form?

The purpose of the tourist tax - form is to report and pay taxes on income generated from tourism-related activities.

What information must be reported on tourist tax - form?

Information such as income from tourism activities, expenses related to tourism, and any other relevant financial information must be reported on the tourist tax - form.

Fill out your tourist tax - form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tourist Tax - Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.