Get the free Processing Refunds and Forfeits with WriteOffs - JRK AMSI ...

Show details

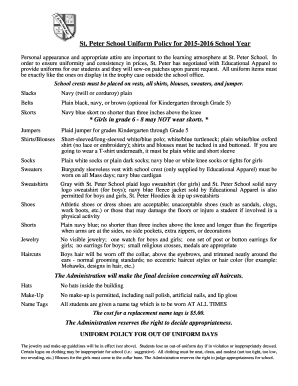

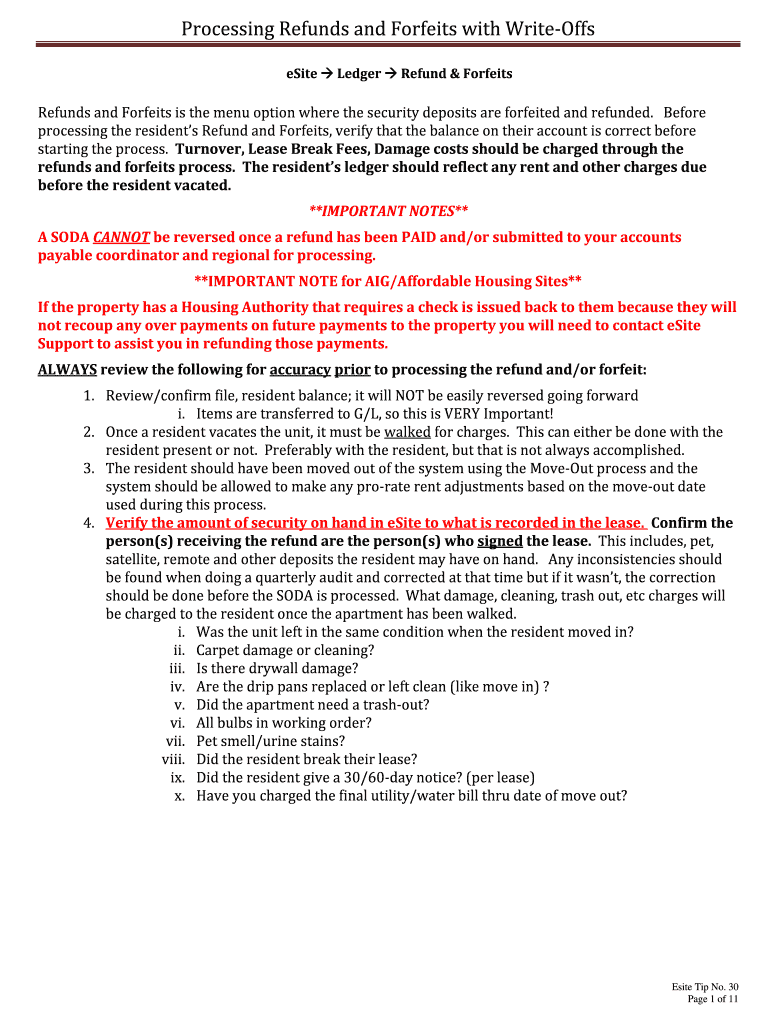

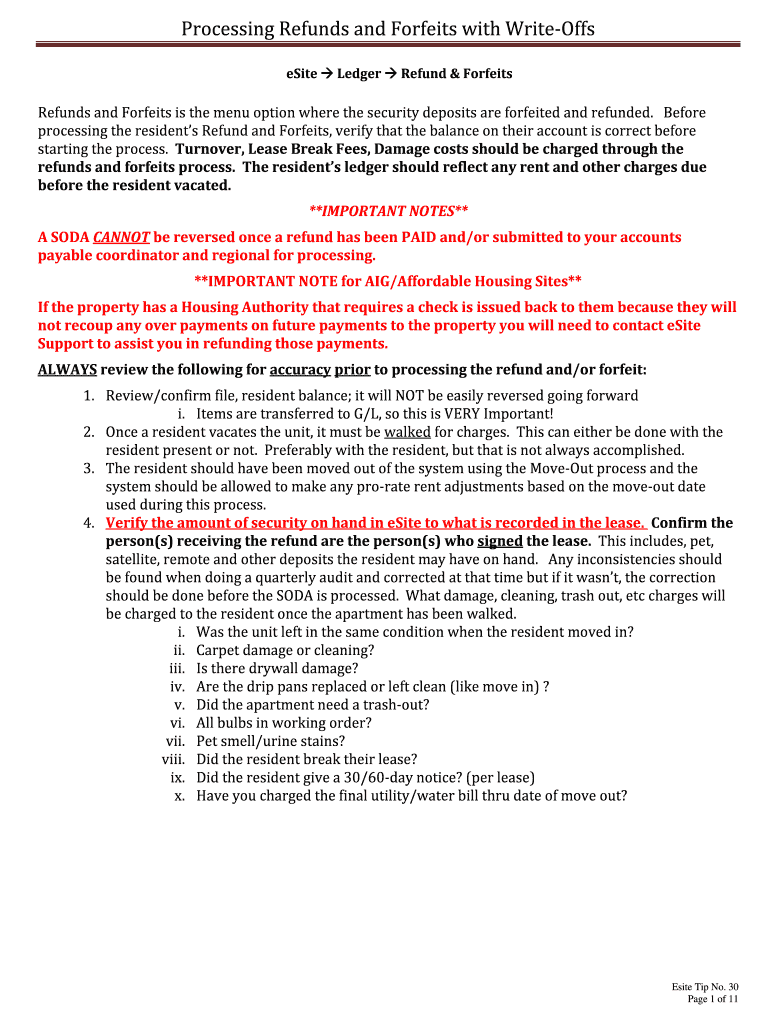

ProcessingRefundsandForfeitswithWriteOffs eSiteLedgerRefund&Forfeits RefundsandForfeitsisthemenuoptionwherethesecuritydepositsareforfeitedandrefunded. Before processingtheresidentsRefundandForfeits,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign processing refunds and forfeits

Edit your processing refunds and forfeits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your processing refunds and forfeits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit processing refunds and forfeits online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit processing refunds and forfeits. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out processing refunds and forfeits

How to fill out processing refunds and forfeits

01

To fill out processing refunds and forfeits, follow these steps:

02

Gather all the necessary information and documentation related to the refund or forfeiture.

03

Identify the reason for the refund or forfeiture and make sure it aligns with your organization's policies and procedures.

04

Determine the applicable refund or forfeiture amount based on the policies and agreements in place.

05

Prepare the necessary forms or documents to initiate the refund or forfeiture process.

06

Clearly communicate the refund or forfeiture process to the parties involved, including any deadlines or additional requirements.

07

Collect any required signatures or approvals from the appropriate individuals or departments.

08

Submit the refund or forfeiture request along with the supporting documentation to the designated department or office.

09

Follow up with the department or office handling the refund or forfeiture to ensure timely processing.

10

Keep proper records of all refund or forfeiture transactions for future reference or audit purposes.

11

Communicate the outcome of the refund or forfeiture process to the parties involved and provide any necessary documentation or payment.

12

Review the refund or forfeiture process periodically to identify any areas for improvement or efficiency.

13

By following these steps, you will be able to effectively fill out processing refunds and forfeits.

Who needs processing refunds and forfeits?

01

Various organizations and businesses may need processing refunds and forfeits, including:

02

- Retailers or e-commerce companies that offer refunds for returned or canceled orders.

03

- Service providers who need to process refunds for unsatisfactory services or cancelled appointments.

04

- Landlords or property managers who handle security deposit forfeits.

05

- Financial institutions or banks that process refunds for fraudulent transactions or errors.

06

- Event organizers or ticketing agencies that handle ticket refunds or forfeits.

07

- Insurance companies that process claim refunds or forfeits.

08

These are just a few examples, but any organization or business that deals with refund or forfeiture processes may require processing refunds and forfeits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my processing refunds and forfeits in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your processing refunds and forfeits and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make changes in processing refunds and forfeits?

With pdfFiller, the editing process is straightforward. Open your processing refunds and forfeits in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the processing refunds and forfeits electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your processing refunds and forfeits.

What is processing refunds and forfeits?

Processing refunds and forfeits involves returning money or assets to customers and forfeiting funds that were not claimed or processed correctly.

Who is required to file processing refunds and forfeits?

Any business or organization that collects payments and issues refunds is required to file processing refunds and forfeits.

How to fill out processing refunds and forfeits?

To fill out processing refunds and forfeits, you need to report the details of all refunds issued and forfeits processed, including the amount, date, and reason for each transaction.

What is the purpose of processing refunds and forfeits?

The purpose of processing refunds and forfeits is to ensure transparency and accountability in financial transactions, and to provide a way for customers to receive their money back if they are owed a refund.

What information must be reported on processing refunds and forfeits?

All details of refunds issued and forfeits processed must be reported, including the amount, date, reason, and recipient of the funds.

Fill out your processing refunds and forfeits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Processing Refunds And Forfeits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.