Get the free Revenue and Cash Collection Processes & Controls - Ch. 8 ...

Show details

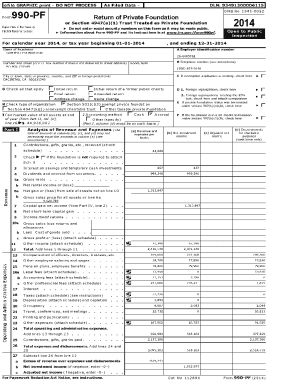

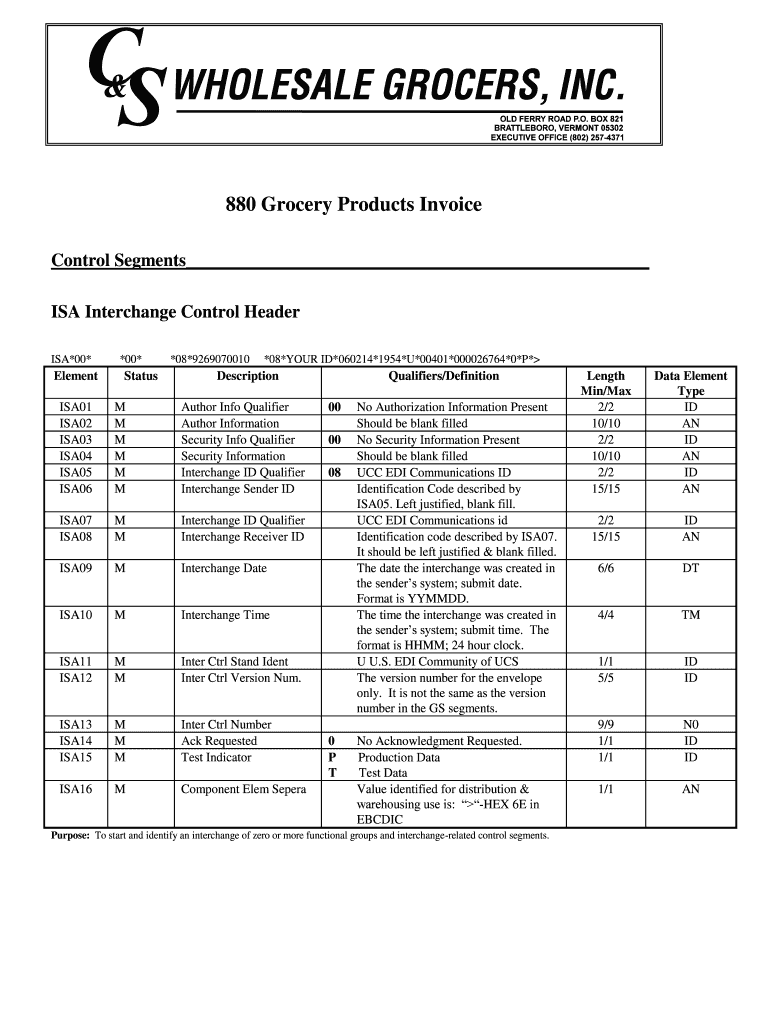

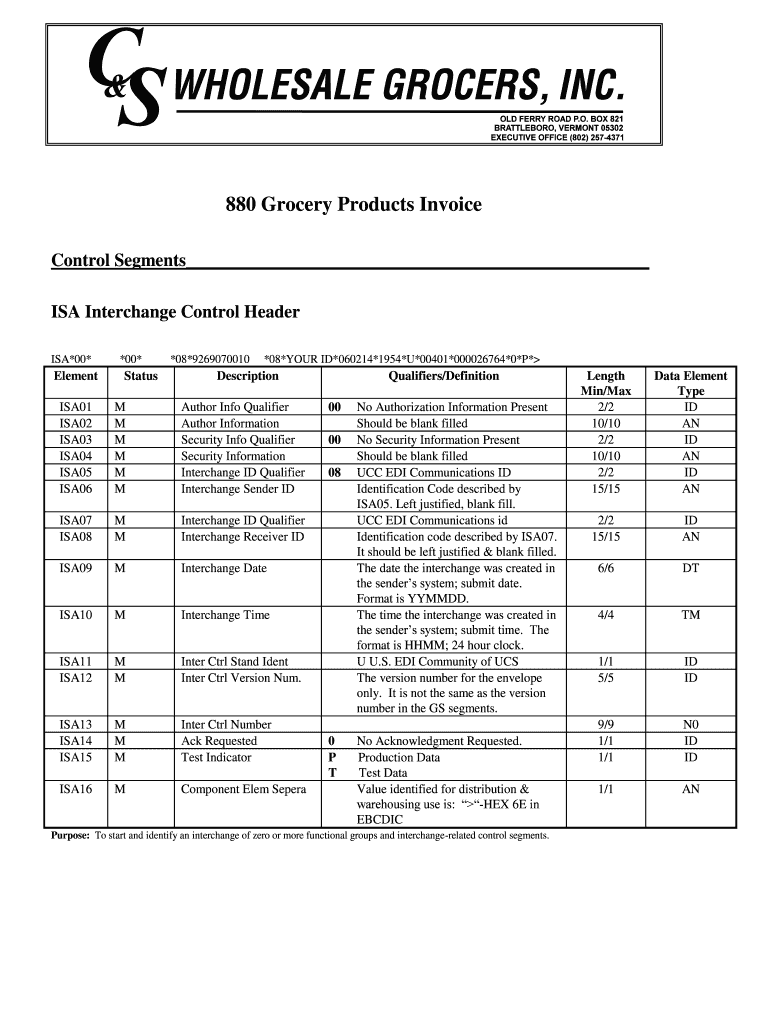

880 Grocery Products Invoice Control Segments ISA Interchange Control Header ISA×00×Element×00×Status×08×9269070010×08×YOUR ID×060214×1954×U×00401×000026764×0×P×DescriptionISA01 ISA02

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue and cash collection

Edit your revenue and cash collection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue and cash collection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue and cash collection online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit revenue and cash collection. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue and cash collection

How to fill out revenue and cash collection

01

To fill out revenue and cash collection, follow these steps:

02

Gather all relevant financial documents, such as invoices, receipts, bank statements, and sales reports.

03

Create a spreadsheet or use accounting software to record the revenue and cash collection.

04

Start by entering the date of each transaction.

05

Enter the details of each transaction, including the source of revenue, such as sales or services provided, and the amount received.

06

Categorize the revenue and cash collection according to different revenue streams or business activities.

07

Calculate the total revenue and cash collection for each period, such as a month or a fiscal year.

08

Double-check all entries for accuracy and ensure that the total revenue matches the cash collection.

09

Save the completed revenue and cash collection records for future reference and reporting purposes.

10

Periodically review and reconcile the revenue and cash collection records to ensure accuracy and identify any discrepancies.

11

Seek the assistance of a professional accountant or bookkeeper if you are unsure about any aspect of filling out revenue and cash collection.

Who needs revenue and cash collection?

01

Revenue and cash collection information is essential for the following entities:

02

- Businesses of all sizes and types, to track their financial performance and make informed decisions.

03

- Entrepreneurs and startup owners, to assess the viability of their business and attract potential investors.

04

- Financial analysts and investors, to evaluate the profitability and liquidity of a company.

05

- Tax authorities and regulatory agencies, to ensure compliance with tax laws and regulations.

06

- Banks and lenders, to assess the creditworthiness of individuals or businesses seeking loans or credit.

07

- Nonprofit organizations, to track and report their revenue from donations, grants, and fundraising activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my revenue and cash collection in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your revenue and cash collection along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send revenue and cash collection to be eSigned by others?

When your revenue and cash collection is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I edit revenue and cash collection on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share revenue and cash collection from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is revenue and cash collection?

Revenue and cash collection refers to the process of recording and tracking the income generated and the money received by a business or organization.

Who is required to file revenue and cash collection?

All businesses and organizations that generate income and receive payments are required to file revenue and cash collection reports.

How to fill out revenue and cash collection?

Revenue and cash collection reports can be filled out either manually or using accounting software, detailing all income and payments received within a specific time period.

What is the purpose of revenue and cash collection?

The purpose of revenue and cash collection is to accurately track and monitor the financial transactions of a business or organization, ensuring transparency and compliance with tax regulations.

What information must be reported on revenue and cash collection?

Typically, revenue and cash collection reports include details such as total income earned, sources of revenue, payment methods, and outstanding balances from customers.

Fill out your revenue and cash collection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue And Cash Collection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.