Get the free Tax Map - Geauga County Auditor - auditor co geauga oh

Show details

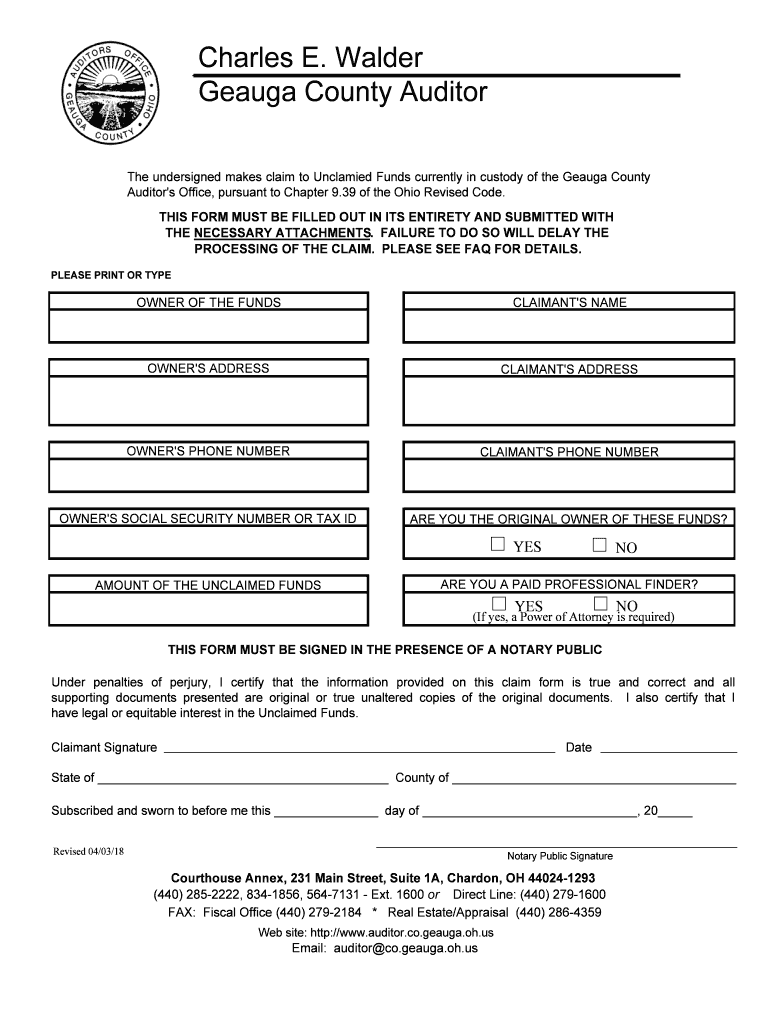

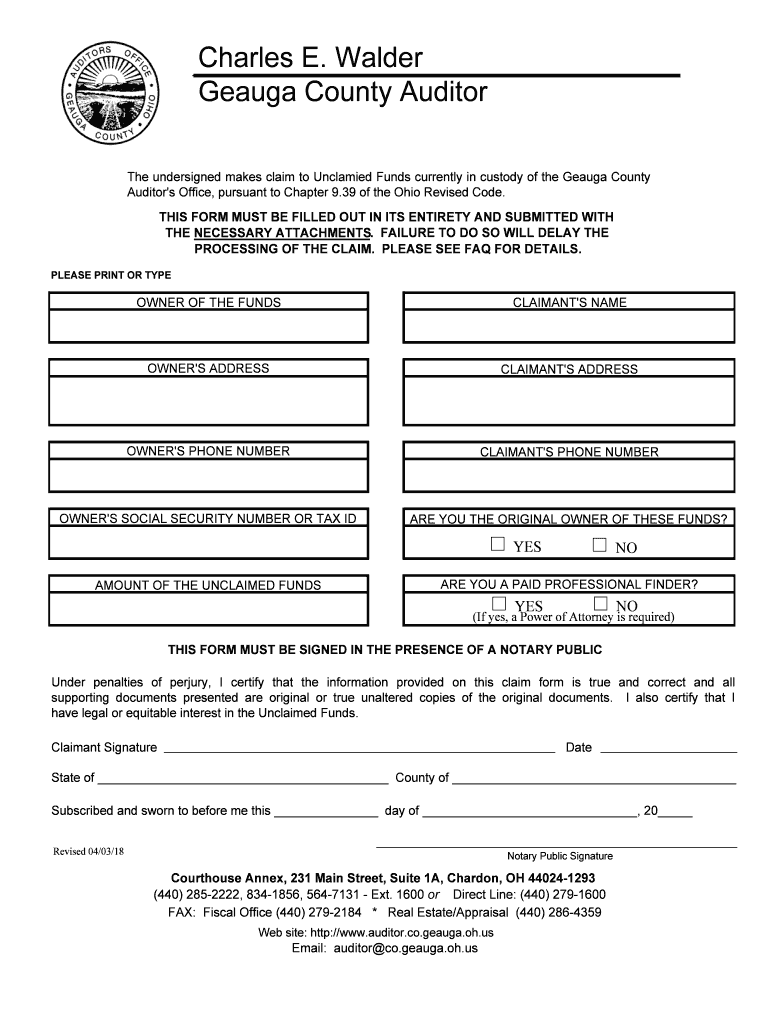

Charles E. Walker

Gauge County Auditor

The undersigned makes claim to Unclaimed Funds currently in custody of the Gauge County

Auditor\'s Office, pursuant to Chapter 9.39 of the Ohio Revised Code.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax map - geauga

Edit your tax map - geauga form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax map - geauga form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax map - geauga online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax map - geauga. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax map - geauga

How to fill out tax map - geauga

01

To fill out a tax map in Geauga County, follow these steps:

02

Gather the necessary information, including property details, ownership documents, and any other relevant documentation.

03

Determine the specific tax map form required. Geauga County may have specific forms for different types of properties or purposes.

04

Obtain the tax map form either online or by visiting the Geauga County Assessor's office in person.

05

Carefully read the instructions provided on the tax map form to understand the required information.

06

Fill out the tax map form accurately and legibly, ensuring all information is complete.

07

Attach any required supporting documentation, such as surveys or property sketches, as specified in the instructions.

08

Review the completed form and attachments to ensure accuracy and completeness.

09

Sign and date the tax map form as required.

10

Submit the filled-out tax map form and any accompanying documents to the Geauga County Assessor's office either in person or by mail.

11

Keep copies of all submitted documents for your records.

12

Please note that these steps are a general guideline and it is advisable to refer to the specific instructions provided by Geauga County for accurate and up-to-date information.

Who needs tax map - geauga?

01

Various individuals and entities may need tax maps in Geauga County, including:

02

- Property owners who want to understand the boundaries and details of their land for tax assessment purposes.

03

- Real estate developers or land surveyors who require precise information about parcels of land.

04

- Title companies or legal professionals involved in property transactions or disputes.

05

- Government agencies or planning departments responsible for zoning, land use, or infrastructure development initiatives.

06

- Appraisers or assessors assessing the value of properties for taxation purposes.

07

- Investors or lenders evaluating properties for potential investment or financing opportunities.

08

- Researchers or historians studying the historical or cultural significance of certain properties or areas.

09

This list is not exhaustive, and there may be other individuals or entities who may need tax maps depending on their specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax map - geauga directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your tax map - geauga along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make edits in tax map - geauga without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your tax map - geauga, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete tax map - geauga on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your tax map - geauga, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is tax map - geauga?

Tax map - Geauga is a visual representation of property boundaries, showing both individual parcels and the overall geographical layout within Geauga County, Ohio.

Who is required to file tax map - geauga?

Property owners and businesses within Geauga County are required to file tax map - Geauga to accurately depict their property boundaries and details.

How to fill out tax map - geauga?

Tax map - Geauga can be filled out by accurately marking property boundaries, including structures, roads, and other relevant details using mapping software or drawing tools.

What is the purpose of tax map - geauga?

The purpose of tax map - Geauga is to assist in property assessment, tax collection, land use planning, and other administrative functions within Geauga County.

What information must be reported on tax map - geauga?

Information such as property boundaries, structures, roads, utilities, and land use details must be accurately reported on tax map - Geauga.

Fill out your tax map - geauga online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Map - Geauga is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.