Get the free Motor Fuel Tax Information By State - Federation of Tax ...

Show details

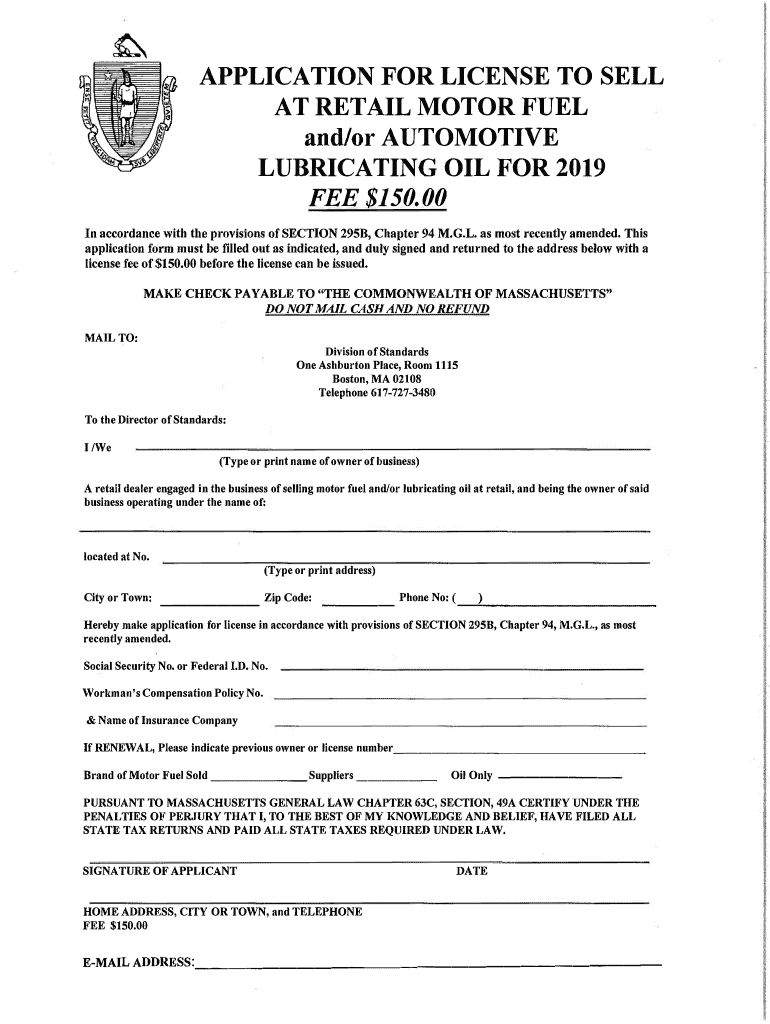

APPLICATION FOR LICENSE TO SELL AT RETAIL MOTOR FUEL and/or AUTOMOTIVE LUBRICATING OIL FOR 2019 FEE $150.00 In accordance with the provisions of SECTION 295B, Chapter 94 M.G.L. as most recently amended.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor fuel tax information

Edit your motor fuel tax information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor fuel tax information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit motor fuel tax information online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit motor fuel tax information. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor fuel tax information

How to fill out motor fuel tax information

01

To fill out motor fuel tax information, follow these steps:

02

Gather all necessary documentation, such as fuel receipts, mileage logs, and vehicle information.

03

Determine the period for which you need to report the motor fuel tax.

04

Calculate the total amount of fuel consumed during the reporting period.

05

Determine the type of fuel used (e.g., gasoline, diesel, biofuel) and its corresponding tax rate.

06

Multiply the fuel consumption by the tax rate to calculate the total tax liability.

07

Fill out the appropriate motor fuel tax form provided by your local tax authority.

08

Enter the required information, such as vehicle identification number, fuel type, fuel consumption, and tax amount.

09

Double-check the accuracy of the information entered before submitting the form.

10

Submit the completed motor fuel tax form along with any supporting documents to the designated tax authority.

11

Keep copies of the filed form and supporting documents for your records.

12

Note: The specific requirements and forms may vary depending on your jurisdiction. It is advised to consult your local tax authority or seek professional assistance for accurate and up-to-date instructions.

Who needs motor fuel tax information?

01

Motor fuel tax information is needed by:

02

- Individuals or businesses involved in the sale, distribution, or use of motor fuel.

03

- Transportation companies, such as trucking, delivery, or logistics companies.

04

- Government agencies responsible for enforcing and collecting motor fuel taxes.

05

- Tax professionals or accountants handling tax compliance for clients in the motor fuel industry.

06

- Any individual or organization that owns or operates vehicles powered by motor fuel and is required to report and pay fuel taxes.

07

It is important to comply with motor fuel tax regulations to avoid penalties and ensure the funding for transportation infrastructure and related services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify motor fuel tax information without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including motor fuel tax information. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in motor fuel tax information without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit motor fuel tax information and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit motor fuel tax information on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign motor fuel tax information right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your motor fuel tax information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Fuel Tax Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.