Get the free Back pay due to misclassification

Show details

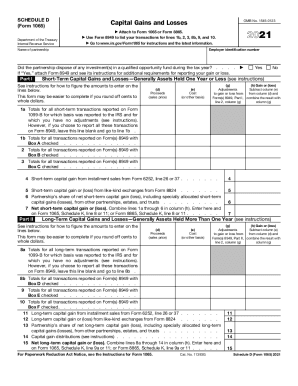

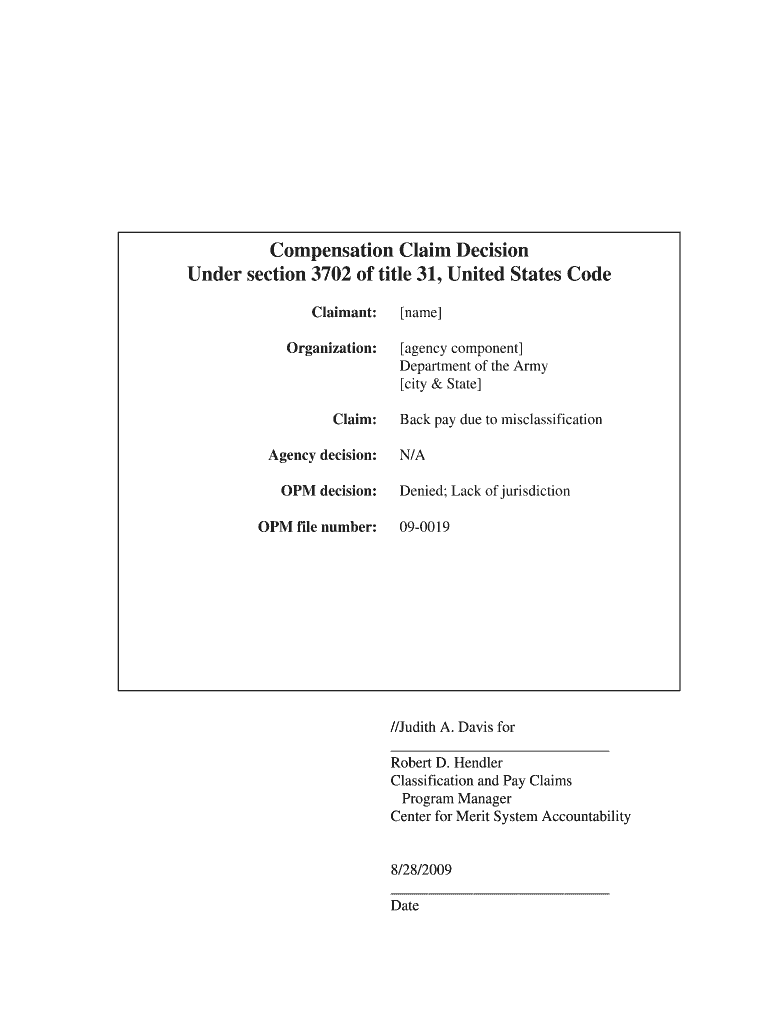

Compensation Claim Decision Under section 3702 of title 31, United States Code Claimant: Organization:Claim: Agency decision: OPM decision: OPM file number: name agency component Department of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign back pay due to

Edit your back pay due to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your back pay due to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit back pay due to online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit back pay due to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out back pay due to

How to fill out back pay due to

01

To fill out back pay due to, follow these steps:

02

Gather all relevant information: Before filling out back pay due to, collect all the necessary information such as the employee's name, employee ID, date range for which back pay is due, and the amount owed.

03

Calculate the back pay amount: Determine the correct amount owed to the employee as back pay. This could include unpaid wages, overtime, bonuses, or other forms of compensation that were not previously paid.

04

Check legal requirements: Ensure that the back pay calculations comply with all applicable labor laws, employment agreements, and company policies.

05

Prepare the necessary forms: Use the appropriate back pay form provided by your company or create one that includes the employee's details, the amount owed, and the reason for back pay.

06

Seek approval: If required, obtain the necessary approvals from supervisors or higher authorities before proceeding with the back pay.

07

Communicate with the employee: Inform the employee about the back pay due to and provide any supporting documentation or explanations as needed.

08

Process the payment: Once all approvals and verifications are complete, process the payment for the back pay owed to the employee. Be sure to maintain appropriate records of the payment for future reference.

09

Document the transaction: Keep a record of the back pay transaction, including the date, amount paid, and any relevant notes or comments.

10

Follow up: After the back pay has been processed, follow up with the employee to ensure they have received the payment and address any concerns or questions they may have.

11

Retain records: Maintain copies of all relevant documents, forms, and records related to the back pay due to for future reference and compliance purposes.

Who needs back pay due to?

01

Back pay due to is needed by employees who have not received their rightful compensation for a specific period of time. It can be applicable in various situations, such as:

02

- Employees who were underpaid or not paid at all for their work

03

- Employees who were not compensated for overtime hours worked

04

- Employees who were wrongly denied bonuses or incentives

05

- Employees who have experienced pay discrimination or unequal pay

06

- Employees who were incorrectly classified as exempt from overtime pay

07

- Employees who were on leave and are entitled to receive back pay upon their return

08

In general, anyone who has been deprived of their rightful earnings for any reason may need to seek back pay due to.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send back pay due to for eSignature?

Once you are ready to share your back pay due to, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find back pay due to?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific back pay due to and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the back pay due to in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your back pay due to and you'll be done in minutes.

What is back pay due to?

Back pay is due to an employee when they have not been paid the wages and benefits they are owed.

Who is required to file back pay due to?

Employers are required to file back pay due to employees who have not been paid appropriately.

How to fill out back pay due to?

To fill out back pay due to, employers must calculate the amount owed to the employee and provide a detailed breakdown of the back pay.

What is the purpose of back pay due to?

The purpose of back pay due to is to compensate employees for wages and benefits that were not paid to them.

What information must be reported on back pay due to?

Employers must report the total amount of back pay owed, the time period it covers, and any other relevant details.

Fill out your back pay due to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Back Pay Due To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.