Get the free Shared Fund Contingency Program Confirmation Form - CMAP

Show details

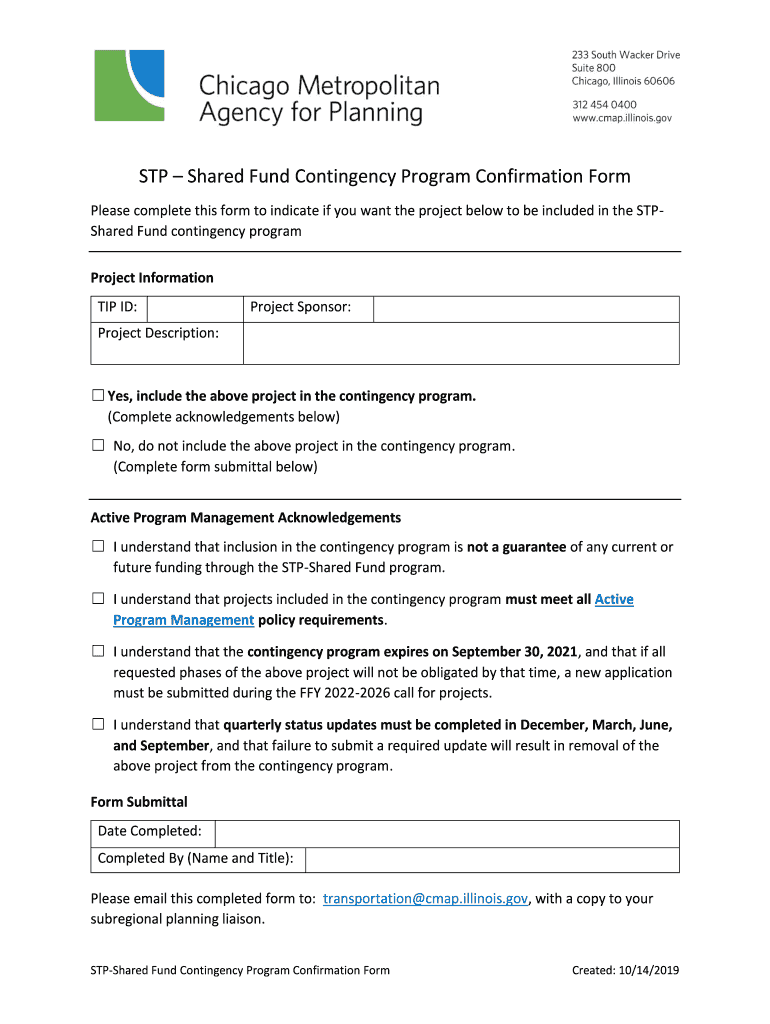

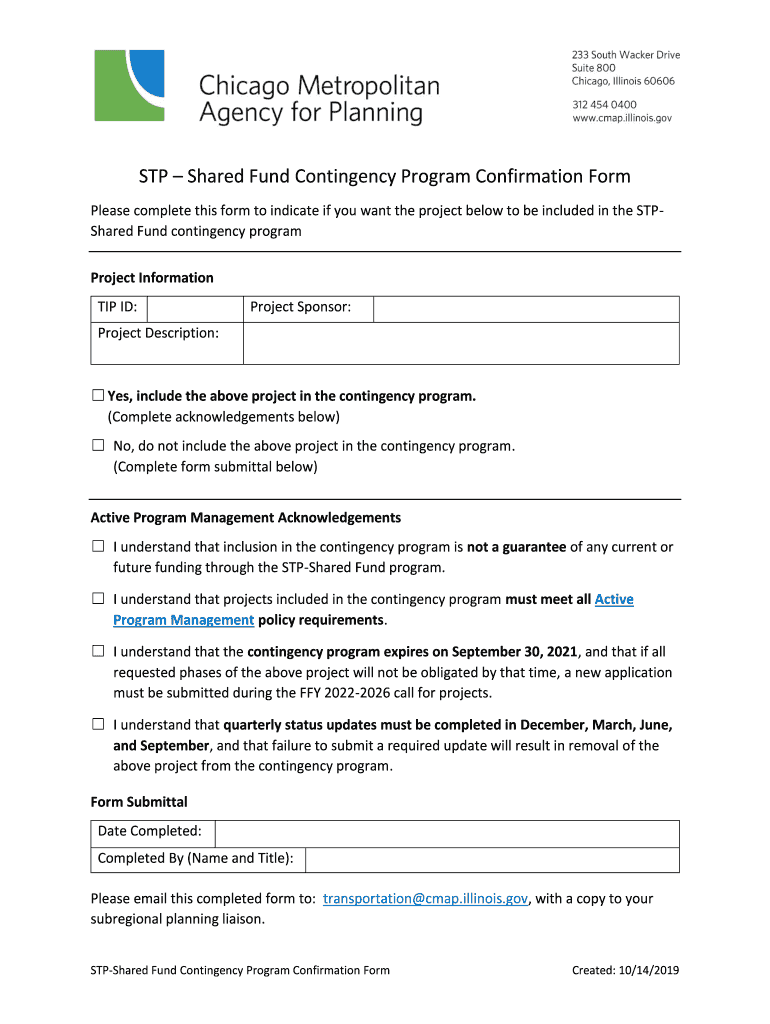

STP Shared Fund Contingency Program Confirmation Form Please complete this form to indicate if you want the project below to be included in the Standard Fund contingency program Project Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign shared fund contingency program

Edit your shared fund contingency program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your shared fund contingency program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit shared fund contingency program online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit shared fund contingency program. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out shared fund contingency program

How to fill out shared fund contingency program

01

Start by gathering all the necessary information such as financial statements, investment agreements, and any other relevant documents.

02

Review the fund's investment strategy and objectives to understand the purpose of the contingency program.

03

Identify potential risks and scenarios that could impact the fund's performance or stability.

04

Develop a comprehensive plan to mitigate these risks, including setting aside sufficient funds and establishing protocols for addressing contingencies.

05

Define clear guidelines and protocols for decision-making in case of a contingency event.

06

Ensure that the contingency plan aligns with regulatory requirements and industry best practices.

07

Communicate the contingency program to stakeholders, including fund investors and relevant regulatory authorities.

08

Regularly review and update the contingency program as needed to adapt to changing market conditions or regulatory requirements.

09

Conduct periodic simulations or stress tests to assess the effectiveness of the contingency program and identify areas for improvement.

10

Train fund managers and relevant staff on the proper implementation of the contingency program so they are prepared to act in case of an emergency.

Who needs shared fund contingency program?

01

Shared fund contingency programs are crucial for any organization or individual investing in shared funds.

02

This includes institutional investors such as pension funds, endowments, and insurance companies, as well as individual retail investors.

03

By having a well-defined contingency program, investors can protect themselves from unforeseen events that could negatively impact their investments.

04

Additionally, regulatory authorities often require fund managers to have contingency plans in place to ensure the stability and integrity of the shared fund industry.

05

Overall, anyone who has exposure to shared funds should consider implementing a contingency program to safeguard their investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify shared fund contingency program without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including shared fund contingency program, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get shared fund contingency program?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific shared fund contingency program and other forms. Find the template you want and tweak it with powerful editing tools.

Can I edit shared fund contingency program on an Android device?

With the pdfFiller Android app, you can edit, sign, and share shared fund contingency program on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is shared fund contingency program?

Shared fund contingency program is a regulatory requirement for asset management firms to have a plan in place in case of unexpected events that could impact the operations of shared funds.

Who is required to file shared fund contingency program?

Asset management firms who manage shared funds are required to file a shared fund contingency program.

How to fill out shared fund contingency program?

The shared fund contingency program should be filled out by outlining potential risks, detailing response plans, and assigning responsibilities within the asset management firm.

What is the purpose of shared fund contingency program?

The purpose of shared fund contingency program is to ensure that asset management firms are prepared to handle emergencies and maintain the stability of shared funds.

What information must be reported on shared fund contingency program?

Information such as risk assessment, mitigation strategies, communication plans, and contact information for key personnel must be reported on shared fund contingency program.

Fill out your shared fund contingency program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Shared Fund Contingency Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.