Get the free Bonus Depreciation and How It Affects Business Taxes

Show details

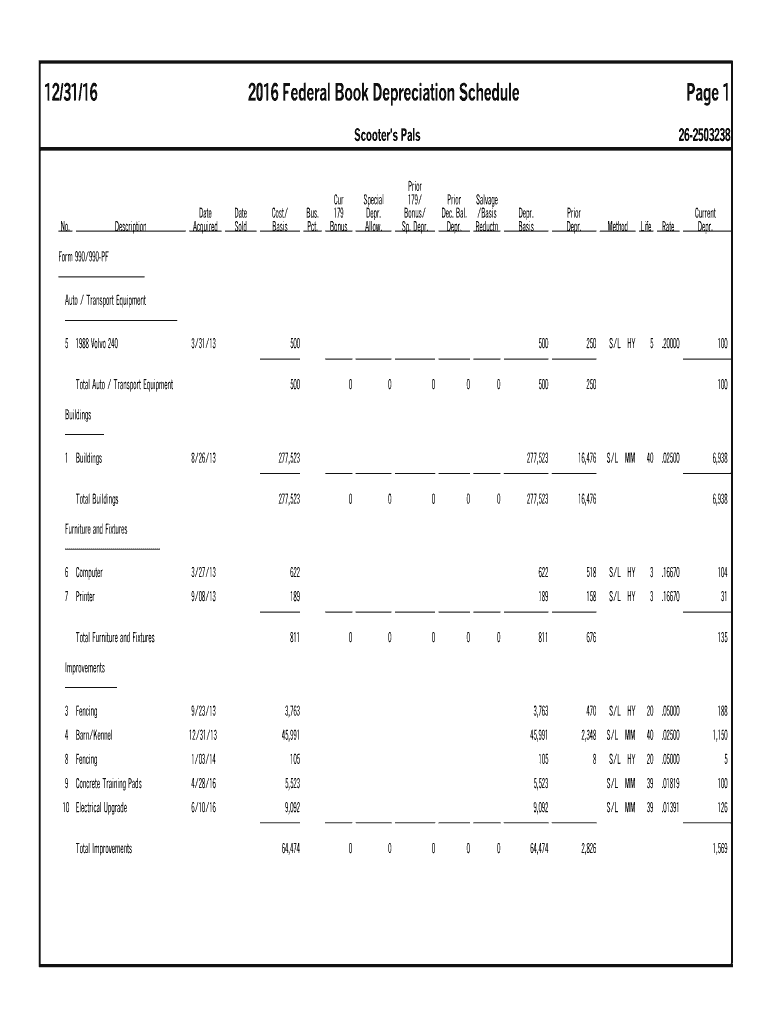

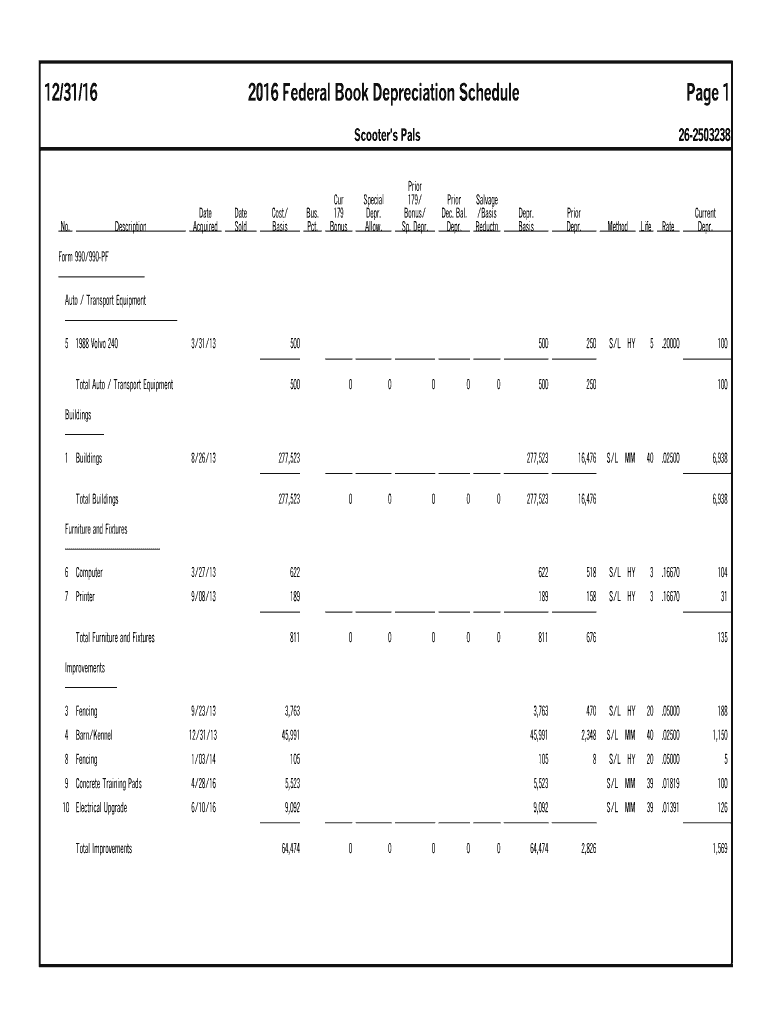

12/31/162016 Federal Book Depreciation Schedule Page 1Scooter's Pals No. DescriptionDate AcquiredDate Oldest/ Basis. Pct. Cur 179 Bonus262503238Prior 179/ Bonus/ Sp. Dear. Special Deer. Allow. Prior

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bonus depreciation and how

Edit your bonus depreciation and how form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bonus depreciation and how form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bonus depreciation and how online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bonus depreciation and how. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bonus depreciation and how

How to fill out bonus depreciation and how

01

To fill out bonus depreciation, follow these steps:

02

Determine if your business is eligible for bonus depreciation. Generally, businesses that have purchased qualifying property, such as equipment, furniture, or vehicles, may be eligible for bonus depreciation.

03

Gather the necessary information and documents. This may include purchase invoices, receipts, and details about the property being depreciated.

04

Calculate the bonus depreciation amount. The specific calculation method may vary depending on your country's tax laws, so consult with a tax professional or refer to the relevant tax guidelines.

05

Complete the appropriate tax forms. This may include Form 4562 in the United States, or similar forms in other countries.

06

Double-check your calculations and ensure all required fields are filled out accurately.

07

Submit the completed forms along with any supporting documents to the relevant tax authority.

08

Keep copies of all filed documents and supporting evidence for your records.

09

It is recommended to seek guidance from a tax professional or accountant to ensure proper adherence to tax regulations and accurately fill out bonus depreciation.

Who needs bonus depreciation and how?

01

Bonus depreciation is beneficial for businesses that meet certain criteria. Some examples of who may benefit from bonus depreciation include:

02

- Small businesses looking to reduce their tax liability by accelerating depreciation deductions

03

- Businesses that have made significant equipment or property purchases and want to maximize tax benefits

04

- Businesses in industries with high capital expenditures, such as manufacturing or construction

05

- Real estate investors who qualify for bonus depreciation on qualifying property investments

06

- Startups or companies in their early stages that have incurred substantial expenses on qualifying assets

07

However, it is important to consult with a tax professional or accountant to determine if bonus depreciation is suitable for your specific situation, as eligibility and benefits may vary based on tax laws and individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in bonus depreciation and how without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your bonus depreciation and how, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the bonus depreciation and how electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your bonus depreciation and how in seconds.

Can I edit bonus depreciation and how on an iOS device?

Use the pdfFiller mobile app to create, edit, and share bonus depreciation and how from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is bonus depreciation and how?

Bonus depreciation is a tax incentive that allows businesses to immediately deduct a large portion of the cost of qualifying assets in the year they are placed in service. This encourages businesses to invest in new equipment and property. To claim bonus depreciation, businesses must use Form 4562 when filing their tax return.

Who is required to file bonus depreciation and how?

Any business that purchases qualifying assets that meet the requirements for bonus depreciation is eligible to file. This includes corporations, partnerships, and sole proprietors. To claim bonus depreciation, the business must file Form 4562 along with their tax return.

How to fill out bonus depreciation and how?

To fill out bonus depreciation, businesses must first determine if their asset qualifies for bonus depreciation. They then need to calculate the depreciation deduction using the appropriate percentage, which varies depending on the year the asset was placed in service. Finally, the business must report this information on Form 4562 when filing their tax return.

What is the purpose of bonus depreciation and how?

The purpose of bonus depreciation is to stimulate investment in new equipment and property by allowing businesses to deduct a large portion of the cost in the year the asset is placed in service. This helps businesses grow and expand by reducing their tax liability.

What information must be reported on bonus depreciation and how?

Businesses must report the cost of the qualifying asset, the date it was placed in service, the depreciation percentage used, and the total depreciation deduction claimed for the year on Form 4562 when filing their tax return.

Fill out your bonus depreciation and how online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bonus Depreciation And How is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.