Get the free Revenue AnalysesMinnesota Department of Revenue

Show details

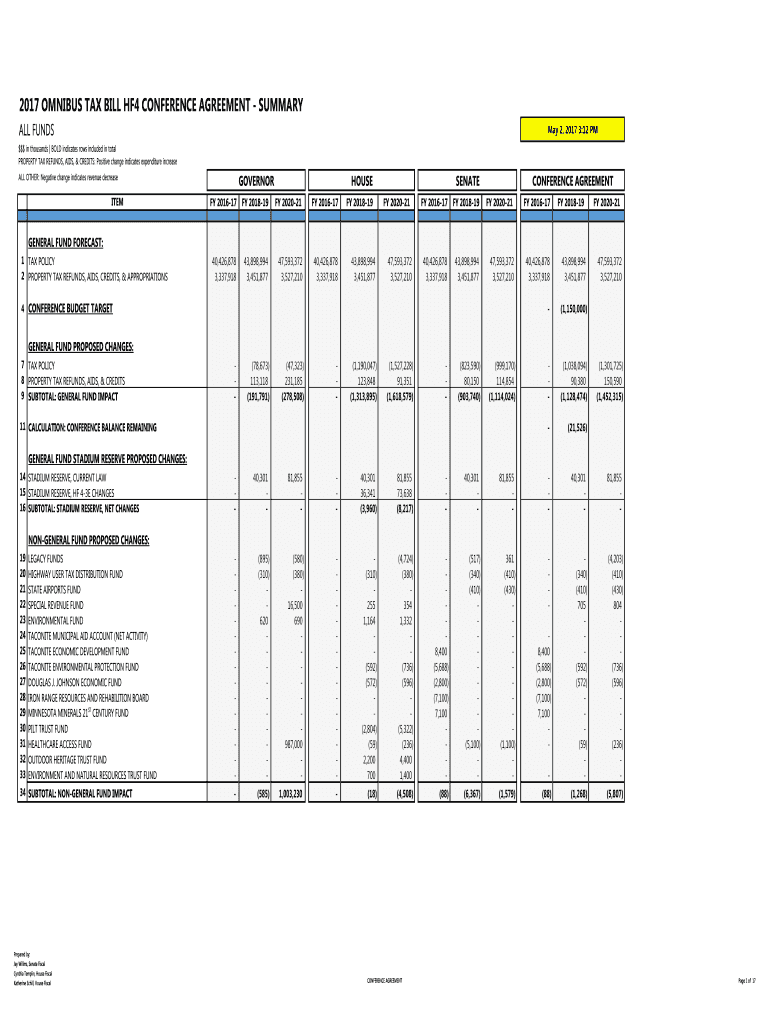

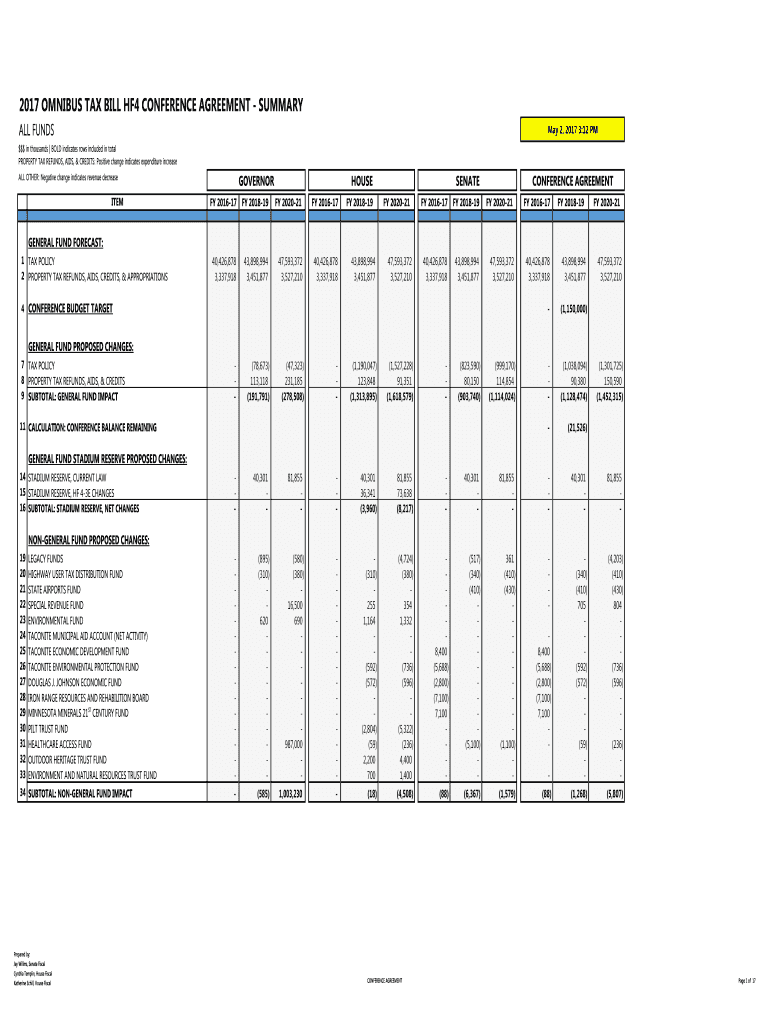

2017 OMNIBUS TAX BILL HF4 CONFERENCE AGREEMENT SUMMARY ALL FUNDS May 2, 2017 3:12 PM in thousands BOLD indicates rows included in total PROPERTY TAX REFUNDS, AIDS, & CREDITS: Positive change indicates

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue analysesminnesota department of

Edit your revenue analysesminnesota department of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue analysesminnesota department of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revenue analysesminnesota department of online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit revenue analysesminnesota department of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue analysesminnesota department of

How to fill out revenue analysesminnesota department of

01

To fill out revenue analyses for the Minnesota Department of Revenue, follow these steps:

02

Gather all relevant financial data, including revenue records, expenses, and any other relevant information.

03

Determine the time period for which you are conducting the analysis. This could be a monthly, quarterly, or annual analysis.

04

Use appropriate software or tools to input the financial data and perform calculations. This may include spreadsheets or specialized accounting software.

05

Analyze the data by comparing revenue trends, identifying any significant changes or patterns, and evaluating the overall financial performance.

06

Prepare a written report summarizing the revenue analysis findings, including any insights or recommendations.

07

Ensure accuracy and completeness of the analysis by reviewing all calculations and double-checking the data.

08

Submit the revenue analysis report to the Minnesota Department of Revenue or any relevant stakeholders as required.

Who needs revenue analysesminnesota department of?

01

Revenue analyses are needed by various entities, including:

02

- Businesses: Businesses use revenue analyses to evaluate their financial performance, identify areas for improvement, and make informed decisions.

03

- Government Agencies: Government agencies, such as the Minnesota Department of Revenue, require revenue analyses to assess tax collection and compliance, analyze economic trends, and allocate resources effectively.

04

- Investors: Investors use revenue analyses to assess the financial health and growth potential of companies before making investment decisions.

05

- Financial Institutions: Banks and other financial institutions may require revenue analyses as part of loan applications or credit assessments to evaluate the borrower's ability to generate income and repay debt.

06

- Consultants: Financial consultants and advisors may use revenue analyses to provide insights and recommendations to their clients for improving revenue generation and profitability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send revenue analysesminnesota department of to be eSigned by others?

Once you are ready to share your revenue analysesminnesota department of, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in revenue analysesminnesota department of?

With pdfFiller, the editing process is straightforward. Open your revenue analysesminnesota department of in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out revenue analysesminnesota department of on an Android device?

Use the pdfFiller mobile app and complete your revenue analysesminnesota department of and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is revenue analysesminnesota department of?

Revenue analysis for the Minnesota Department of Revenue involves examining financial data to assess the sources and trends of revenue.

Who is required to file revenue analysesminnesota department of?

Certain businesses and individuals may be required to file revenue analyses with the Minnesota Department of Revenue, depending on their income and tax obligations.

How to fill out revenue analysesminnesota department of?

To fill out revenue analyses for the Minnesota Department of Revenue, one must gather and analyze financial data, report relevant information, and submit the form by the deadline.

What is the purpose of revenue analysesminnesota department of?

The purpose of revenue analyses for the Minnesota Department of Revenue is to track and assess revenue sources, identify trends, and ensure compliance with tax laws.

What information must be reported on revenue analysesminnesota department of?

Revenue analyses for the Minnesota Department of Revenue may require reporting of income sources, deductions, expenses, and other financial data relevant to tax obligations.

Fill out your revenue analysesminnesota department of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Analysesminnesota Department Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.