Get the free Deposit insurance conditions for boats from Adriatic Challenge putnika agencija d

Show details

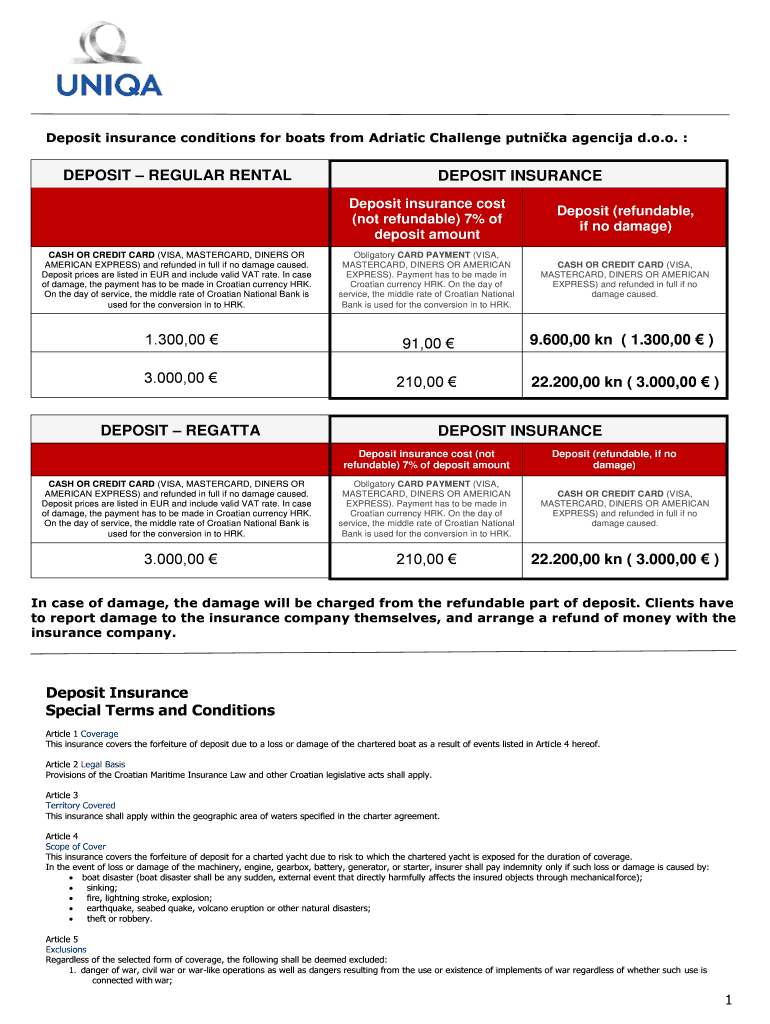

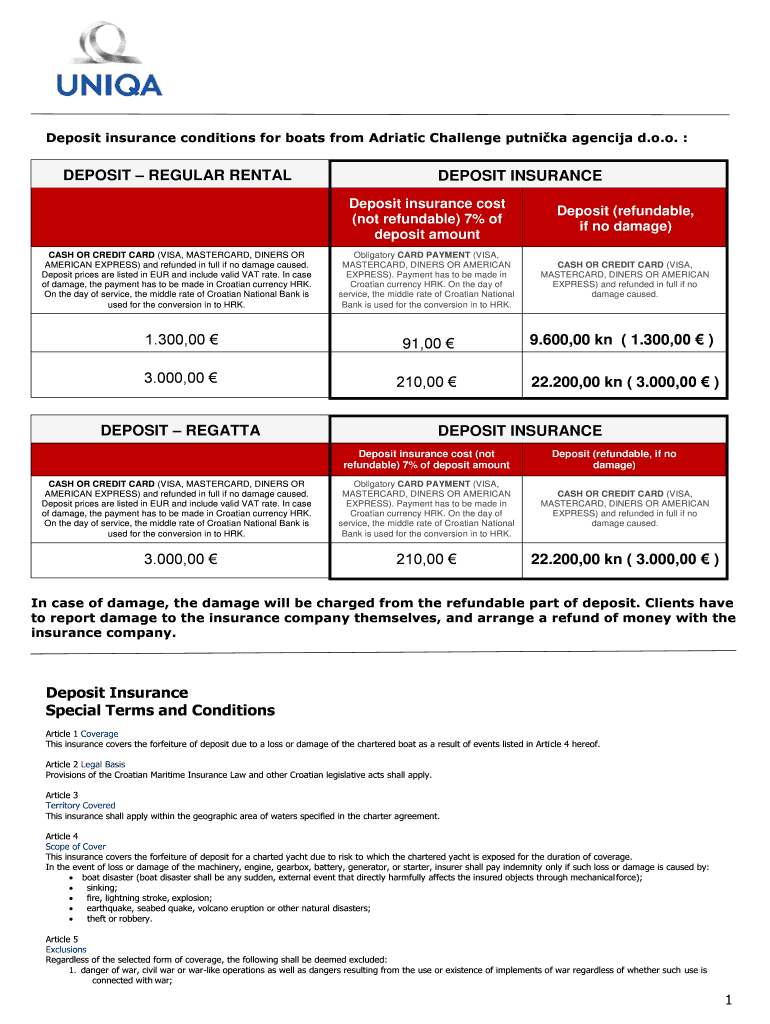

Deposit insurance conditions for boats from Adriatic Challenge Sputnik agencies d.o.o. :DEPOSIT REGULAR RENTALS OR CREDIT CARD (VISA, MASTERCARD, DINERS OR AMERICAN EXPRESS) and refunded in full if

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deposit insurance conditions for

Edit your deposit insurance conditions for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deposit insurance conditions for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deposit insurance conditions for online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit deposit insurance conditions for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

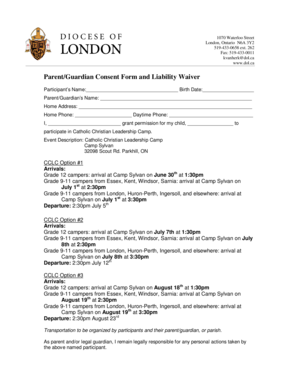

How to fill out deposit insurance conditions for

How to fill out deposit insurance conditions for

01

To fill out deposit insurance conditions, follow these steps:

02

Understand the terms and conditions of your deposit insurance policy.

03

Gather all the required documents, such as identification proof, proof of residence, and proof of income.

04

Visit the nearest branch of your bank or insurance company.

05

Approach the customer service desk and ask for assistance in filling out the deposit insurance conditions.

06

Provide all the necessary information asked on the application form accurately.

07

Attach the required documents with the application form.

08

Review the filled form and ensure all the details are correct.

09

Submit the completed application form along with the supporting documents to the customer service representative.

10

Pay any applicable fees or premiums, if required.

11

Wait for the confirmation and acknowledgement of your deposit insurance conditions.

12

Keep a copy of the filled application form and supporting documents for your records.

Who needs deposit insurance conditions for?

01

Deposit insurance conditions are beneficial for anyone who wants to protect their deposited funds from various risks.

02

Individuals: Individuals who have significant savings or regular deposits in banks can benefit from deposit insurance conditions. It gives them financial security in case of bank failures or other unforeseen circumstances.

03

Small Businesses: Small businesses that deposit their funds in banks can also benefit from deposit insurance conditions. It safeguards their working capital and ensures that their funds are protected in case of any financial institution insolvencies.

04

Investors: Investors who have invested their money in financial institutions can mitigate risks by opting for deposit insurance conditions. It provides an added layer of protection to their investments.

05

Retirees: Retirees who rely on their pension or savings can safeguard their funds through deposit insurance conditions. It offers peace of mind and ensures their financial stability during retirement.

06

Joint Account Holders: Individuals who hold joint bank accounts can opt for deposit insurance conditions to protect their shared funds.

07

Families: Families with a shared bank account or multiple individual accounts can benefit from deposit insurance conditions as it secures their collective savings.

08

Anyone Seeking Financial Security: Anyone who wants to ensure the safety of their deposited funds in banks can proactively opt for deposit insurance conditions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send deposit insurance conditions for for eSignature?

When you're ready to share your deposit insurance conditions for, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit deposit insurance conditions for online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your deposit insurance conditions for to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit deposit insurance conditions for in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing deposit insurance conditions for and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is deposit insurance conditions for?

Deposit insurance conditions are put in place to protect depositors' funds in case a financial institution fails.

Who is required to file deposit insurance conditions for?

Financial institutions are required to file deposit insurance conditions.

How to fill out deposit insurance conditions for?

Deposit insurance conditions can be filled out online through the designated portal provided by the regulatory authority.

What is the purpose of deposit insurance conditions for?

The purpose of deposit insurance conditions is to ensure that depositors' funds are safeguarded and insured in case of financial institution insolvency.

What information must be reported on deposit insurance conditions for?

Information such as account holders' names, account numbers, account balances, and transaction details must be reported on deposit insurance conditions.

Fill out your deposit insurance conditions for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deposit Insurance Conditions For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.