Get the free LUMP SUM INCOME - Dhs.state.mn.us

Show details

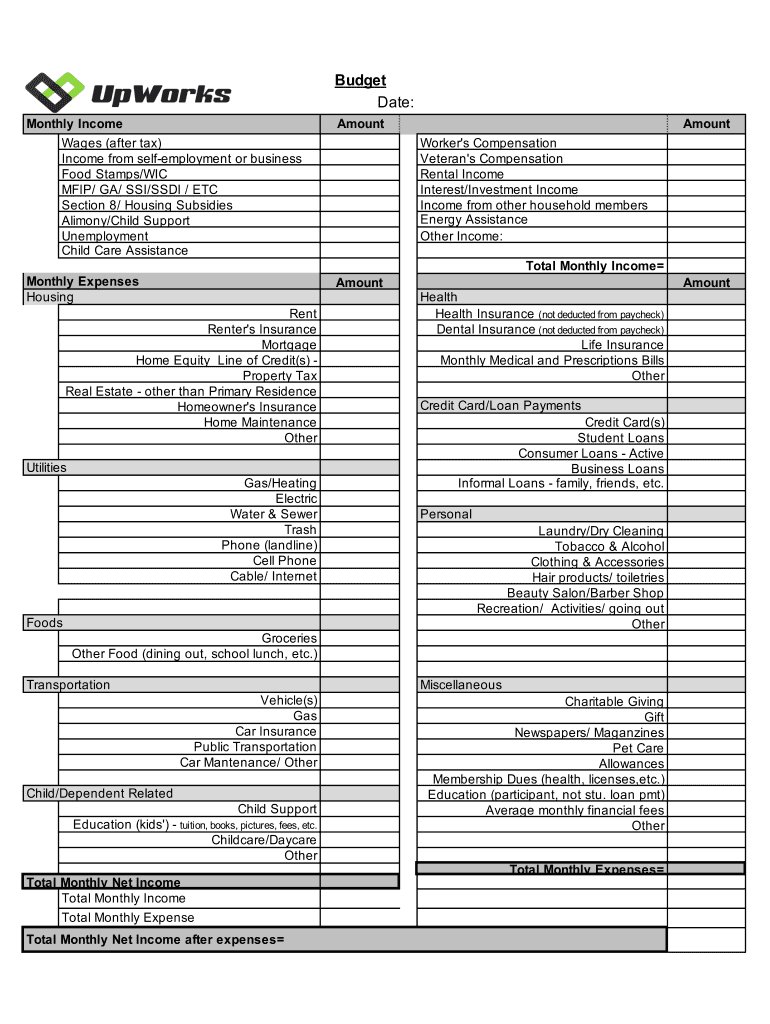

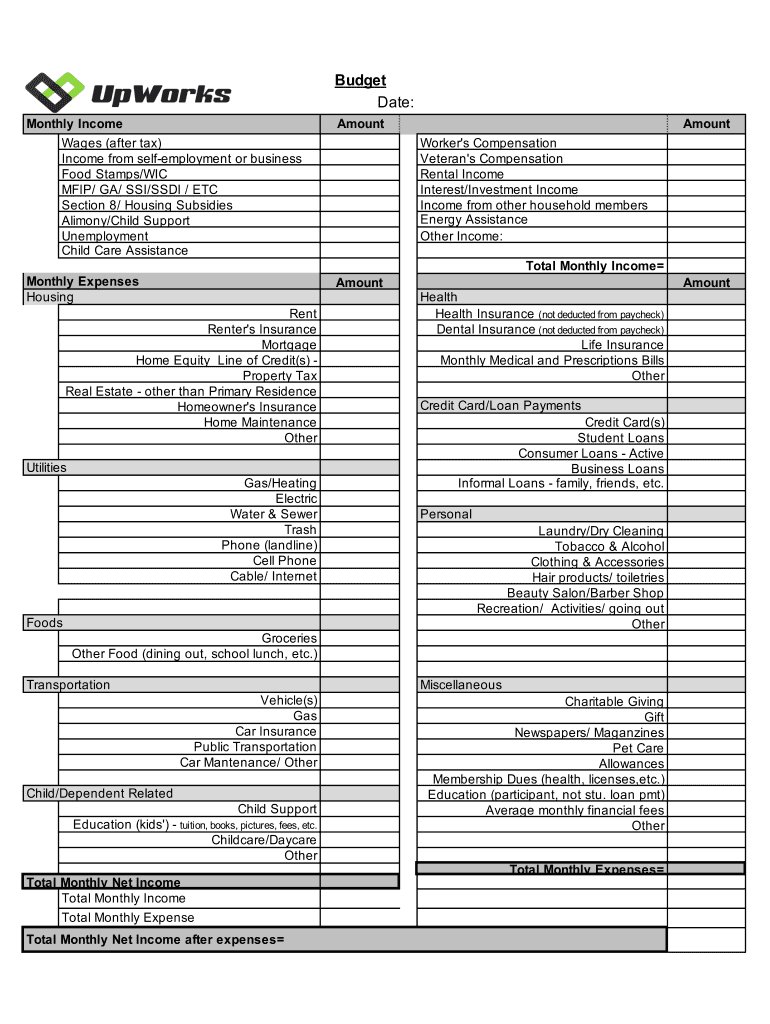

Budget

Date:

Monthly Income

Wages (after tax)

Income from self-employment or business

Food Stamps/WIC

FIP/ GA/ SSI/SDI / ETC

Section 8/ Housing Subsidies

Alimony/Child Support

Unemployment

Child Care

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lump sum income

Edit your lump sum income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lump sum income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lump sum income online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit lump sum income. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lump sum income

How to fill out lump sum income

01

Determine the source of your lump sum income, such as an inheritance, a one-time bonus, or a large financial settlement.

02

Calculate the total amount of the lump sum income you have received.

03

Assess your financial goals and circumstances to determine how you want to allocate the lump sum income.

04

Prioritize any outstanding debts you may have, such as credit card debts or student loans, and consider using a portion of the lump sum income to pay them off.

05

Create an emergency fund by setting aside a portion of the lump sum income to cover unexpected expenses.

06

Consider investing a portion of the lump sum income to help grow your wealth over time.

07

Consult with a financial advisor or tax professional to understand the potential tax implications of your lump sum income and any investment decisions you make.

08

Keep track of your financial transactions related to the lump sum income for record-keeping purposes.

09

Review your financial plan regularly to ensure the lump sum income is being used effectively to achieve your financial goals.

Who needs lump sum income?

01

Individuals who receive a large windfall, such as an inheritance or a lottery win, may need to manage their lump sum income.

02

Business owners who sell their company or receive a significant payout may need to consider how to handle their lump sum income.

03

Individuals who receive a large legal settlement due to a lawsuit or insurance claim may need to navigate the management of their lump sum income.

04

Employees who receive a substantial one-time bonus or severance package may need to make financial decisions regarding their lump sum income.

05

Retirees who receive a lump sum payment, such as a pension buyout or retirement savings distribution, may need to plan for its usage in retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my lump sum income directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your lump sum income along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit lump sum income on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing lump sum income right away.

How do I edit lump sum income on an iOS device?

Use the pdfFiller mobile app to create, edit, and share lump sum income from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your lump sum income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lump Sum Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.