Get the free 9-19 YTD BALANCE SHEET.pdf. None

Show details

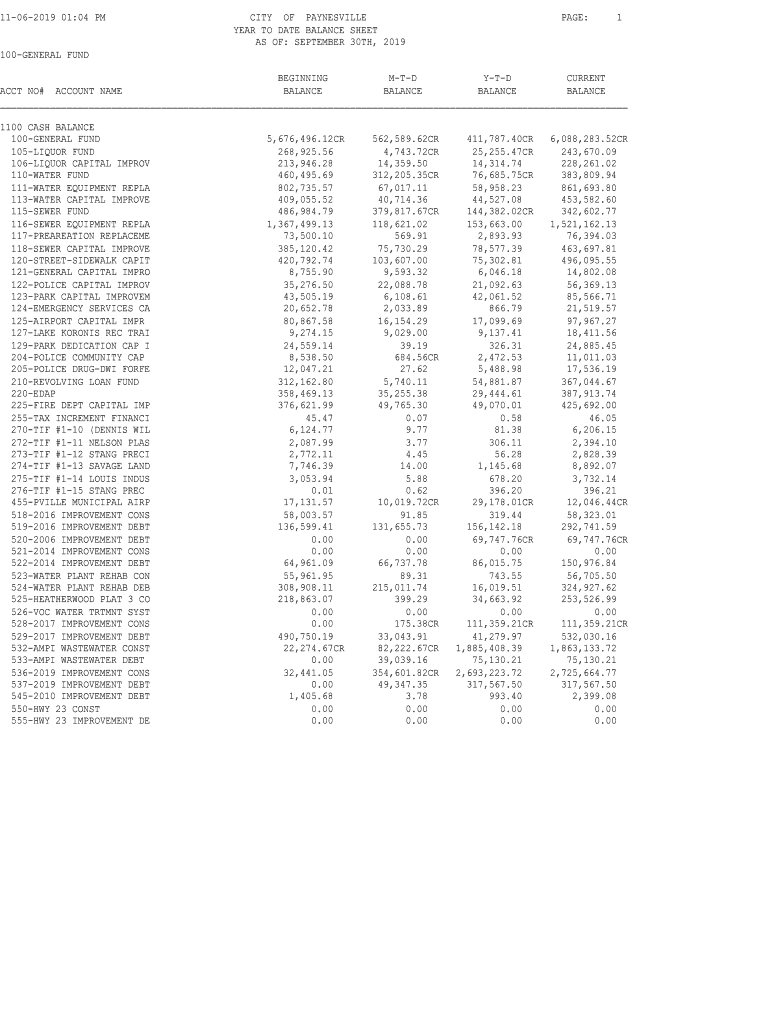

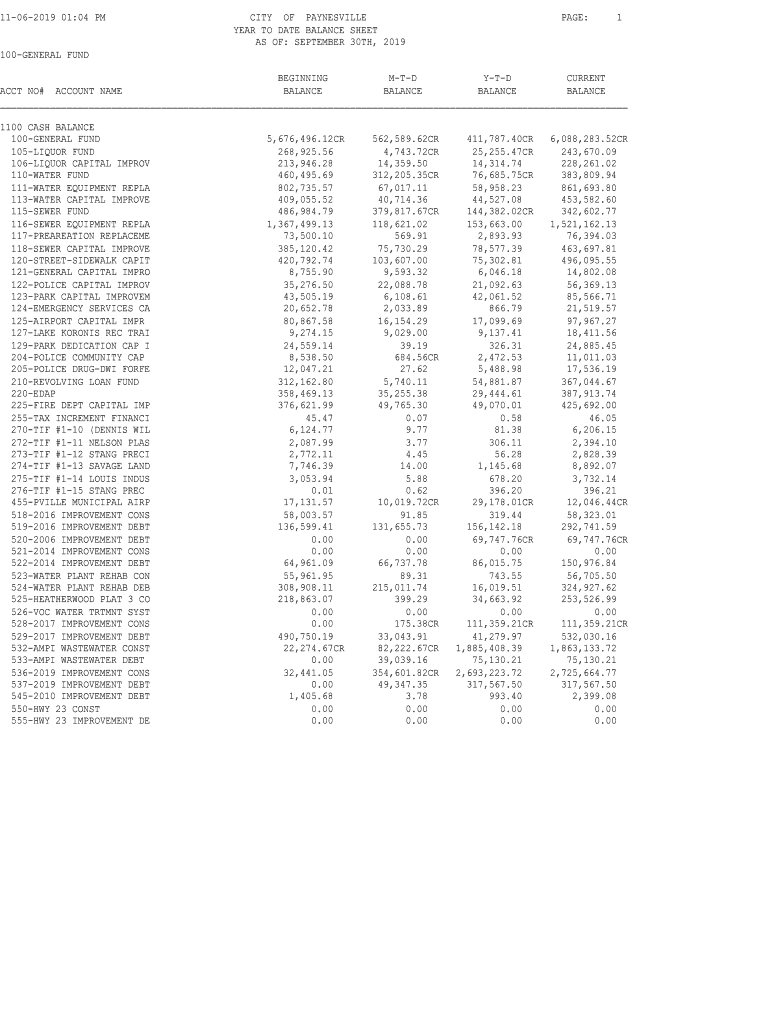

11062019 01:04 CITY OF PAINESVILLE YEAR TO DATE BALANCE SHEET AS OF: SEPTEMBER 30TH, 2019PAGE:1100GENERAL FUND BEGINNING MTD YTD CURRENT ACCT NO# ACCOUNT NAME BALANCE 1100 CASH BALANCE 100GENERAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 9-19 ytd balance sheetpdf

Edit your 9-19 ytd balance sheetpdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 9-19 ytd balance sheetpdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 9-19 ytd balance sheetpdf online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 9-19 ytd balance sheetpdf. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 9-19 ytd balance sheetpdf

How to fill out 9-19 ytd balance sheetpdf

01

To fill out the 9-19 YTD balance sheetpdf, follow these steps:

1. Open the document using a PDF reader or editor software.

02

Locate the section for assets and liabilities.

03

List all of your company's assets under the appropriate categories, such as cash, accounts receivable, inventory, etc. Include the corresponding values for each asset.

04

List all of your company's liabilities under the appropriate categories, such as accounts payable, loans, etc. Include the corresponding values for each liability.

05

Calculate the total value of assets and liabilities separately.

06

Subtract the total liabilities from the total assets to determine your company's equity.

07

Provide any required additional information, such as a breakdown of specific assets or liabilities.

08

Double-check all entries for accuracy and completeness.

09

Save the filled-out balance sheetpdf file with an appropriate name for future reference.

Who needs 9-19 ytd balance sheetpdf?

01

The 9-19 YTD balance sheetpdf is needed by businesses and organizations to keep track of their financial standing. It is particularly useful for accounting purposes, tax filings, and reporting to stakeholders. Company owners, investors, lenders, and regulatory authorities may require the balance sheet as part of financial analysis and decision-making processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 9-19 ytd balance sheetpdf to be eSigned by others?

9-19 ytd balance sheetpdf is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute 9-19 ytd balance sheetpdf online?

pdfFiller has made it easy to fill out and sign 9-19 ytd balance sheetpdf. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit 9-19 ytd balance sheetpdf on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing 9-19 ytd balance sheetpdf right away.

What is 9-19 ytd balance sheetpdf?

9-19 ytd balance sheetpdf is a financial document that shows the financial position of a company from the beginning of the year up to the specified date in September.

Who is required to file 9-19 ytd balance sheetpdf?

Any company or organization that follows a fiscal year calendar and operates in accordance with financial reporting standards may be required to file the 9-19 ytd balance sheetpdf.

How to fill out 9-19 ytd balance sheetpdf?

To fill out the 9-19 ytd balance sheetpdf, you will need to aggregate financial information for the period from January to September and present it in a structured format according to accounting principles.

What is the purpose of 9-19 ytd balance sheetpdf?

The purpose of 9-19 ytd balance sheetpdf is to provide stakeholders with an overview of the company's financial position and performance for the year-to-date period.

What information must be reported on 9-19 ytd balance sheetpdf?

Information such as assets, liabilities, equity, revenues, expenses, and net income for the year-to-date period must be reported on the 9-19 ytd balance sheetpdf.

Fill out your 9-19 ytd balance sheetpdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

9-19 Ytd Balance Sheetpdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.