Get the free GST and Service Tax - - Tax Publishers

Show details

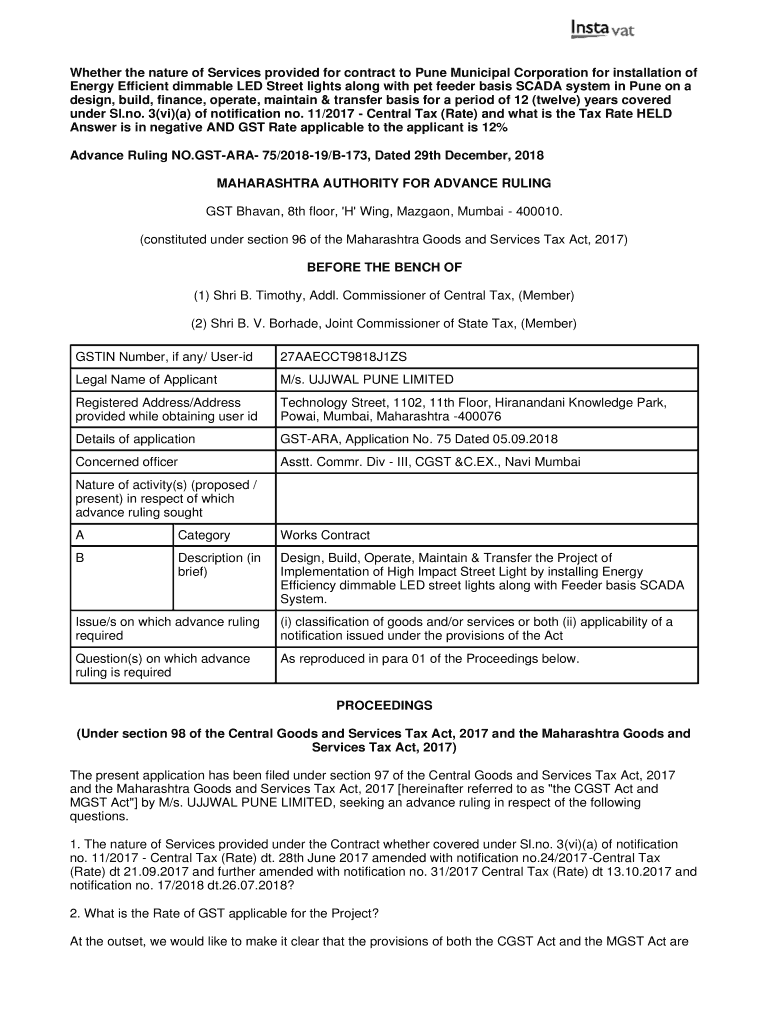

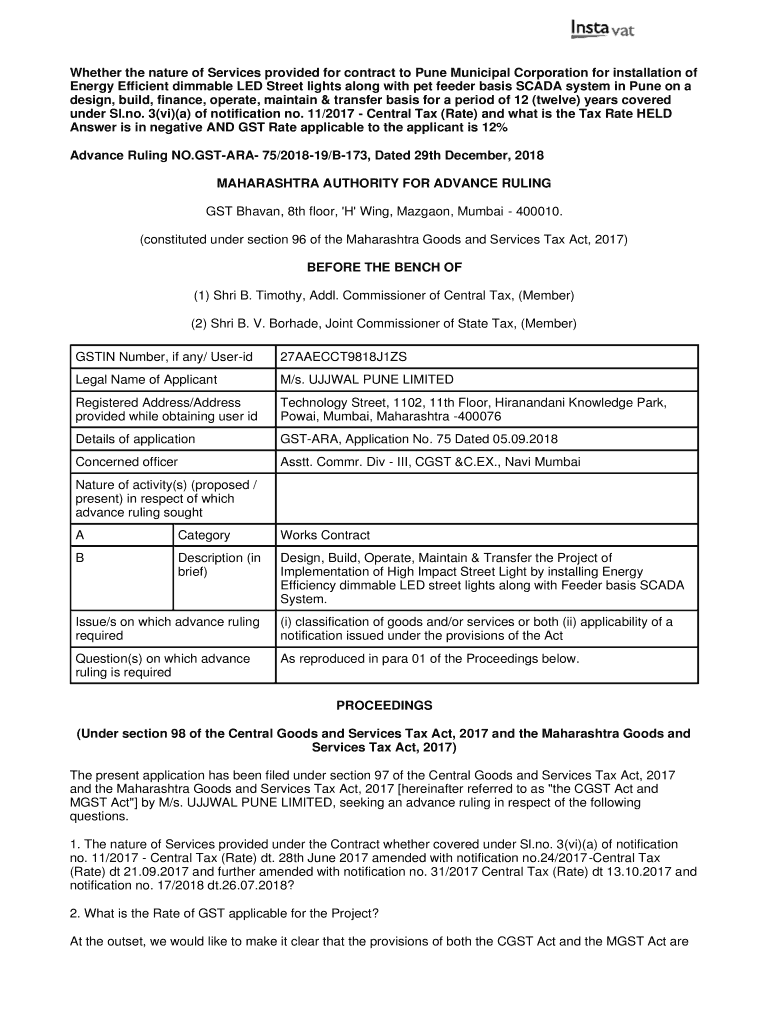

Whether the nature of Services provided for contract to Pune Municipal Corporation for installation of Energy Efficient dimmable LED Streetlights along with pet feeder basis SCADA system in Pune on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gst and service tax

Edit your gst and service tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst and service tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gst and service tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gst and service tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gst and service tax

How to fill out gst and service tax

01

To fill out GST and service tax forms, follow these steps:

02

Gather all the necessary information such as the taxable sales and services, tax exemptions, and applicable tax rates.

03

Identify the correct form to be filled out based on the type of transaction and the tax jurisdiction.

04

Fill in the required details accurately, including the taxpayer's identification number, invoice details, and taxable amounts.

05

Calculate the total tax amount by applying the relevant tax rate to the taxable value.

06

Review the filled-out form for any errors or omissions, and make corrections if needed.

07

Sign and date the form as required by the tax authority.

08

Submit the completed form along with any supporting documents to the designated tax office within the specified deadline.

09

Keep a copy of the filled-out form and supporting documents for future reference and audit purposes.

Who needs gst and service tax?

01

GST (Goods and Services Tax) and service tax are required by individuals or businesses that are involved in the provision of taxable goods or services.

02

Who needs GST and service tax depends on the tax regulations of each country or region. Generally, businesses with an annual turnover above a certain threshold are required to register for GST or service tax and file regular tax returns.

03

In addition, certain specific industries or types of transactions may have their own requirements for GST or service tax compliance.

04

It is important for businesses to consult with a tax professional or refer to the local tax authority's guidelines to determine if they are required to register and comply with GST and service tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find gst and service tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the gst and service tax in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the gst and service tax electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your gst and service tax and you'll be done in minutes.

How can I edit gst and service tax on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing gst and service tax, you need to install and log in to the app.

What is gst and service tax?

GST stands for Goods and Services Tax, which is a consumption tax based on value-added concept. Service tax is a tax levied by the government on services provided.

Who is required to file gst and service tax?

Businesses and individuals who provide taxable goods or services are required to file GST and service tax returns.

How to fill out gst and service tax?

GST and service tax returns can be filled out online on the respective tax department websites.

What is the purpose of gst and service tax?

The purpose of GST and service tax is to collect tax revenue from the consumption of goods and services.

What information must be reported on gst and service tax?

Information such as sales revenue, tax collected, and input tax credits must be reported on GST and service tax returns.

Fill out your gst and service tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gst And Service Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.