Get the free SUMMARY BOOKKEEPING Non Cash Payments Net Sales ...

Show details

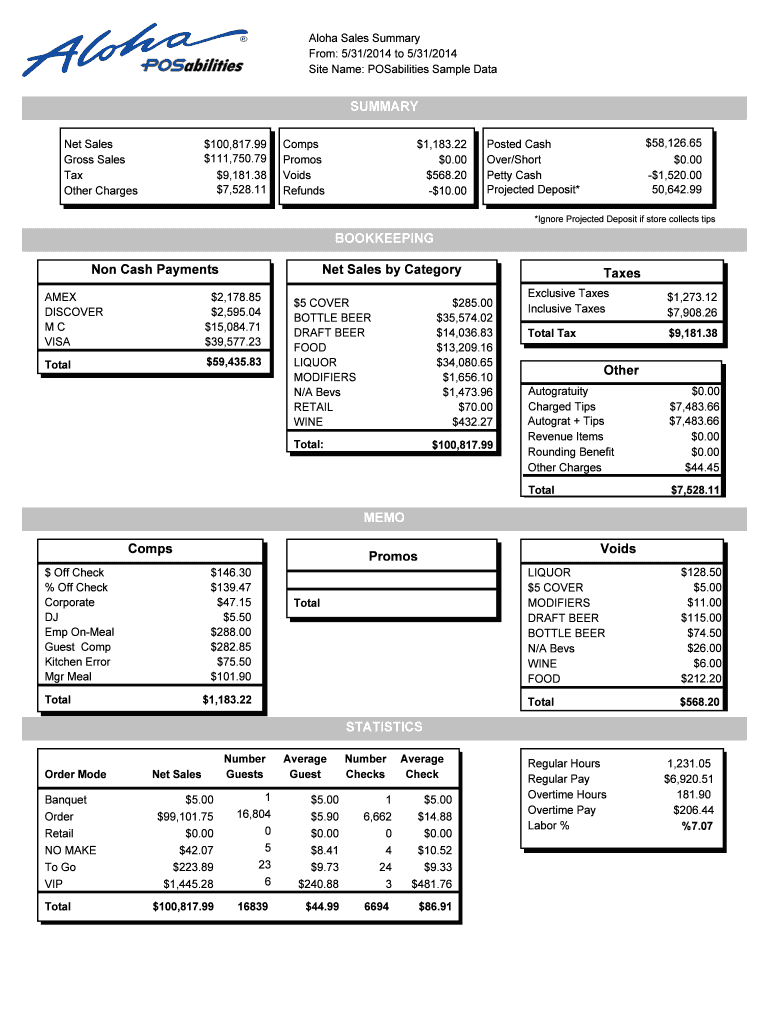

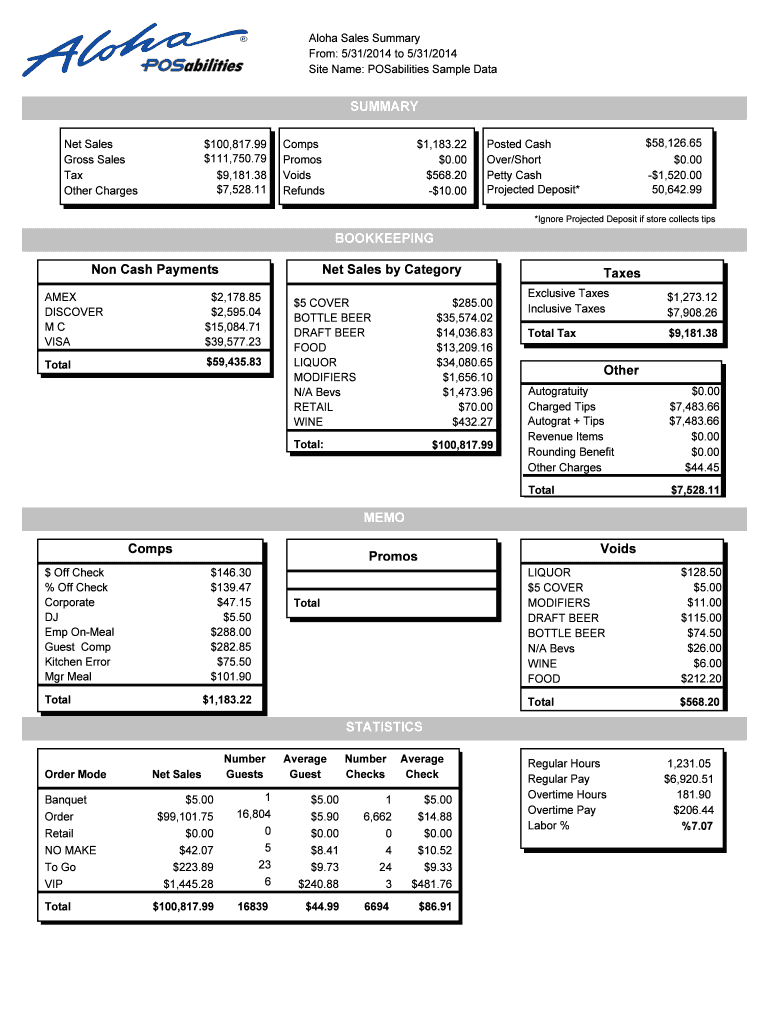

Aloha Sales Summary

From: 5/31/2014 to 5/31/2014

Site Name: POS abilities Sample DataSUMMARY

Net Sales

Gross Sales

Tax

Other Charges×100,817.99

×111,750.79

×9,181.38

×7,528.11Comps

Promos

Voids

Refunds×1,183.22

×0.00

×568.20

×10.00×58,126.65

×0.00

×1,520.00

50,642.99Posted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign summary bookkeeping non cash

Edit your summary bookkeeping non cash form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your summary bookkeeping non cash form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing summary bookkeeping non cash online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit summary bookkeeping non cash. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out summary bookkeeping non cash

How to fill out summary bookkeeping non cash

01

To fill out a summary bookkeeping for non-cash transactions, follow these steps:

02

Gather all the necessary documentation related to the non-cash transactions, such as purchase receipts, sales invoices, loan agreements, etc.

03

Identify the type of non-cash transaction you are dealing with, whether it is a purchase, sale, exchange, loan, or any other type.

04

Record the details of the non-cash transaction in the summary bookkeeping format. This typically includes the date of the transaction, the description of the transaction, the amount involved, and any relevant account numbers.

05

Ensure that the entries are accurately recorded and categorized according to the appropriate accounting principles and standards. This helps in generating accurate financial statements and reports.

06

Reconcile the non-cash transactions recorded in the summary bookkeeping with other relevant accounting records, such as cash book, general ledger, etc.

07

Verify the accuracy of the summary bookkeeping by cross-checking it with supporting documentation and conducting internal audits or reviews.

08

Regularly update and maintain the summary bookkeeping for non-cash transactions to ensure it reflects the most current and accurate financial information.

09

Seek professional advice or consult with a certified accountant or bookkeeper if you encounter any difficulties or have specific questions related to filling out the summary bookkeeping for non-cash transactions.

Who needs summary bookkeeping non cash?

01

Summary bookkeeping for non-cash transactions is needed by businesses and organizations that engage in transactions where cash is not directly involved.

02

This includes but is not limited to:

03

- Companies that conduct barter or trade transactions

04

- Businesses that accept non-cash payments, such as credit card payments or electronic fund transfers

05

- Organizations that use non-cash assets as collateral for loans or financing

06

- Entities that participate in non-cash exchanges or swaps

07

- Non-profit organizations that receive non-cash donations or contributions

08

By maintaining a summary bookkeeping for non-cash transactions, these entities can accurately track and report their financial activities, ensure compliance with accounting regulations, and make informed business decisions based on the non-cash transactions they engage in.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit summary bookkeeping non cash online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your summary bookkeeping non cash to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit summary bookkeeping non cash in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing summary bookkeeping non cash and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out summary bookkeeping non cash on an Android device?

On an Android device, use the pdfFiller mobile app to finish your summary bookkeeping non cash. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is summary bookkeeping non cash?

Summary bookkeeping non cash is a method of recording financial transactions that do not involve the exchange of physical currency.

Who is required to file summary bookkeeping non cash?

Businesses and individuals who have non-cash transactions are required to file summary bookkeeping non cash.

How to fill out summary bookkeeping non cash?

Summary bookkeeping non cash can be filled out by recording non-cash transactions in a detailed summary report.

What is the purpose of summary bookkeeping non cash?

The purpose of summary bookkeeping non cash is to accurately track non-cash transactions for financial reporting and tax purposes.

What information must be reported on summary bookkeeping non cash?

Information such as the date of the transaction, description of the transaction, parties involved, and the value of the transaction must be reported on summary bookkeeping non cash.

Fill out your summary bookkeeping non cash online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Summary Bookkeeping Non Cash is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.