Get the free r REPORT OF RECEIPTS n FEC AND DISBURSEMENTS RECEIVED

Show details

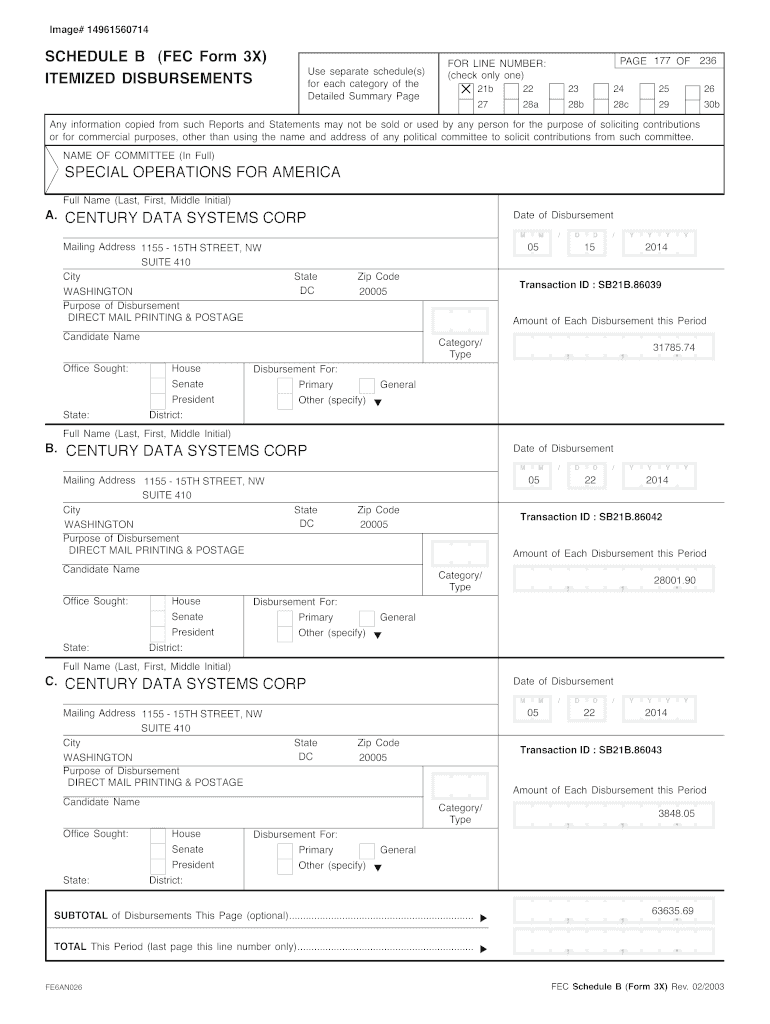

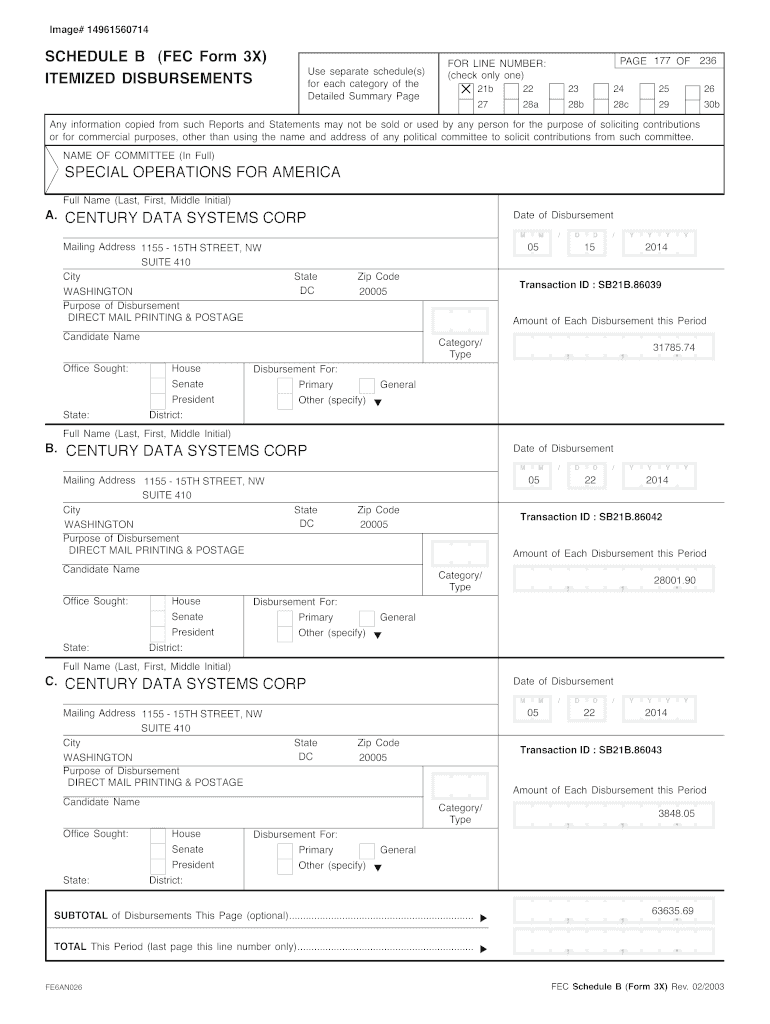

Image# 14961560714SCHEDULE B (FEC Form 3X)

ITEMIZED Disbursements separate schedule(s)

for each category of the

Detailed Summary Average 177 OF 236FOR LINE NUMBER:

(check only one)

21b22232425262728a28b28c2930bAny

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign r report of receipts

Edit your r report of receipts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your r report of receipts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit r report of receipts online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit r report of receipts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out r report of receipts

How to fill out r report of receipts

01

To fill out a report of receipts, follow these steps:

02

Start by gathering all your receipts and organizing them by date or category.

03

Go through each receipt and make sure it contains all the necessary information, such as the date, amount, and purpose of the expense.

04

Create a spreadsheet or use accounting software to record all the details from each receipt.

05

Include additional information like the vendor name, payment method, and any relevant notes.

06

Calculate the total amount spent for each category or time period.

07

Double-check all the entries for accuracy and completeness.

08

Attach the physical receipts to the report or keep them organized in a secure place.

09

Submit the report of receipts to the relevant person or department according to your organization's procedures.

Who needs r report of receipts?

01

A report of receipts is typically needed by individuals or organizations that require record-keeping of expenses for various purposes, such as:

02

- Small business owners or self-employed individuals for tax purposes

03

- Accountants or financial professionals for bookkeeping and auditing

04

- Employees who need to submit expense reports to get reimbursement

05

- Organizations that want to track and analyze their expenses

06

- Government agencies or regulatory bodies for compliance and reporting

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my r report of receipts in Gmail?

r report of receipts and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send r report of receipts for eSignature?

When your r report of receipts is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete r report of receipts online?

Completing and signing r report of receipts online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is r report of receipts?

The report of receipts is a document that is used to report all income received during a specific time period.

Who is required to file a report of receipts?

Any individual or business that has received income during the specified time period is required to file a report of receipts.

How to fill out a report of receipts?

The report of receipts can be filled out manually or electronically, depending on the requirements of the organization or entity requesting the information.

What is the purpose of a report of receipts?

The purpose of a report of receipts is to accurately document all income received during a specific time period for organizational or tax reporting purposes.

What information must be reported on a report of receipts?

The information that must be reported on a report of receipts typically includes the amount of income received, the source of the income, and the date it was received.

Fill out your r report of receipts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

R Report Of Receipts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.