Get the free IRA Application (Traditional, Roth, SEP and ... - Hennessy Funds

Show details

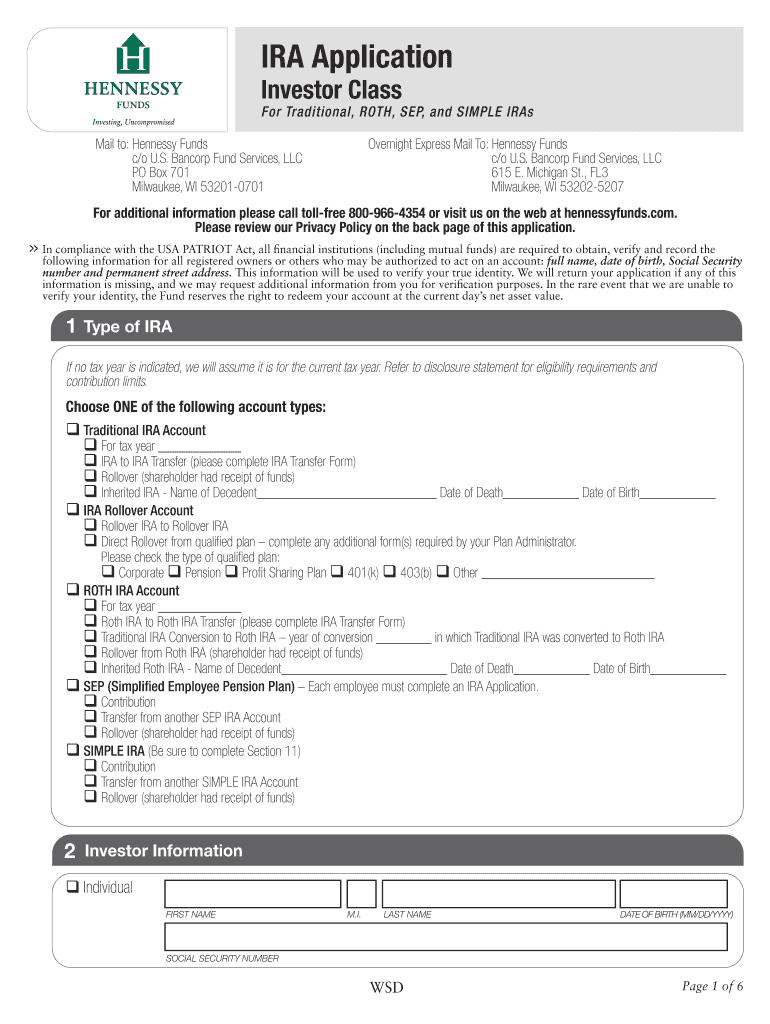

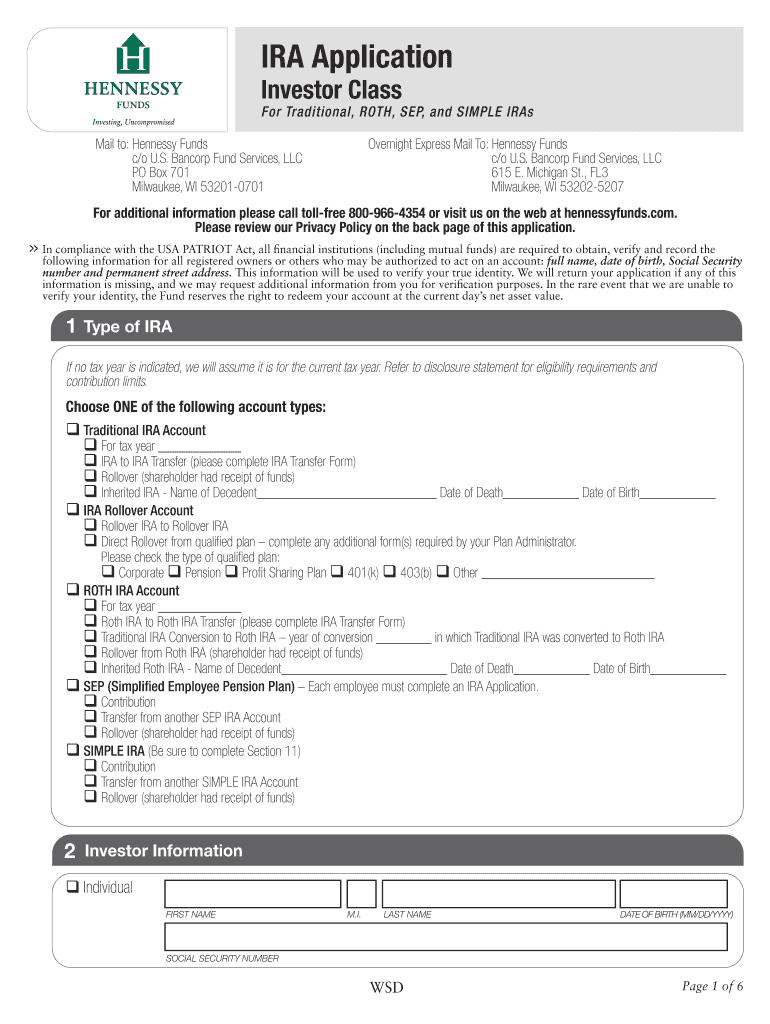

IRA Application Investor Class For Traditional, ROTH, SEP, and SIMPLE IRAs Mail to: Hennessy Funds c/o U.S. Ban corp Fund Services, LLC PO Box 701 Milwaukee, WI 53201-0701 Overnight Express Mail To:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira application traditional roth

Edit your ira application traditional roth form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira application traditional roth form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ira application traditional roth online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ira application traditional roth. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira application traditional roth

How to fill out IRA application traditional Roth:

01

Gather necessary documents: Before starting the application, make sure you have all the required documents on hand. This typically includes your Social Security number, bank account information, and beneficiary details.

02

Download or obtain the application: You can typically find the IRA application traditional Roth form on the website of the financial institution where you plan to open your account. Alternatively, you can visit a local branch and ask for a physical copy.

03

Fill out personal information: The application will ask for your personal information such as your name, address, date of birth, and contact details. Ensure that all information provided is accurate and up to date.

04

Choose your contribution type: For an IRA traditional Roth, you need to decide whether you want to make contributions with pre-tax or after-tax income. Pre-tax contributions provide a tax deduction in the current year, while after-tax contributions allow for tax-free withdrawals in retirement.

05

Select investment options: The application will likely include a section where you can choose the investments for your IRA. This could be mutual funds, stocks, bonds, or other options offered by the financial institution. Consider your risk tolerance and long-term goals when selecting investments.

06

Nominate beneficiaries: Specify who will receive your IRA funds in case of your death. You may need to provide their names, addresses, and Social Security numbers. It's important to review and update your beneficiaries periodically to ensure your wishes are carried out.

Who needs an IRA application traditional Roth:

01

Individuals planning for retirement: Anyone who is interested in saving for retirement and wants to take advantage of potential tax benefits can consider opening an IRA traditional Roth.

02

Employees without a 401(k) plan: If your employer does not offer a 401(k) plan or you are not eligible to participate, an IRA can be a good alternative to save for retirement.

03

Self-employed individuals: Entrepreneurs, freelancers, and small business owners can use an IRA traditional Roth to save for retirement and take advantage of the potential tax benefits.

04

Individuals looking for tax diversification: Having a mix of retirement accounts, such as a traditional 401(k), Roth IRA, or traditional IRA, can provide tax diversification in retirement. Opening an IRA traditional Roth can be a part of this strategy.

05

Individuals interested in tax-free withdrawals: Contributions to an IRA traditional Roth are made with after-tax income, meaning you won't owe taxes on qualified withdrawals in retirement. If tax-free withdrawals are appealing to you, an IRA traditional Roth may be worth considering.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ira application traditional roth to be eSigned by others?

When your ira application traditional roth is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get ira application traditional roth?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific ira application traditional roth and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in ira application traditional roth?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your ira application traditional roth to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is ira application traditional roth?

IRA application traditional roth is a form used to open an individual retirement account with traditional or Roth investment options.

Who is required to file ira application traditional roth?

Any individual who wants to open an IRA account is required to file the IRA application traditional roth form.

How to fill out ira application traditional roth?

To fill out the IRA application traditional roth, you will need to provide personal information, select the type of IRA (traditional or Roth), and indicate investment preferences.

What is the purpose of ira application traditional roth?

The purpose of IRA application traditional roth is to establish a tax-advantaged retirement savings account for individuals.

What information must be reported on ira application traditional roth?

Information such as name, address, Social Security number, investment selections, and beneficiary designation must be reported on IRA application traditional roth.

Fill out your ira application traditional roth online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Application Traditional Roth is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.