Get the free DHFL stops fixed deposit withdrawals; should you avoid all ...

Show details

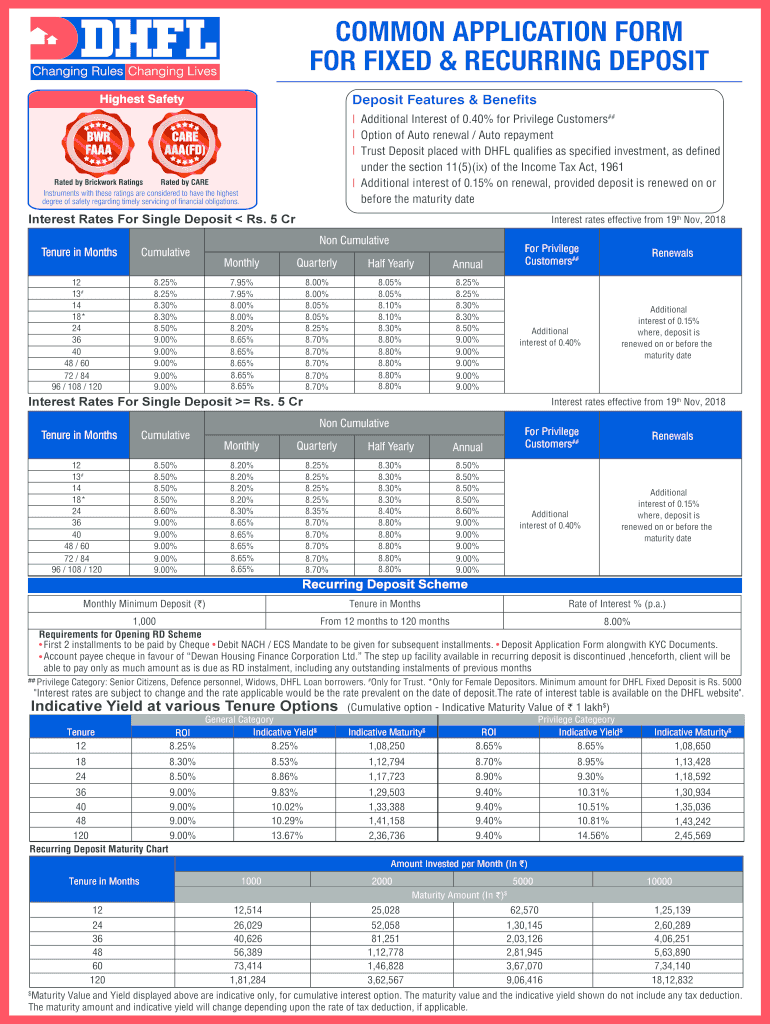

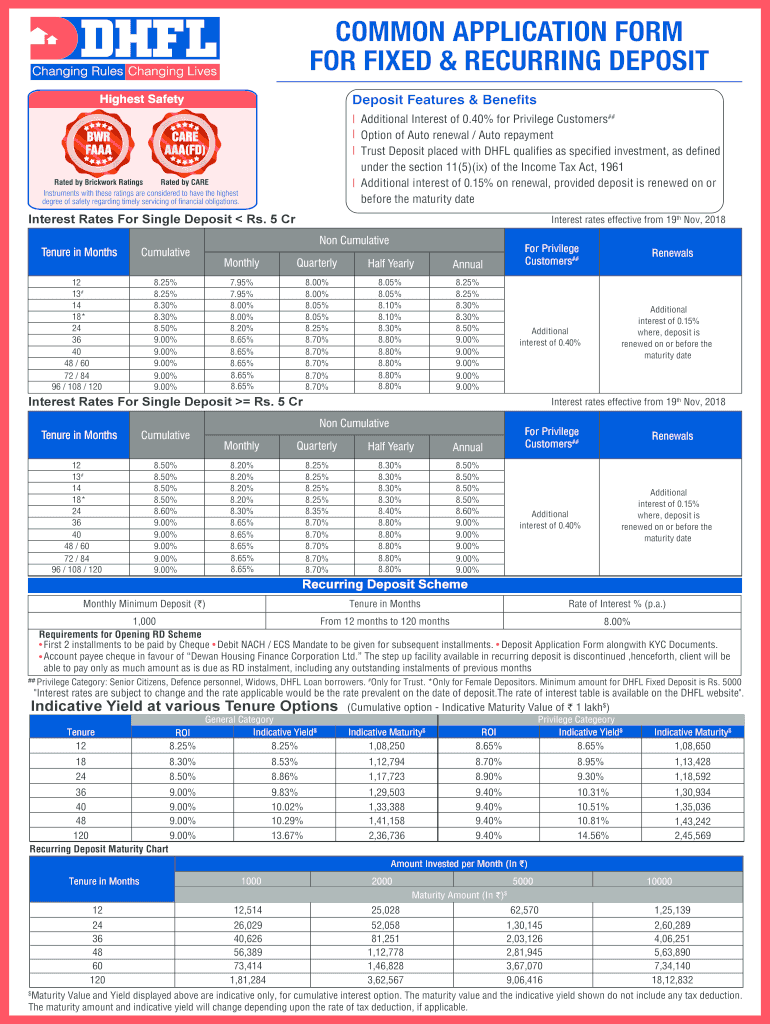

COMMON APPLICATION FORM FOR FIXED & RECURRING DEPOSIT Additional Interest of 0.40% for Privilege Customers## Option of Auto renewal / Auto repayment Trust Deposit placed with DFL qualifies as specified

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dhfl stops fixed deposit

Edit your dhfl stops fixed deposit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dhfl stops fixed deposit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dhfl stops fixed deposit online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit dhfl stops fixed deposit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dhfl stops fixed deposit

How to fill out dhfl stops fixed deposit

01

Collect the necessary documents for filling out the DHFL stops fixed deposit form - PAN card, Aadhaar card, address proof, and passport-sized photographs.

02

Visit the nearest DHFL branch or go to their official website to download the fixed deposit form.

03

Fill out the form accurately and provide all the required information such as name, address, contact details, and nominee details.

04

Choose the type of fixed deposit account you want to open - individual, joint, or minor. Also, select the type of deposit scheme and the tenure of the deposit.

05

Specify the amount you want to deposit and select the mode of payment - cash, cheque, or online transfer.

06

Attach the necessary documents along with the filled-out form, such as self-attested copies of PAN card, Aadhaar card, and address proof.

07

Submit the form with the required documents to the DHFL representative at the branch or follow the instructions for online submission.

08

Once the form is submitted, you will receive an acknowledgment receipt. Keep it safely for future reference.

09

The DHFL representative will verify the documents and process your fixed deposit request.

10

After the verification process, you will receive a confirmation regarding the successful opening of your DHFL stops fixed deposit account.

Who needs dhfl stops fixed deposit?

01

Anyone looking for a safe and secure investment option with guaranteed returns can opt for DHFL stops fixed deposit.

02

Individuals who want to earn higher interest rates on their savings while keeping their funds accessible.

03

Investors who believe in the credibility and reputation of DHFL as a financial institution.

04

People who want to diversify their investment portfolio and include fixed deposits as a part of their overall financial planning.

05

Individuals who prioritize capital preservation and prefer a low-risk investment instrument.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in dhfl stops fixed deposit?

With pdfFiller, it's easy to make changes. Open your dhfl stops fixed deposit in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the dhfl stops fixed deposit in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your dhfl stops fixed deposit.

How do I fill out dhfl stops fixed deposit on an Android device?

Use the pdfFiller mobile app to complete your dhfl stops fixed deposit on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is dhfl stops fixed deposit?

DHFL stands for Dewan Housing Finance Corporation Limited. DHFL stops fixed deposit is a type of investment where an individual or entity deposits a fixed amount of money for a specific period of time in DHFL.

Who is required to file dhfl stops fixed deposit?

Any individual or entity looking to invest their money in a fixed deposit with DHFL is required to file for a DHFL stops fixed deposit.

How to fill out dhfl stops fixed deposit?

To fill out a DHFL stops fixed deposit, one must contact DHFL directly or visit their website to get the necessary forms and instructions.

What is the purpose of dhfl stops fixed deposit?

The purpose of a DHFL stops fixed deposit is to provide individuals or entities with a secure investment option that offers a fixed rate of return over a specific period.

What information must be reported on dhfl stops fixed deposit?

The information required to be reported on a DHFL stops fixed deposit typically includes the depositor's personal information, the amount of money being deposited, the term of the deposit, and the interest rate.

Fill out your dhfl stops fixed deposit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dhfl Stops Fixed Deposit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.