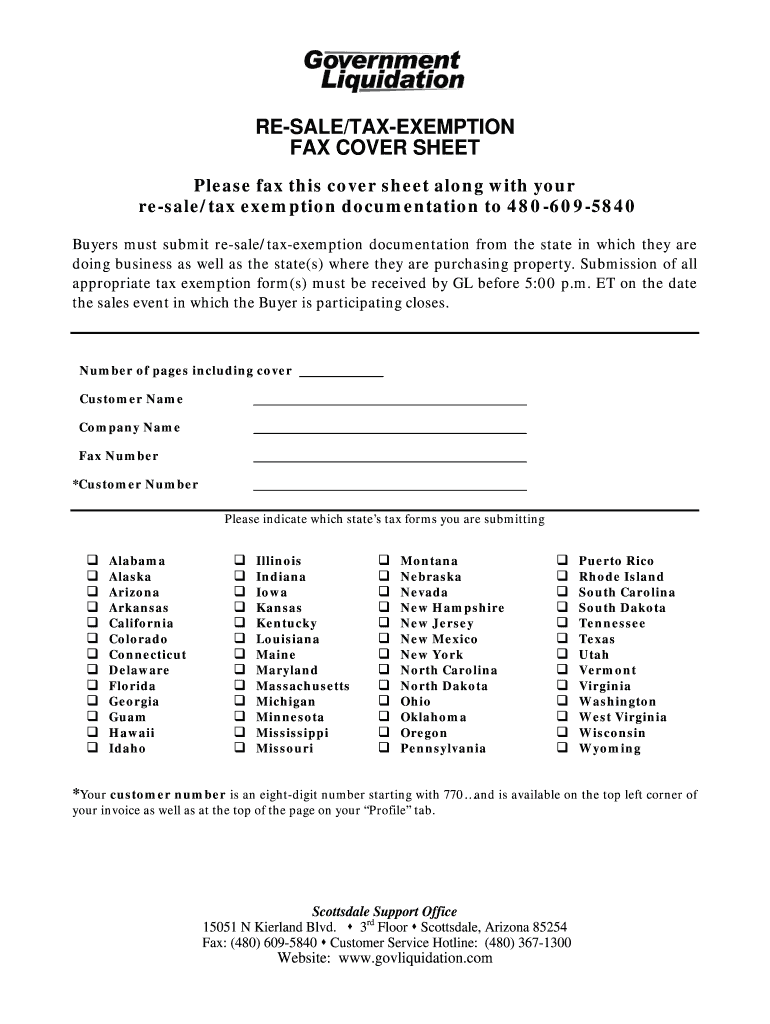

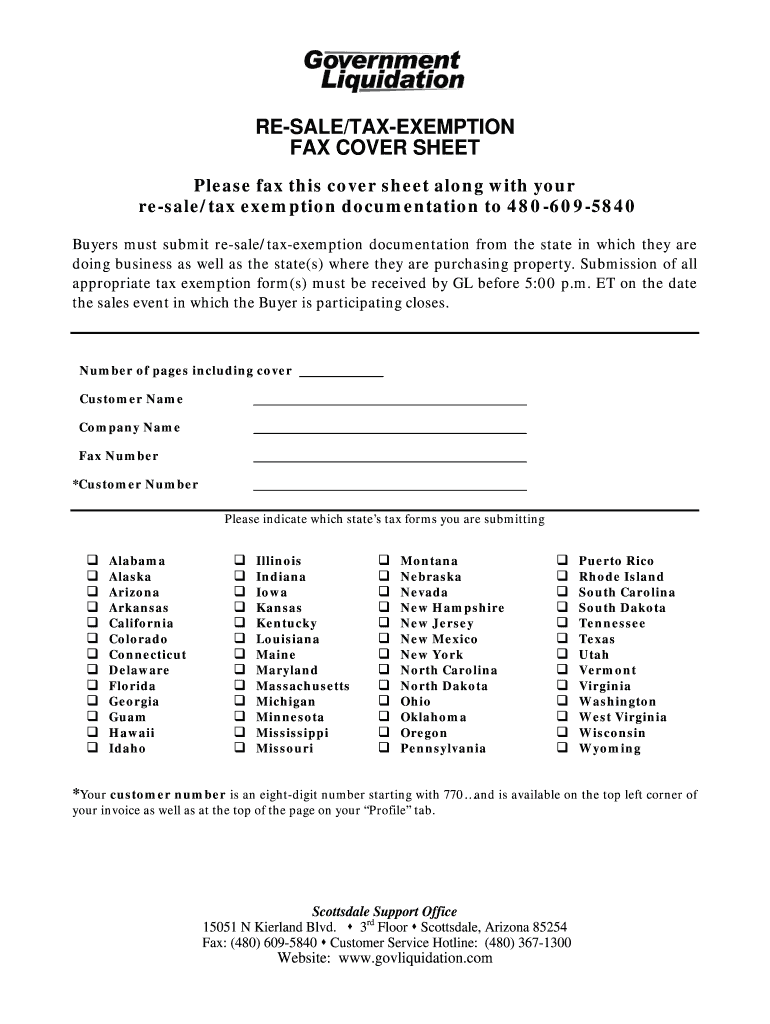

Get the free Buyers must submit resaletaxexemption documentation from the state in which they are

Show details

RESALE/EXEMPTION FAX COVER SHEET Please fax this cover sheet along with your resale/tax exemption documentation to 4806095840 Buyers must submit resale/tax exemption documentation from the state in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign buyers must submit resaletaxexemption

Edit your buyers must submit resaletaxexemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your buyers must submit resaletaxexemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit buyers must submit resaletaxexemption online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit buyers must submit resaletaxexemption. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out buyers must submit resaletaxexemption

How to fill out the buyer's must submit resaletaxexemption:

01

Begin by obtaining the necessary forms: The first step in filling out the buyer's must submit resaletaxexemption is to acquire the required forms from the relevant tax authority or department. These forms are usually available online or can be obtained from a local tax office.

02

Provide personal and company information: The form will typically require you to provide your personal and company details. This may include your name, address, contact information, and tax identification number. Ensure that this information is accurate and up to date.

03

State the reason for the exemption: In this section, you will need to clearly explain the reason for seeking resaletaxexemption. Determine the specific exemption category that applies to your situation, such as purchasing goods solely for resale purposes.

04

Provide supporting documentation: Depending on the jurisdiction, you may be required to attach supporting documentation to validate your request for resaletaxexemption. This might include copies of your business license, resale certificate, or any other relevant documents. Make sure to include all necessary paperwork to avoid any delays or rejections.

05

Review and sign the form: Before submitting the form, carefully review all the information you have provided to ensure its accuracy. Double-check for any missing or incorrect details. Once you are confident that everything is correct, sign the form as required.

Who needs to submit the buyer's must submit resaletaxexemption?

01

Registered businesses: Any registered business engaged in buying and reselling goods or services may need to submit the buyer's must submit resaletaxexemption. This can include wholesalers, retailers, distributors, or any other entities involved in the supply chain.

02

B2B transactions: When engaging in business-to-business transactions, it is often mandatory for the buying party to submit the resaletaxexemption form. This ensures that sales tax is not collected multiple times along the supply chain, as each party can claim exemption based on resale.

03

Tax-exempt organizations: Certain non-profit organizations or entities with tax-exempt status might need to submit the buyer's must submit resaletaxexemption. This allows them to avoid paying sales tax on qualifying purchases, freeing up funds to support their charitable or mission-driven activities.

It is important to note that the specific requirements for submitting resaletaxexemption may vary depending on the jurisdiction and applicable laws. It is advisable to consult with a tax professional or refer to the guidelines provided by the relevant tax authority for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send buyers must submit resaletaxexemption to be eSigned by others?

When your buyers must submit resaletaxexemption is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out the buyers must submit resaletaxexemption form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign buyers must submit resaletaxexemption. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete buyers must submit resaletaxexemption on an Android device?

On Android, use the pdfFiller mobile app to finish your buyers must submit resaletaxexemption. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is buyers must submit resaletaxexemption?

Buyers must submit resaletaxexemption is a form that allows buyers to claim exemption from paying sales tax when purchasing items for resale.

Who is required to file buyers must submit resaletaxexemption?

Buyers who are purchasing items for resale are required to file buyers must submit resaletaxexemption.

How to fill out buyers must submit resaletaxexemption?

Buyers must fill out buyers must submit resaletaxexemption by providing information about their business, the items being purchased for resale, and the reason for claiming exemption.

What is the purpose of buyers must submit resaletaxexemption?

The purpose of buyers must submit resaletaxexemption is to allow buyers to avoid paying sales tax on items that will be resold.

What information must be reported on buyers must submit resaletaxexemption?

Buyers must report information such as their business name, address, resale certificate number, and the items being purchased for resale.

Fill out your buyers must submit resaletaxexemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Buyers Must Submit Resaletaxexemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.