Get the free Application for Credit Account - Tidewater Credit Services

Show details

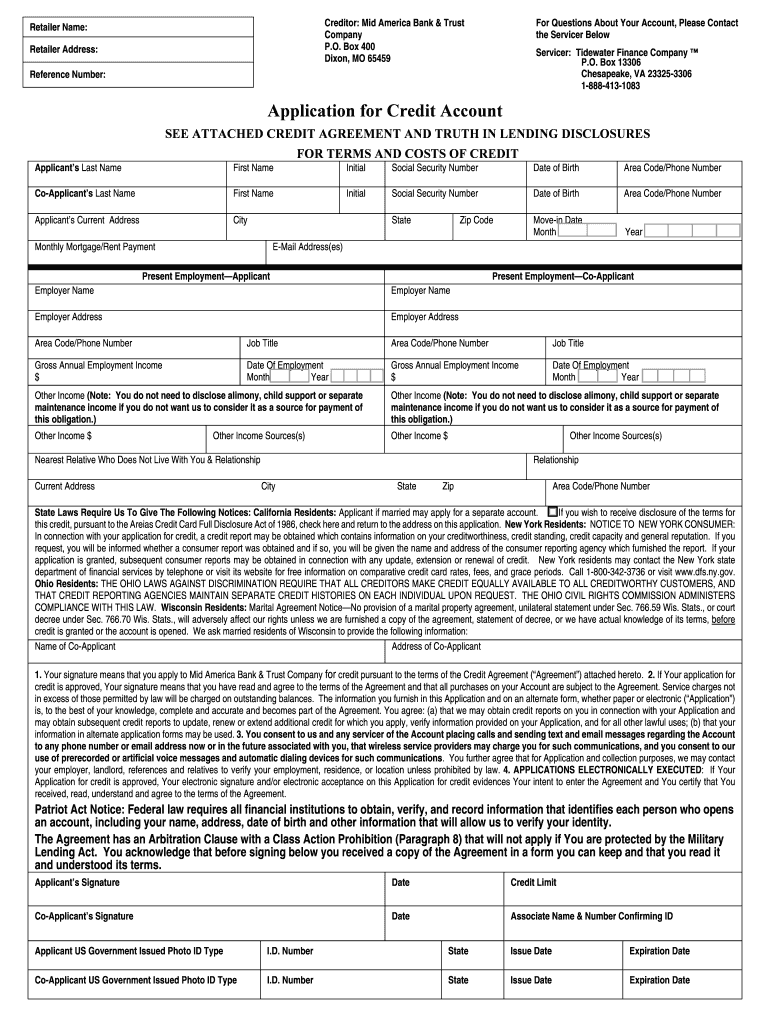

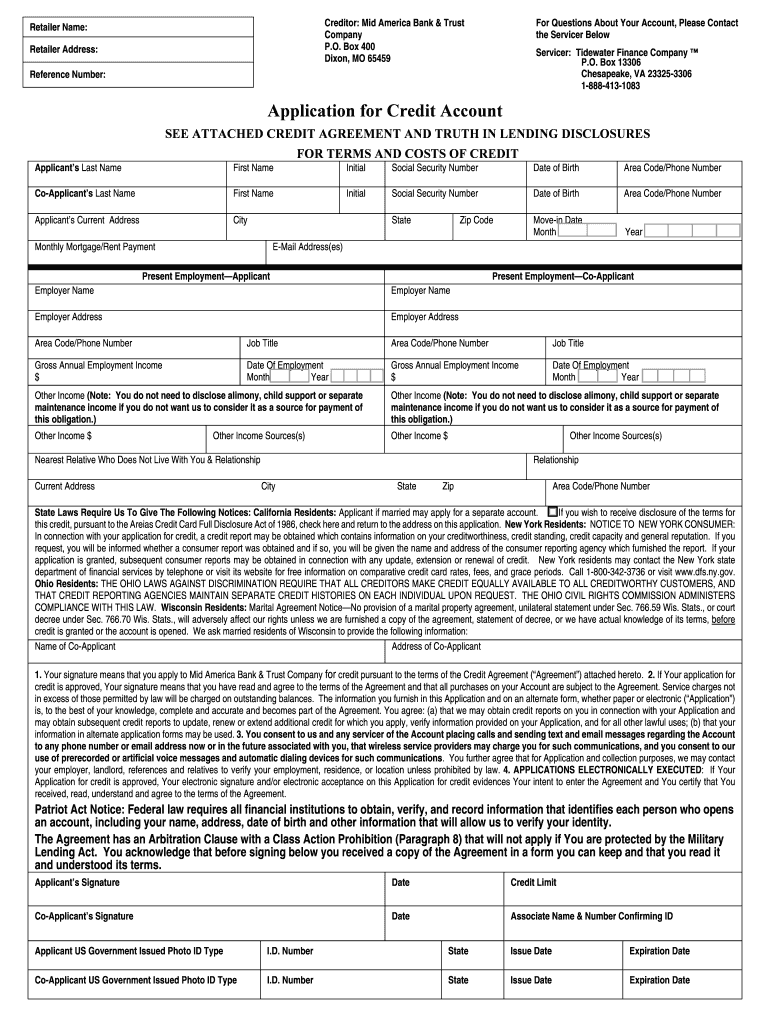

For Questions About Your Account, Please Contact the Service BelowCreditor: Mid-America Bank & Trust Company P.O. Box 400 Dixon, MO 65459Retailer Name: Retailer Address:Service: Tidewater Finance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for credit account

Edit your application for credit account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for credit account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for credit account online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for credit account. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for credit account

How to fill out application for credit account

01

Step 1: Begin by gathering all necessary documents and information required to fill out the application for a credit account. This may include identification proof, address proof, income details, and previous employment details.

02

Step 2: Carefully read and understand the instructions provided on the credit account application form. Make sure you have a clear understanding of the terms and conditions mentioned.

03

Step 3: Fill out the personal information section of the application form accurately. This typically includes your full name, contact details, date of birth, and social security number.

04

Step 4: Provide your employment information, including your current job position and income details. Some applications may also require you to provide information about your previous employment history.

05

Step 5: Fill out the financial information section of the application form. This includes details about your current financial situation, such as monthly income, monthly expenses, and any existing debts or loans.

06

Step 6: If applicable, provide information about your co-applicant or joint account holder. This is required when applying for a credit account jointly with another individual.

07

Step 7: Review the filled-out application form to ensure that all details are accurate and complete. Make corrections if necessary and double-check for any missing information.

08

Step 8: Attach any supporting documents that may be required, such as proof of address, identification proof, income statements, or bank statements. Make sure to submit copies and retain the originals for your records.

09

Step 9: Sign and date the application form in the designated area to acknowledge that all information provided is true and accurate to the best of your knowledge.

10

Step 10: Submit the completed application form along with the supporting documents to the credit account provider. You can typically do this by mailing it to the specified address or by visiting a branch in person.

11

Step 11: Once submitted, wait for the credit account provider to review your application. This may take a few days or weeks, depending on their processing time.

12

Step 12: If approved, you will receive notification from the credit account provider along with any additional instructions or documents required to finalize the account setup.

13

Step 13: Follow the instructions provided by the credit account provider to complete the account setup process. This may involve signing further agreements, activating the account, or undergoing identity verification.

14

Step 14: Once the credit account is successfully set up, you can start using it to make purchases and manage your finances.

15

Step 15: Keep track of your credit usage and make timely payments to maintain a good credit history. Failure to make payments on time may negatively impact your credit score.

Who needs application for credit account?

01

Individuals who require access to credit for making purchases but do not have sufficient funds at the time of purchase may need to apply for a credit account.

02

Businesses or organizations that need credit to manage their cash flow, make bulk purchases, or finance their operations may also need to apply for a credit account.

03

People who want to build or improve their credit history may consider applying for a credit account as responsible usage and timely repayments can positively impact their credit score.

04

Individuals who want to take advantage of various credit account benefits, such as rewards programs, discounts, or promotional offers, may find it beneficial to apply for a credit account.

05

Some credit accounts may also offer additional financial services or perks, such as low interest rates, installment payment options, or cashback rewards, which can be appealing to certain individuals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my application for credit account directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your application for credit account as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in application for credit account?

With pdfFiller, the editing process is straightforward. Open your application for credit account in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete application for credit account on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your application for credit account. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is application for credit account?

An application for credit account is a form that individuals or businesses fill out to apply for credit from a lender or financial institution.

Who is required to file application for credit account?

Any individual or business looking to establish a line of credit with a lender or financial institution is required to file an application for credit account.

How to fill out application for credit account?

To fill out an application for credit account, you will need to provide personal or business information, financial details, and possibly references. It is important to be truthful and accurate when completing the form.

What is the purpose of application for credit account?

The purpose of an application for credit account is to request and establish a credit relationship with a lender or financial institution, allowing individuals or businesses to borrow money or make purchases on credit.

What information must be reported on application for credit account?

The information required on an application for credit account typically includes personal or business details, financial information, employment history, and references.

Fill out your application for credit account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Credit Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.