Get the free How to Avoid Overdraft Fees - NerdWallet

Show details

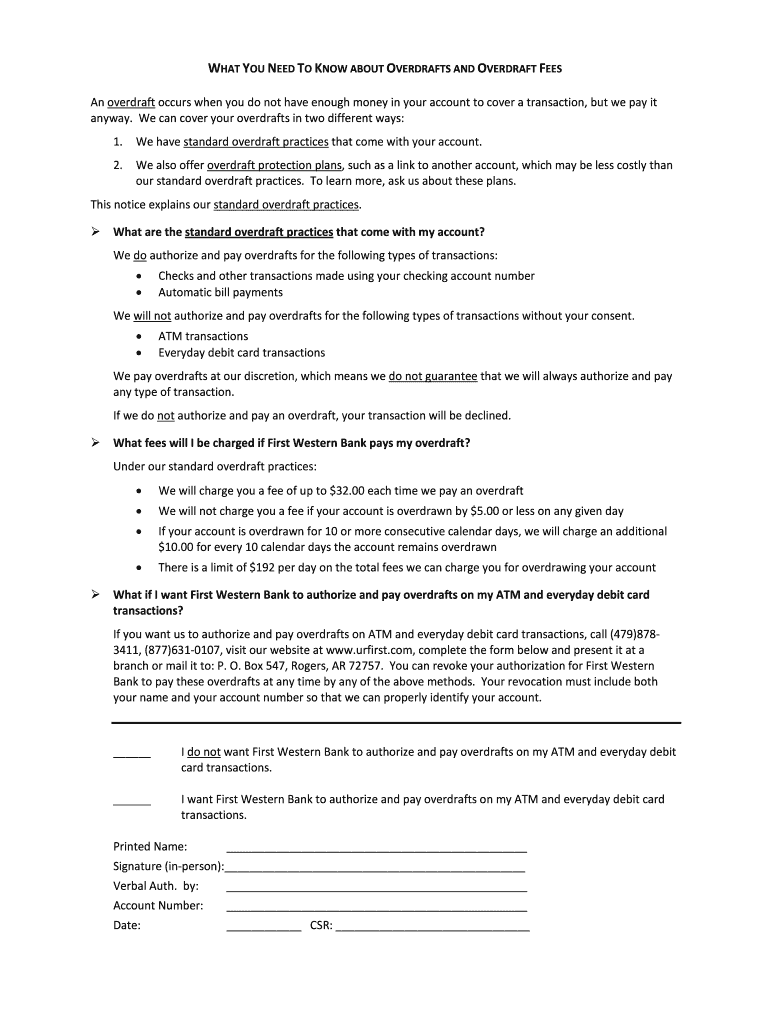

WHAT YOU NEED TO KNOW ABOUT OVERDRAFTS AND OVERDRAFT FEES

An overdraft occurs when you do not have enough money in your account to cover a transaction, but we pay it

anyway. We can cover your overdrafts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to avoid overdraft

Edit your how to avoid overdraft form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to avoid overdraft form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to avoid overdraft online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how to avoid overdraft. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to avoid overdraft

How to fill out how to avoid overdraft

01

Keep track of your financial transactions: Regularly check your bank account balance and track your expenses to ensure that you do not spend beyond your available balance.

02

Set up account alerts: Many banks offer account alert services that notify you when your account balance falls below a certain threshold. Take advantage of these alerts to stay informed about your account balance and avoid overdrafts.

03

Create a budget: Develop a monthly budget that takes into account your income and expenses. This will help you manage your money effectively and prevent overspending.

04

Use online banking tools: Utilize your bank's online banking platform to monitor your account activity, set up automatic bill payments, and manage your finances efficiently.

05

Opt out of overdraft protection: Some banks provide overdraft protection, which allows transactions to go through even if you have insufficient funds in your account. However, this service may come with fees. If you want to avoid overdrafts completely, consider opting out of overdraft protection.

06

Link your checking account to a savings account: If you have a savings account with your bank, you may be able to link it to your checking account. This way, if your checking account balance is low, funds can be automatically transferred from your savings account to cover any transactions, preventing overdrafts.

07

Communicate with your bank: In case of financial difficulties or unexpected circumstances, it is advisable to timely communicate with your bank. They may be able to provide solutions or advice to help you avoid overdrafts.

Who needs how to avoid overdraft?

01

Anyone who has a bank account and wants to prevent overdrafts can benefit from knowing how to avoid them.

02

People who often struggle with maintaining a positive account balance or frequently overspend should especially pay attention to these techniques.

03

Individuals who want to improve their financial habits and avoid unnecessary fees associated with overdrafts should also follow these guidelines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get how to avoid overdraft?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the how to avoid overdraft in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make edits in how to avoid overdraft without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing how to avoid overdraft and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit how to avoid overdraft straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing how to avoid overdraft.

What is how to avoid overdraft?

How to avoid overdraft refers to taking steps to ensure that your account balance does not go below zero, such as monitoring your spending and balances regularly.

Who is required to file how to avoid overdraft?

There is no specific filing requirement for avoiding overdrafts, it is up to the account holder to manage their finances responsibly.

How to fill out how to avoid overdraft?

There is no form or document to fill out for avoiding overdrafts, it involves monitoring your account balance and spending habits.

What is the purpose of how to avoid overdraft?

The purpose of avoiding overdrafts is to prevent incurring fees and penalties for having a negative account balance.

What information must be reported on how to avoid overdraft?

No specific information needs to be reported, it is more about managing your finances effectively.

Fill out your how to avoid overdraft online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Avoid Overdraft is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.