IL SBE R-19 2017 free printable template

Show details

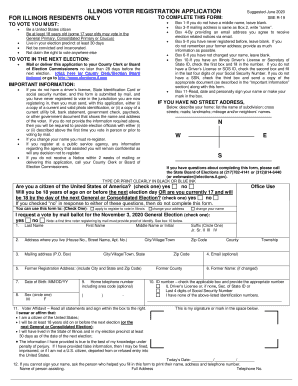

ILLINOIS VOTER REGISTRATION APPLICATION TO COMPLETE THIS FORM: FOR ILLINOIS RESIDENTS ONLY TO VOTE YOU MUST: Be a United States citizen Be at least 18 years old (some 17-year-olds may vote in the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL SBE R-19

Edit your IL SBE R-19 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL SBE R-19 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL SBE R-19 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL SBE R-19. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL SBE R-19 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL SBE R-19

How to fill out IL SBE R-19

01

Obtain the IL SBE R-19 form from the official state website or local election office.

02

Fill in your name, address, and other required personal information in the designated fields.

03

Provide the name of the candidate or party you are supporting, as well as any relevant election information.

04

Sign and date the form at the bottom where indicated.

05

Submit the completed form to your local election authority by the specified deadline.

Who needs IL SBE R-19?

01

Voters who wish to support a specific candidate or party in Illinois elections need to fill out the IL SBE R-19.

02

Political organizations may require the form to document endorsements or support for candidates.

Fill

form

: Try Risk Free

People Also Ask about

What is a CMS100 form?

Information provided on the CMS100 application is used to determine your eligibility for appointment to a State of Illinois position title. Thus, it is critical that all information requested be provided accurately and completely.

Where to find Illinois tax forms?

How to get Forms Download Forms. Submit a request to have forms or publications mailed to you. You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302.

How do I remit sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

Do you have to attach W-2 to Illinois tax return?

Attach a completed Schedule IL-WIT and all withholding forms (W-2s, 1099s, etc.) to support the amount you claim as Illinois Income Tax withheld on Line 25.

What is the hiring process for the state of Illinois?

State of Illinois Hiring Process The first step is to submit an online application. Once your application has been reviewed, you will be contacted for an initial phone interview. If you pass the phone interview, you will be invited to come in for an in-person interview.

Where do I find my Illinois tax ID number?

To locate your Taxpayer ID Number: Log in to your MyTax Illinois online account. Locate your Taxpayer ID Number on any previous Illinois Withholding Income Tax Return (Form IL-941).

What tax forms do I need for Illinois?

Illinois Income Tax Forms & Instructions The most common Illinois income tax form is the IL-1040. This form is used by Illinois residents who file an individual income tax return.

How do I get a CMS 100 application?

The CMS100 application is no longer used. You will apply for every posting that you are interested in working via the Apply button on the bottom of each posting. If the position you applied for requires an in-person exam, CMS will contact you to set up an appointment to test.

What is Illinois filing requirement?

You must file a Form IL-1040, Individual Income Tax Return, if you are an Illinois resident and: You were required to file a federal income tax return. You were not required to file a federal return, but your Illinois base income is greater than your exemption allowance.

What is CMS 100?

MANAGEMENT SERVICES. EXAMINING/EMPLOYMENT APPLICATION. (CMS100) CMS administers civil service testing for agencies under the jurisdiction of the Governor; however, actual employment decisions are made by the hiring agencies.

How do I register as a reseller in Illinois?

To register as a reseller, you may choose one of the following options: Register electronically using MyTax Illinois. Complete and mail Form REG-1, Illinois Business Registration Application. Visit a regional office.

How do I know what forms I need for my taxes?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

What is Illinois Reg-1 form?

REG-1 - Illinois Business Registration Application.

Where to get Illinois tax forms?

Submit a request to have forms or publications mailed to you. You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302.

Can I get tax forms at my local library?

Yes, library staff will print a specific form upon request but you will need to view instructions, tables, and schedules online.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IL SBE R-19 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your IL SBE R-19 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete IL SBE R-19 online?

Filling out and eSigning IL SBE R-19 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the IL SBE R-19 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IL SBE R-19 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IL SBE R-19?

IL SBE R-19 is a form used by the State Board of Elections in Illinois to report contributions and expenditures made by political committees and candidates.

Who is required to file IL SBE R-19?

Candidates for public office, political committees, and organizations that receive or spend funds for political purposes are required to file IL SBE R-19.

How to fill out IL SBE R-19?

To fill out IL SBE R-19, you must provide detailed information about contributions received and expenditures made, including dates, amounts, and the names of contributors and/or payees.

What is the purpose of IL SBE R-19?

The purpose of IL SBE R-19 is to ensure transparency in campaign financing and to provide the public with information about the sources and use of political funds.

What information must be reported on IL SBE R-19?

The IL SBE R-19 form requires reporting of all contributions received, expenditures made, the names and addresses of contributors and payees, and the purpose of each expenditure.

Fill out your IL SBE R-19 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL SBE R-19 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.