Get the free Illinois Estate Planning FormsWills, Living Wills, Trusts ...

Show details

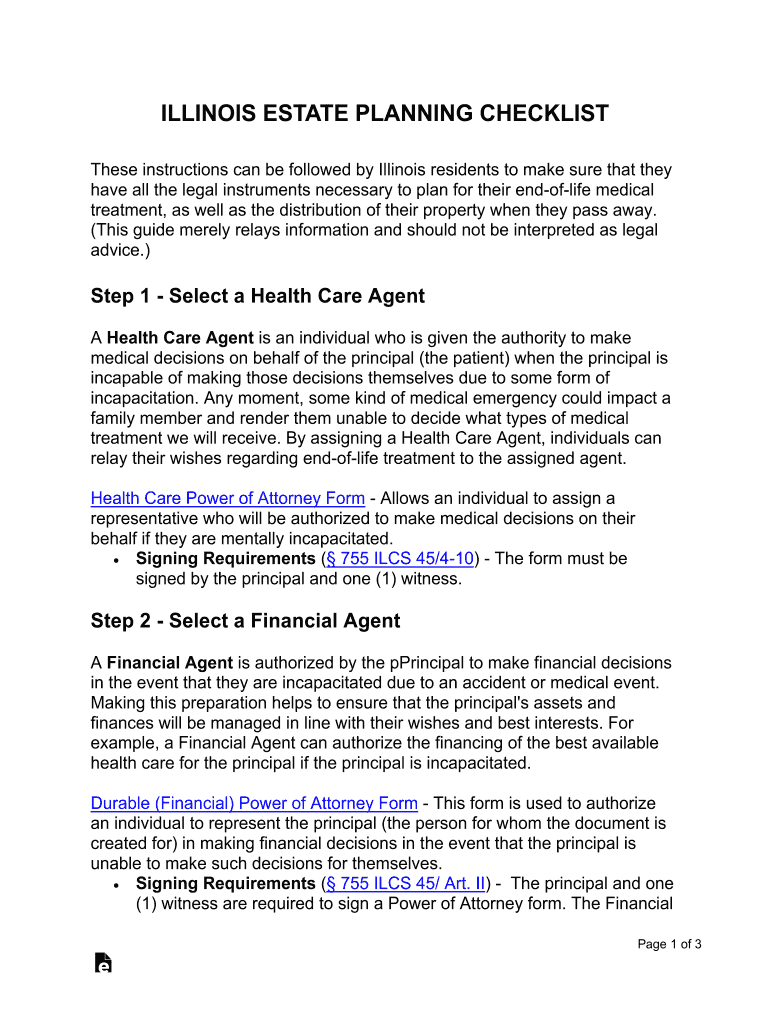

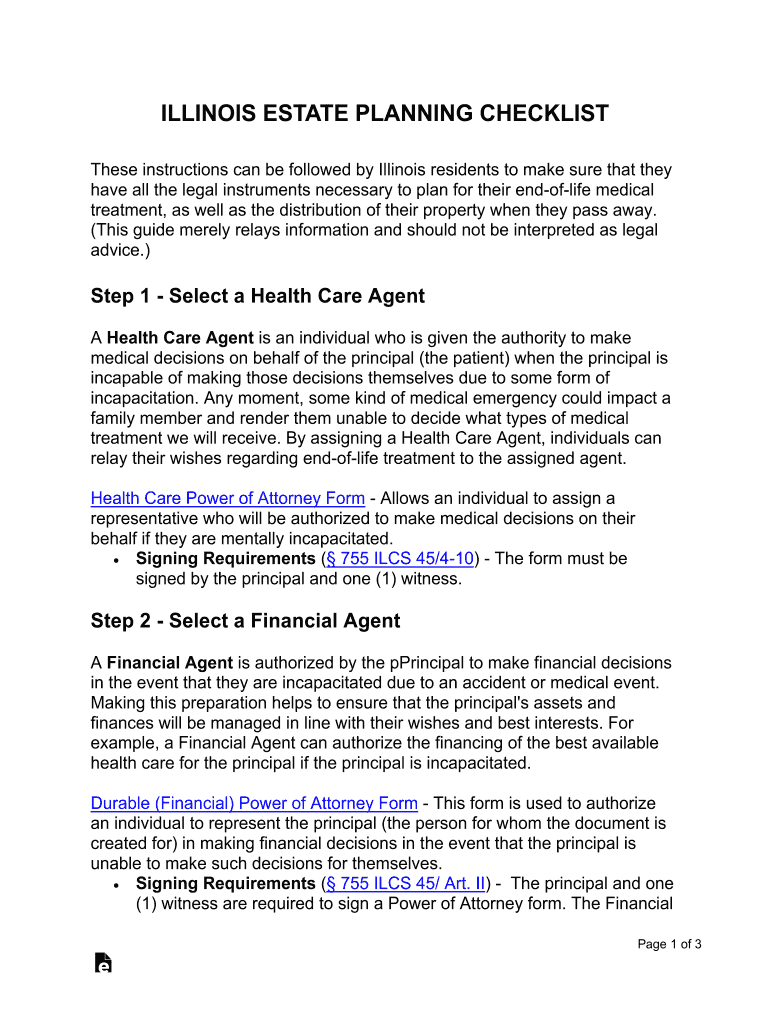

ILLINOIS ESTATE PLANNING CHECKLIST These instructions can be followed by Illinois residents to make sure that they have all the legal instruments necessary to plan for their endocrine medical treatment,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign illinois estate planning formswills

Edit your illinois estate planning formswills form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois estate planning formswills form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing illinois estate planning formswills online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit illinois estate planning formswills. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out illinois estate planning formswills

How to fill out illinois estate planning formswills

01

Step 1: Gather information - Before filling out the Illinois estate planning forms or wills, gather all the relevant information related to your assets, debts, beneficiaries, and any specific instructions or wishes you have for the distribution of your estate.

02

Step 2: Download the forms - Visit the official website of the Illinois state government or reputable legal websites to download the required estate planning forms or wills.

03

Step 3: Understand the forms - Take your time to carefully read and understand the instructions and requirements mentioned in the forms. Make sure you are aware of the legal implications and consequences of the choices you make while filling out the forms.

04

Step 4: Complete the forms - Start filling out the forms by providing accurate and up-to-date personal information. Follow the instructions provided for each section and make sure to answer every question thoroughly.

05

Step 5: Seek legal advice if needed - If you have any doubts or concerns regarding the completion of the forms, it is recommended to seek legal advice from an experienced estate planning attorney. They can provide guidance and ensure the forms are correctly filled out.

06

Step 6: Review and revise - Once you have filled out the forms, review them carefully to ensure accuracy and completeness. Make any necessary revisions or corrections.

07

Step 7: Sign and execute - After reviewing and revising the forms, sign them in the presence of witnesses as required by Illinois state law. Execute the forms according to the provided instructions.

08

Step 8: Keep copies and inform relevant parties - Make copies of the completed and executed forms and keep them in a safe place. Inform your chosen executor or trustee, as well as any other relevant parties, about the existence and location of the estate planning forms or wills.

Who needs illinois estate planning formswills?

01

Anyone who wants to ensure their wishes regarding the distribution of their estate are legally documented and followed can benefit from Illinois estate planning forms or wills.

02

Specifically, individuals who have significant assets, own property, have dependents, or wish to leave specific instructions for the distribution of their estate should consider utilizing these forms.

03

It is particularly important for individuals who want to avoid any potential disputes among family members or beneficiaries after their passing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send illinois estate planning formswills to be eSigned by others?

Once your illinois estate planning formswills is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete illinois estate planning formswills online?

pdfFiller has made it easy to fill out and sign illinois estate planning formswills. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in illinois estate planning formswills without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your illinois estate planning formswills, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is illinois estate planning formswills?

Illinois estate planning formswills are legal documents that outline how a person's assets should be distributed after their death.

Who is required to file illinois estate planning formswills?

Anyone who wants to ensure their assets are distributed according to their wishes after they pass away should consider filing Illinois estate planning formswills.

How to fill out illinois estate planning formswills?

Illinois estate planning formswills can be filled out with the help of an attorney or using online templates. It is important to include all necessary information and make sure the document is legally valid.

What is the purpose of illinois estate planning formswills?

The purpose of illinois estate planning formswills is to provide instructions on how a person's assets should be distributed after their death, and to ensure that the wishes of the deceased are carried out.

What information must be reported on illinois estate planning formswills?

Illinois estate planning formswills must include details about the deceased's assets, beneficiaries, executors, and any specific instructions for the distribution of assets.

Fill out your illinois estate planning formswills online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Estate Planning Formswills is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.