Get the free Illinois Last Will and Testament Template

Show details

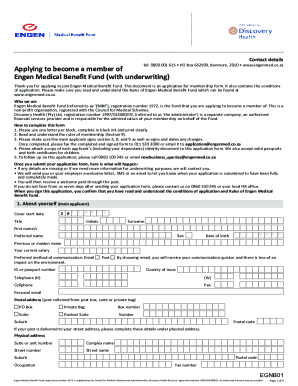

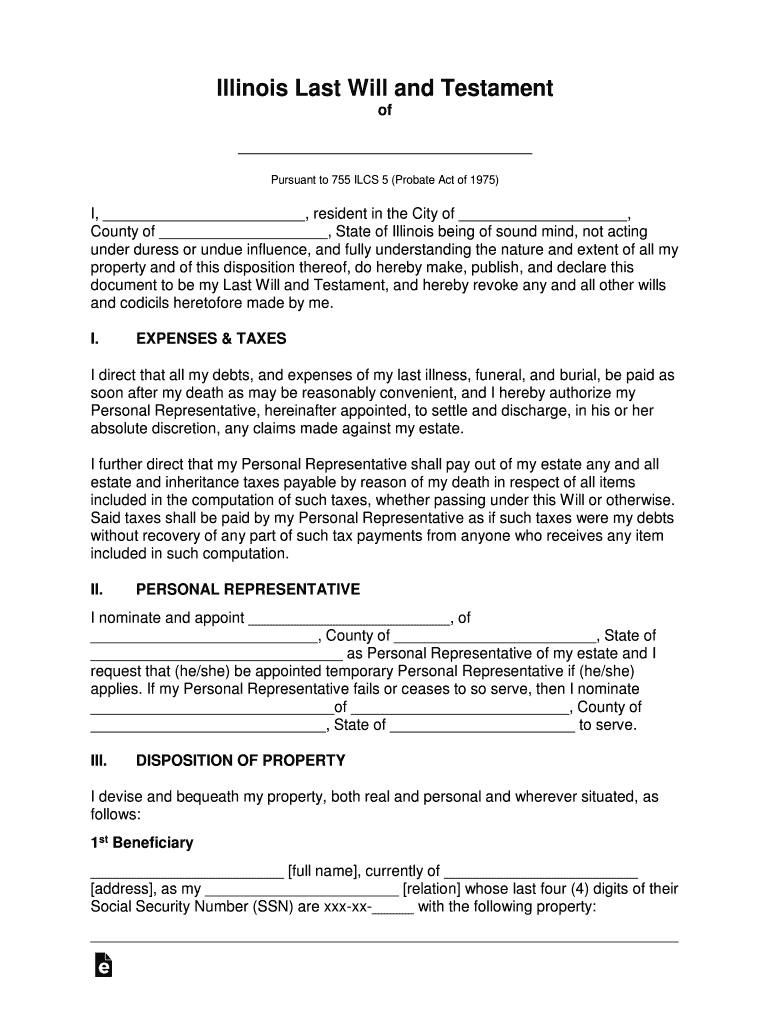

Illinois Last Will and Testament of Pursuant to 755 ILLS 5 (Probate Act of 1975)I, resident in the City of, County of, State of Illinois being of sound mind, not acting under duress or undue influence,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign illinois last will and

Edit your illinois last will and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois last will and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing illinois last will and online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit illinois last will and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out illinois last will and

How to fill out illinois last will and

01

To fill out an Illinois last will, follow these steps:

02

Determine your assets and debts: Make a list of all your assets such as properties, bank accounts, investments, and personal belongings, as well as your debts such as loans and mortgages.

03

Choose an executor: Select someone you trust to administer your estate and carry out the instructions in your will.

04

Decide on beneficiaries: Determine who will inherit your assets and how they will be distributed. This may include family members, friends, or charitable organizations.

05

Appoint guardians: If you have minor children, select a guardian who will take care of them in the event of your death.

06

Consult an attorney: It is recommended to seek legal advice to ensure your will complies with Illinois state laws and is properly executed.

07

Draft your will: With the assistance of an attorney, create a complete and clear document that outlines your wishes.

08

Sign and date your will: Execute the will in the presence of two witnesses who are not beneficiaries or related to beneficiaries.

09

Store your will: Keep the original will in a safe place such as a secure file cabinet or a safety deposit box. Inform your executor of its location and provide them with a copy.

10

Review and update your will: Regularly review your will to ensure it reflects your current wishes and make any necessary amendments.

11

Inform your loved ones: Let your family members and other important individuals know about the existence and location of your will.

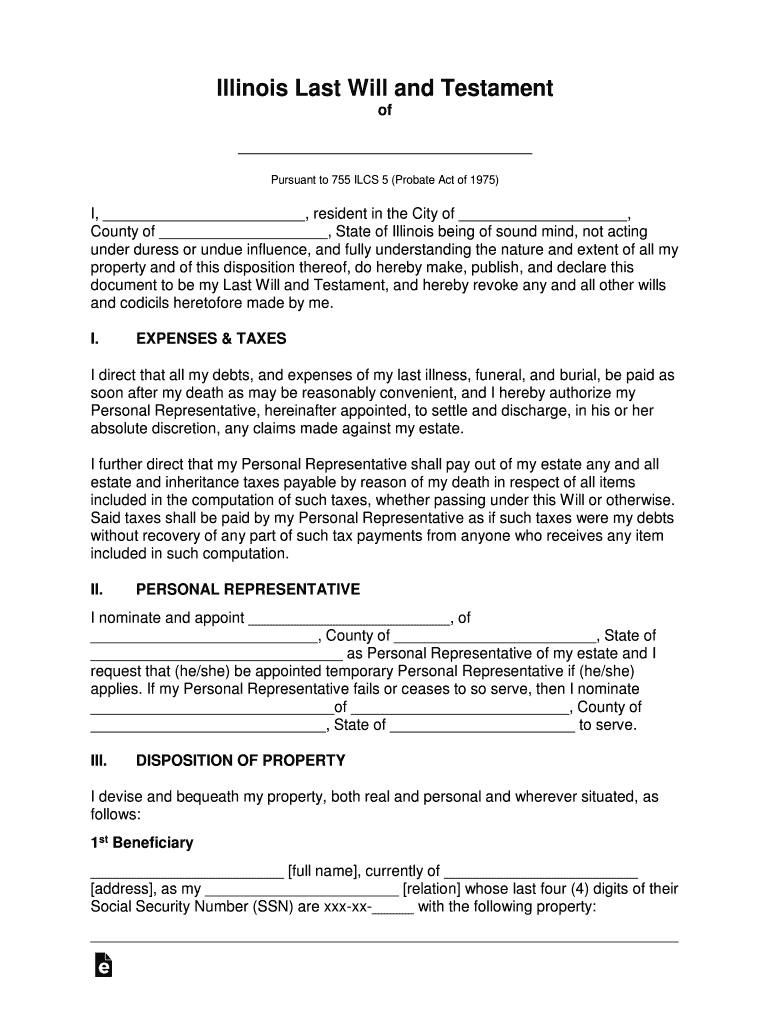

Who needs illinois last will and?

01

Anyone who wishes to have control over the distribution of their assets after death needs an Illinois last will.

02

Specific individuals who may benefit from having an Illinois last will include:

03

- Parents with minor children: They can designate a guardian to care for their children and ensure their financial well-being.

04

- Married individuals: They can provide for their spouse in the event of their death and determine how their joint assets will be divided.

05

- Unmarried couples: They can ensure their partner receives their assets and exclude others who may have a claim.

06

- Individuals with significant assets: They can specify how their assets will be distributed and minimize legal disputes among potential beneficiaries.

07

- Charitable individuals: They can leave a portion of their estate to charitable organizations or causes they support.

08

- Individuals with specific end-of-life wishes: They can outline their preferences for burial or cremation, funeral arrangements, and medical treatment in their last will.

09

It is important to consult with an attorney in order to create a valid and legally binding Illinois last will.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit illinois last will and online?

The editing procedure is simple with pdfFiller. Open your illinois last will and in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out illinois last will and using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign illinois last will and and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out illinois last will and on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your illinois last will and by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is illinois last will and?

Illinois last will and is a legal document that allows a person to specify how their assets will be distributed after their death.

Who is required to file illinois last will and?

Any individual who wants to ensure their assets are distributed according to their wishes after their death is required to file an illinois last will and.

How to fill out illinois last will and?

To fill out an illinois last will and, an individual must list their assets, beneficiaries, and specify how they want their assets to be distributed.

What is the purpose of illinois last will and?

The purpose of an illinois last will and is to ensure that a person's assets are distributed according to their wishes after their death.

What information must be reported on illinois last will and?

Information such as assets, beneficiaries, and distribution instructions must be reported on an illinois last will and.

Fill out your illinois last will and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Last Will And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.