TX Secured Promissory Note 2018 free printable template

Show details

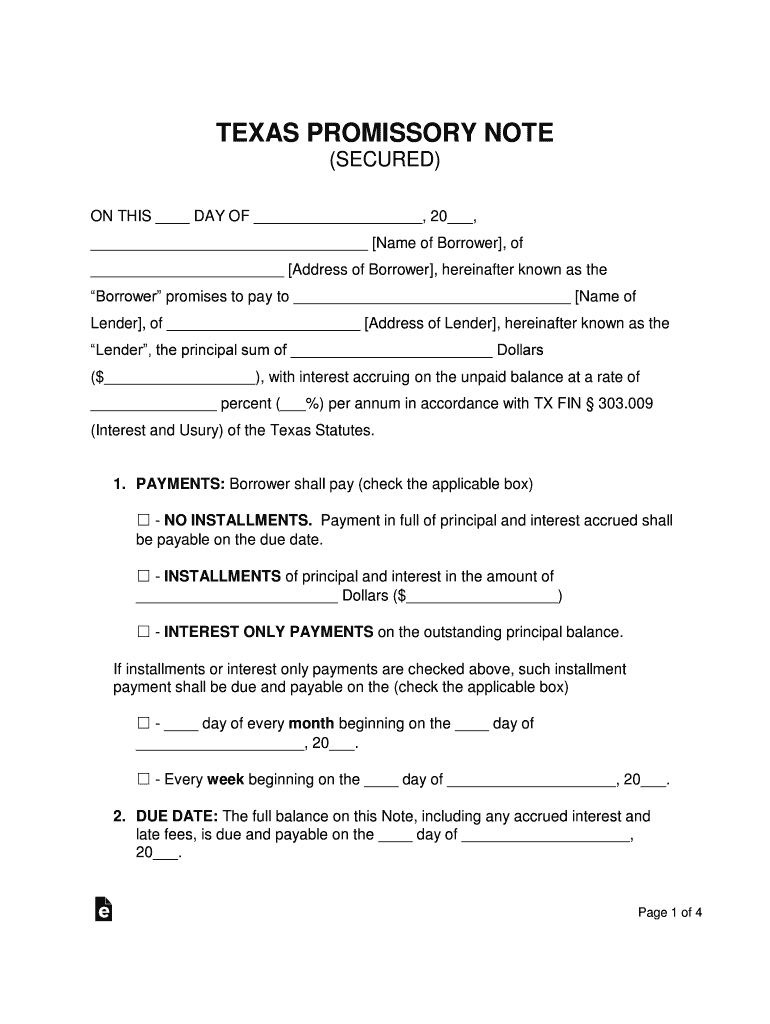

TEXAS PROMISSORY NOTE (SECURED) ON THIS DAY OF, 20, Name of Borrower, of Address of Borrower, hereinafter known as the Borrower promises to pay to Name of Lender, of Address of Lender, hereinafter

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign loan agreement promissory note

Edit your loan agreement promissory note form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan agreement promissory note form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan agreement promissory note online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan agreement promissory note. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Secured Promissory Note Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out loan agreement promissory note

How to fill out TX Secured Promissory Note

01

Begin with the title 'Texas Secured Promissory Note' at the top of the document.

02

Insert the date on which the note is being executed.

03

Clearly state the names of the borrower and lender, including their addresses.

04

Specify the principal amount being borrowed.

05

Outline the interest rate, indicating whether it is fixed or variable.

06

Define the repayment schedule, including due dates and payment amounts.

07

Include any late payment penalties or fees.

08

Describe the collateral securing the note, providing details about the asset.

09

Insert any additional terms or conditions pertinent to the agreement.

10

Ensure both parties sign and date the document to make it legally binding.

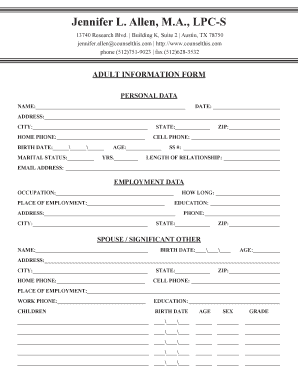

Who needs TX Secured Promissory Note?

01

Individuals or businesses borrowing money who want to secure the loan with collateral.

02

Lenders who need assurance that they can reclaim funds through the secured asset if the borrower defaults.

03

Real estate investors looking to finance property purchases while minimizing risk.

04

Parties involved in personal loans where collateral can be provided.

Fill

form

: Try Risk Free

People Also Ask about

What makes a promissory note legally binding?

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

What makes a promissory note invalid?

Promissory notes are legally binding, but if a note becomes invalid, it may not be enforceable. A promissory note could become invalid if: It isn't signed by both parties.

Are promissory notes legally binding in Texas?

Texas promissory notes do not have to be notarized. However, to make them a legal document, they must be signed and dated by the borrower. If there is a co-signer, they should also sign and date the agreement.

What is the limitation on a promissory note in Texas?

The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

How do you make a promissory note legally binding?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Does a promissory note need to be notarized?

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send loan agreement promissory note for eSignature?

Once your loan agreement promissory note is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit loan agreement promissory note online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your loan agreement promissory note and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the loan agreement promissory note electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your loan agreement promissory note in seconds.

What is TX Secured Promissory Note?

A TX Secured Promissory Note is a financial instrument that outlines a borrower's promise to repay a loan secured by collateral. It specifies the terms of the loan, including the interest rate, repayment schedule, and conditions under which the collateral may be claimed.

Who is required to file TX Secured Promissory Note?

Individuals or entities that are borrowing money and are providing security for the loan through collateral are required to file a TX Secured Promissory Note.

How to fill out TX Secured Promissory Note?

To fill out a TX Secured Promissory Note, one must provide the borrower's and lender's information, specify the loan amount, interest rate, repayment schedule, describe the collateral, and include signatures from both parties to validate the agreement.

What is the purpose of TX Secured Promissory Note?

The purpose of a TX Secured Promissory Note is to formalize the loan agreement between the borrower and lender, outlining the repayment terms and providing security for the lender by including collateral.

What information must be reported on TX Secured Promissory Note?

The TX Secured Promissory Note must report the identities of the borrower and lender, the amount of the loan, the interest rate, the repayment terms, a description of the collateral, and the signatures of both parties.

Fill out your loan agreement promissory note online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Agreement Promissory Note is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.