Get the free EUAS FAMILY CHARITABLE TRUST

Show details

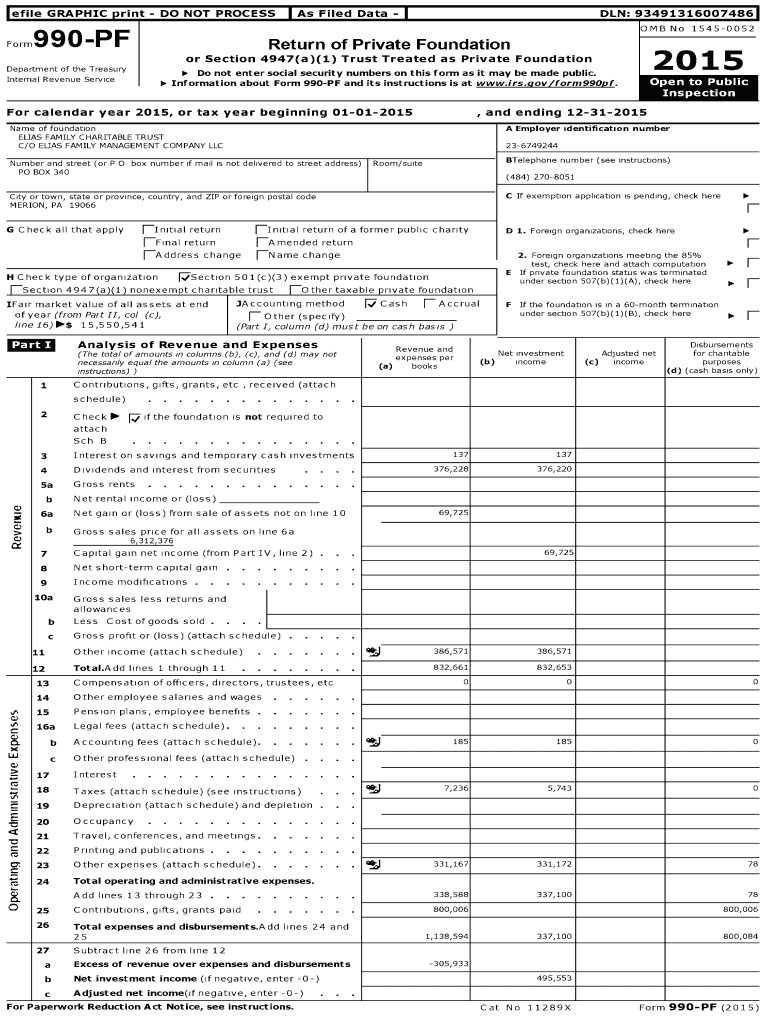

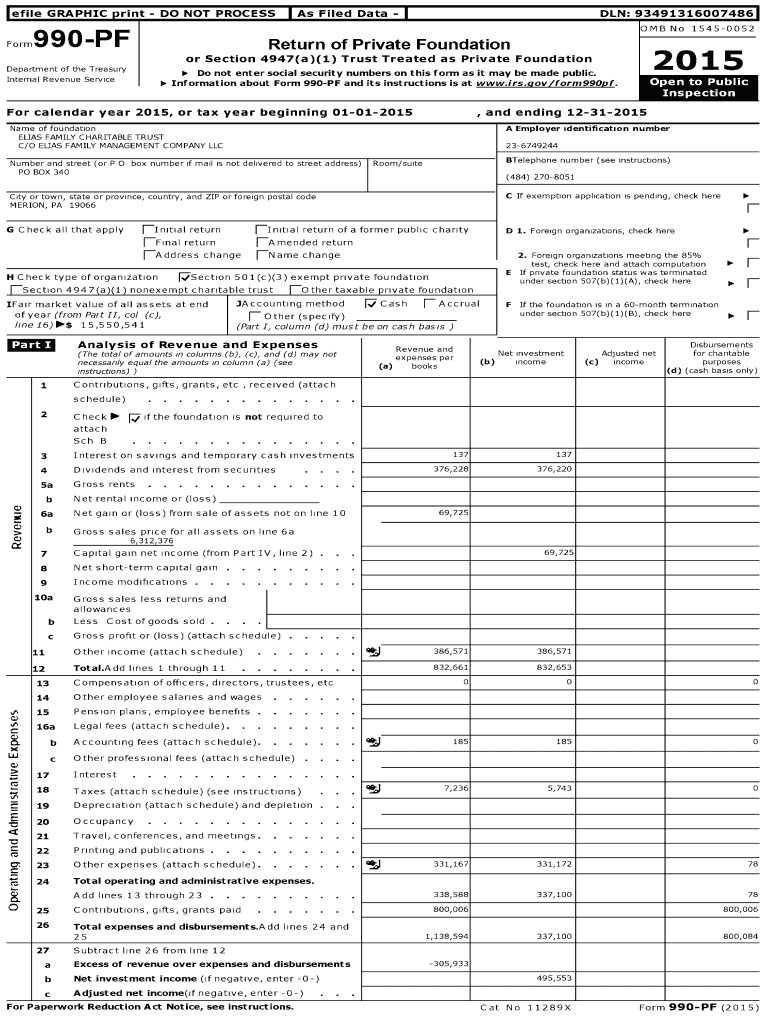

File Graphics Filed Data print DO NOT PROCESSION:93491316007486 OMB No 15450052Form990PFReturn of Private Foundation2015or Section 4947(a)(1) Trust Treated as Private Foundation Department of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign euas family charitable trust

Edit your euas family charitable trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your euas family charitable trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing euas family charitable trust online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit euas family charitable trust. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out euas family charitable trust

How to fill out euas family charitable trust

01

To fill out EUAS Family Charitable Trust, follow these steps:

02

Start by downloading the trust application form from the official EUAS Family Charitable Trust website.

03

Fill in the personal information section, including your name, address, contact details, and social security number.

04

Provide details about the charitable purposes for which you wish to establish the trust. Clearly state the objectives and goals of the trust.

05

List the names of the beneficiaries who will benefit from the trust and provide their relationship to the trust creator.

06

Specify the assets or funds that you plan to transfer to the trust. Be as detailed as possible about the types and values of assets.

07

Designate trustees who will oversee the management and distribution of the trust funds. Include their names, addresses, and contact information.

08

Clearly outline the terms and conditions of the trust, including any restrictions or provisions.

09

Sign and date the trust application form in the presence of a notary public or authorized witness.

10

Submit the completed trust application form along with any required supporting documentation to the EUAS Family Charitable Trust headquarters.

11

Await confirmation and approval from the trust administrators. Once approved, you will receive further instructions on funding the trust and administering its operations.

Who needs euas family charitable trust?

01

The EUAS Family Charitable Trust is beneficial for individuals or organizations who:

02

- Wish to support charitable causes and initiatives

03

- Want to establish a structured framework for philanthropic activities

04

- Seek to have a long-lasting impact on their community

05

- Desire to ensure the proper management and distribution of their charitable assets

06

- Aim to maximize the tax benefits associated with charitable giving

07

- Wish to involve family members or other named beneficiaries in their philanthropic endeavors

08

- Want to contribute to specific charitable sectors or causes

09

- Seek to leave a legacy of giving and make a positive difference in society

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find euas family charitable trust?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific euas family charitable trust and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute euas family charitable trust online?

pdfFiller has made it easy to fill out and sign euas family charitable trust. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit euas family charitable trust in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing euas family charitable trust and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is euas family charitable trust?

Euas Family Charitable Trust is a legal entity set up to distribute funds to charitable organizations or causes.

Who is required to file euas family charitable trust?

The trustees of the Euas Family Charitable Trust are required to file the trust's tax return.

How to fill out euas family charitable trust?

To fill out the Euas Family Charitable Trust tax return, trustees must gather all financial information and report it accurately on the form provided by the tax authorities.

What is the purpose of euas family charitable trust?

The purpose of the Euas Family Charitable Trust is to support charitable causes and organizations by distributing funds.

What information must be reported on euas family charitable trust?

The Euas Family Charitable Trust tax return must include information on the trust's income, expenses, assets, and distributions to charitable organizations.

Fill out your euas family charitable trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Euas Family Charitable Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.