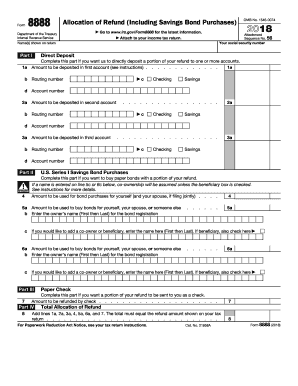

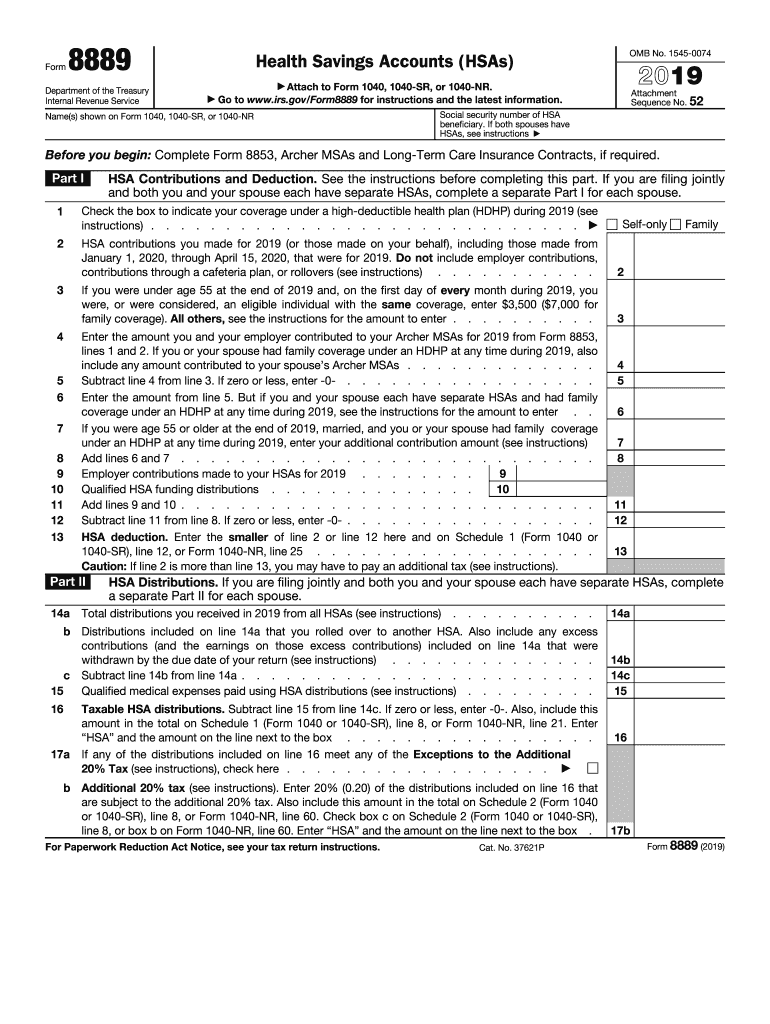

IRS 8889 2019 free printable template

Instructions and Help about IRS 8889

How to edit IRS 8889

How to fill out IRS 8889

About IRS 8889 previous version

What is IRS 8889?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

What are the penalties for not filing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8889

What should I do if I realize I've made a mistake on my IRS 8889 after filing?

If you discover an error on your IRS 8889 after submission, you must file an amended return using Form 1040-X. Make sure to include the corrected IRS 8889 with your amended return, specifying the changes clearly. Keep in mind that it's important to act quickly to minimize any potential penalties.

How can I check the status of my IRS 8889 filing?

You can verify the status of your IRS 8889 by using the IRS 'Where's My Refund?' tool if you expect a refund, or by calling the IRS directly for other inquiries. Keeping track of any confirmation or receipt number when you file can help you reference your submission when checking the status.

What can I do if my e-filed IRS 8889 is rejected?

If your IRS 8889 is rejected during e-filing, review the rejection codes provided by the IRS to understand the issue. Common reasons include incorrect Social Security numbers or missing information. Correct the errors and resubmit the form as soon as possible to avoid delays.

Are there any special considerations for filing IRS 8889 for a nonresident foreign payee?

Filing IRS 8889 on behalf of a nonresident foreign payee requires careful attention to specific regulations. Ensure that all income is correctly reported under the relevant category and that you adhere to any additional documentation requirements that apply to nonresidents. Consulting with a tax professional may be advisable.

What should I do if I receive a notice from the IRS regarding my IRS 8889?

If you receive a notice from the IRS about your IRS 8889, carefully read the letter to understand the issue. Prepare any documents or explanations requested and respond by the deadline stated in the notice. Keeping records of your original submission and communications with the IRS will aid your response.

See what our users say