IRS 2441 2019 free printable template

Show details

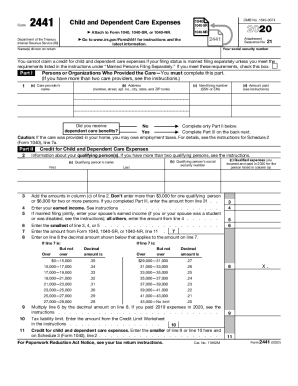

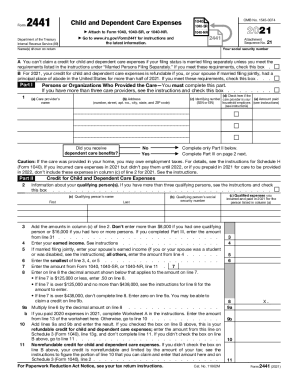

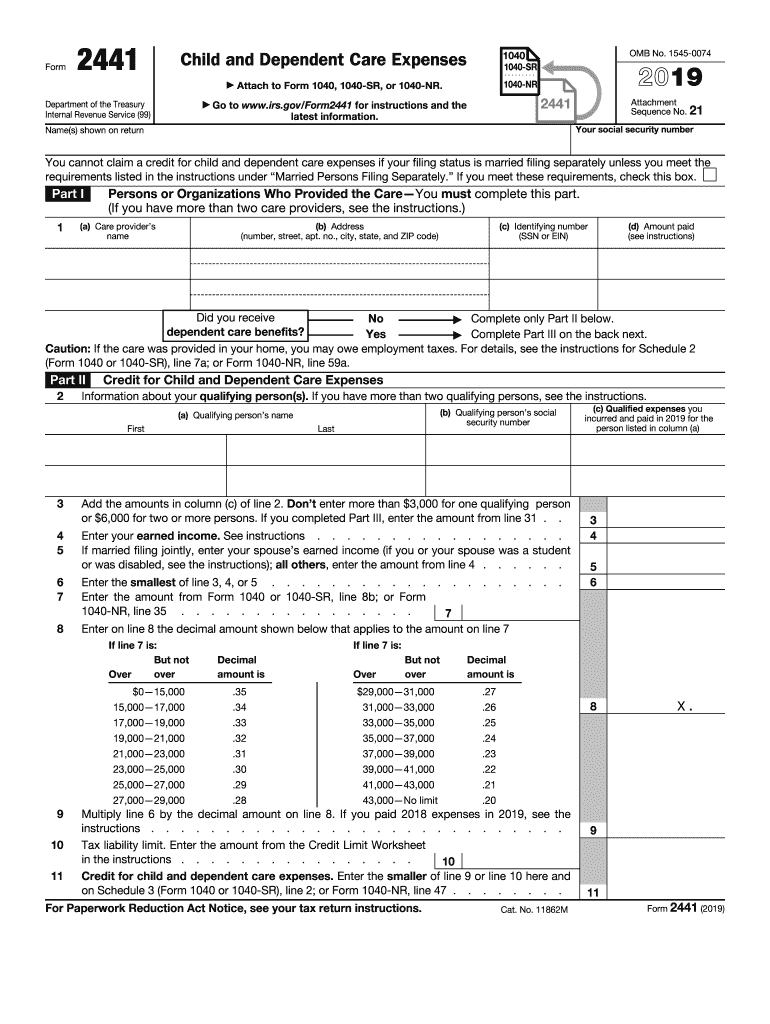

X. Cat. No. 11862M Form 2441 2017 Page 2 Dependent Care Benefits 12 Enter the total amount of dependent care benefits you received in 2017. Form Child and Dependent Care Expenses Department of the Treasury Internal Revenue Service 99 1040A. If you do you can t file Form 1040A. For details see Credit for Child and Dependent Care Expenses Information about your qualifying person s. Form 1040A filers Subtract line 25 from line 15. Also include this amount on Form 1040A line 7. In the space to the...left of line 7 enter DCB. To claim the child and dependent care credit complete lines 27 through 31 below. 27 Enter 3 000 6 000 if two or more qualifying persons. To claim the child and dependent care credit complete lines 27 through 31 below. 27 Enter 3 000 6 000 if two or more qualifying persons. 28 Form 1040 and 1040NR filers Add lines 24 and 25. Form 1040A filers Enter the amount Exception. If you paid 2016 expenses in 2017 see the instructions for line 9. 30 Complete line 2 on the front of...this form. Don t include in column c any benefits shown on line 28 above. Attach to Form 1040 Form 1040A or Form 1040NR* OMB No* 1545-0074 Go to www*irs*gov/Form2441 for instructions and the latest information* Attachment Sequence No* 21 Your social security number Name s shown on return Part I 1040NR Persons or Organizations Who Provided the Care You must complete this part. If you have more than two care providers see the instructions. a Care provider s name b Address number street apt* no*...city state and ZIP code c Identifying number SSN or EIN d Amount paid see instructions Complete only Part II below. No Did you receive dependent care benefits Complete Part III on the back next. Yes Caution If the care was provided in your home you may owe employment taxes. If you have more than two qualifying persons see the instructions. b Qualifying person s social security number Last First Add the amounts in column c of line 2. Don t enter more than 3 000 for one qualifying person or 6 000...for two or more persons. If you completed Part III enter the amount from line 31. Enter your earned income. See instructions. If married filing jointly enter your spouse s earned income if you or your spouse was a student or was disabled see the instructions all others enter the amount from line 4. Enter the smallest of line 3 4 or 5. Enter the amount from Form 1040 line 38 Form 1040A line 22 or Form 1040NR line 37. Decimal amount is 0 15 000 15 000 17 000 17 000 19 000 19 000 21 000 21 000 23...000 23 000 25 000 25 000 27 000 27 000 29 000. Enter on line 8 the decimal amount shown below that applies to the amount on line 7 If line 7 is But not over Over c Qualified expenses you incurred and paid in 2017 for the person listed in column a 29 000 31 000 31 000 33 000 33 000 35 000 35 000 37 000 37 000 39 000 39 000 41 000 41 000 43 000 43 000 No limit Multiply line 6 by the decimal amount on line 8. If you paid 2016 expenses in 2017 see Tax liability limit* Enter the amount from the...Credit Limit Worksheet in the instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 2441

How to edit IRS 2441

How to fill out IRS 2441

Instructions and Help about IRS 2441

How to edit IRS 2441

To edit IRS 2441, use form-filling software, such as pdfFiller, which enables users to make changes smoothly. First, upload a blank or previously filled form to the platform. Then, utilize the editing tools to modify text, add information, or remove entries as needed. Once completed, ensure to save or download the updated form for your records.

How to fill out IRS 2441

To fill out IRS 2441 accurately, follow these steps:

01

Gather necessary documents, such as Social Security numbers for qualifying individuals and records of expenses related to care.

02

Begin with your name, Social Security number, and the details of the qualifying person.

03

Input qualifying expenses in the designated sections, ensuring the totals reflect actual expenses incurred during the tax year.

04

Complete the calculations required to determine the credit amount based on the information provided.

About IRS 2 previous version

What is IRS 2441?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 2 previous version

What is IRS 2441?

IRS 2441, also known as the Child and Dependent Care Expenses Credit form, is utilized by taxpayers to claim a credit for expenses incurred while caring for a qualifying individual. This form assists in reducing the tax burden for eligible filers by providing credits for out-of-pocket childcare costs that allow individuals to work or seek employment.

What is the purpose of this form?

The purpose of IRS 2441 is to facilitate the process of claiming a tax credit for expenses related to the care of a child or other dependent. These expenses may qualify taxpayers for a credit percentage dependent on their income and the amount spent on care, thus offering financial assistance for working individuals with dependents.

Who needs the form?

Individuals who paid for childcare or care for a qualifying person while they worked or looked for work need to complete IRS 2441. This includes parents with children under the age of 13 or taxpayers caring for spouses or dependents who are physically or mentally incapable of self-care. Meeting specific eligibility criteria is essential to claim the credit effectively.

When am I exempt from filling out this form?

You are exempt from filling out IRS 2441 if you did not incur any childcare expenses, if you did not earn income during the year, or if your dependents do not qualify for tax credits as per IRS guidelines. Additionally, individuals using the tax credit for dependent care services that do not meet IRS eligibility standards should not file this form.

Components of the form

The components of IRS 2441 include identifying information about you and your dependents, details about the care provider, and a calculation section for credit eligibility. It also includes instructions on what types of expenses can be included, ensuring filers have a clear understanding of how to complete it correctly.

What are the penalties for not issuing the form?

Failing to file IRS 2441 when required may result in penalties, including the disallowance of the claimed credit and potential interest on owed taxes. Additionally, incomplete or inaccurate forms may lead to audit scrutiny. It is critical to ensure proper filing to avoid these consequences.

What information do you need when you file the form?

Essential information needed when filing IRS 2441 includes your and the qualifying individual's Social Security numbers, details of care providers, and records of eligible expenses. Accurate reporting of income and knowledge of tax brackets are also necessary to determine the credit amount.

Is the form accompanied by other forms?

IRS 2441 may need to be accompanied by Form 1040 or Form 1040-SR as it is part of your overall tax return. It is also important to keep receipts and any relevant documents supporting the expenses incurred, which may not need to be submitted but could be required during an audit.

Where do I send the form?

Once completed, IRS 2441 should be submitted alongside your income tax return to the proper tax processing center, which depends on your filing status and state of residence. Refer to the IRS website for the most current mailing addresses, ensuring you send it to the correct location for prompt processing.

See what our users say