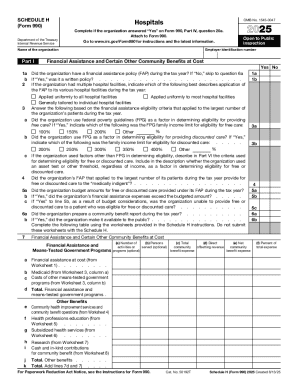

IRS 990 - Schedule H 2019 free printable template

Instructions and Help about IRS 990 - Schedule H

How to edit IRS 990 - Schedule H

How to fill out IRS 990 - Schedule H

About IRS 990 - Schedule H 2019 previous version

What is IRS 990 - Schedule H?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

What is the purpose of this form?

Who needs the form?

Components of the form

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 990 - Schedule H

What should I do if I realize I've made an error on my filed 990 schedule h?

If you've filed your 990 schedule h and later discover a mistake, you should submit an amended return to correct it. The IRS allows you to file Form 990-X for amendments, which enables you to update the previously submitted information. Make sure to include an explanation of the changes made and retain a copy for your records.

How can I track the status of my filed 990 schedule h?

To verify the receipt and processing of your filed 990 schedule h, you can use the IRS's online tracking tools. Ensure you have your submission details handy to check the status on the IRS website. If you encounter any issues, refer to the common e-file rejection codes and follow the corrective steps provided by the IRS.

What privacy measures should I consider when filing a 990 schedule h electronically?

When e-filing your 990 schedule h, it's essential to ensure your data is submitted securely. Use IRS-approved e-filing software that complies with data privacy standards. Also, be mindful to retain records securely, following the IRS's recommended record retention period, to protect sensitive information.

What steps should authorized representatives take when filing a 990 schedule h on behalf of others?

If you are an authorized representative filing a 990 schedule h on someone else's behalf, ensure you have the correct Power of Attorney (POA) documentation in place. This will give you the legal authority to submit the form and address any IRS inquiries as needed. Keep thorough records of the authority granted and the filing for future reference.

What common errors could lead to filing rejection of the 990 schedule h?

Common errors that can lead to rejection of your 990 schedule h include incorrect formatting, missing signatures, or discrepancies between the submitted figures and supporting documentation. To avoid these issues, double-check all entries against the form's guidelines and ensure you have included all necessary attachments before filing.