NE DoR 35K 2023 free printable template

Show details

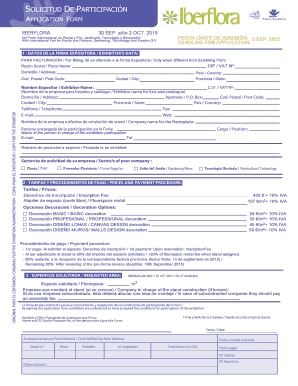

NEBRASKADEPARTMENT OFREVENUENebraska County/City Lottery Annual Report Form 35KC H A R I T A B L EG A M I N G 91972019Important Please Read This booklet contains the Nebraska County/City Lottery Annual

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE DoR 35K

Edit your NE DoR 35K form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE DoR 35K form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NE DoR 35K online

To use the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NE DoR 35K. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE DoR 35K Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE DoR 35K

How to fill out NE DoR 35K

01

Gather necessary personal and financial information.

02

Obtain the NE DoR 35K form from the official website or a local office.

03

Fill out the identification section with your name, address, and contact information.

04

Complete the financial disclosure section accurately, including income and expenses.

05

Provide any additional documentation required to support your application.

06

Review the form for accuracy and completeness before submission.

07

Submit the form by the deadline specified on the form.

Who needs NE DoR 35K?

01

Individuals or businesses seeking financial assistance in Nebraska.

02

Those applying for state-funded programs that require financial disclosure.

03

Applicants for tax rebates or credits that necessitate the NE DoR 35K form.

Fill

form

: Try Risk Free

People Also Ask about

How is Keno legal in Nebraska?

Keno is the closest thing Nebraska has to legal -style games. ing to Nebraska regulations, keno games can be made available in bars, restaurants that serve alcohol, and convenience stores. Nebraska residents who want to play slots or table games have to travel to s in neighboring states.

Who runs Keno in Nebraska?

Charitable Gaming County/City Lottery (Keno) | Nebraska Department of Revenue.

What is Keno in Nebraska?

Keno is a game where 20 numbers, ranging from 1 to 80, are selected each game. You must select 1 to 15 numbers per game. The numbers you select should be marked down on a bet slip, along with the amount you wish to wager and the amount of games you wish to play.

What is the Nebraska County and City lottery Act?

The purpose of the Nebraska County and City Lottery Act is to allow any county, city, or village to conduct a lottery for community betterment purposes. Any lottery conducted by a county, city, or village shall be conducted only by those methods and under those circumstances prescribed in the act.

What is the Keno tax in Nebraska?

The county, city, or village pays a tax of two percent of the total proceeds from the lottery or keno gaming.

How much tax do you pay on gambling winnings in Nebraska?

There is a flat Nebraska income tax withholding rate of 5% of the winnings in Nebraska that are subject to federal income tax withholding. The amount of income tax withheld must be reported on Federal Form W-2G.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NE DoR 35K online?

pdfFiller has made it easy to fill out and sign NE DoR 35K. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out NE DoR 35K using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NE DoR 35K and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out NE DoR 35K on an Android device?

Use the pdfFiller app for Android to finish your NE DoR 35K. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NE DoR 35K?

NE DoR 35K is a document used for reporting specific financial information, typically required by the tax authorities in certain jurisdictions.

Who is required to file NE DoR 35K?

Individuals or entities that meet specific income or business thresholds as defined by the local tax authority must file NE DoR 35K.

How to fill out NE DoR 35K?

To fill out NE DoR 35K, follow the provided guidelines or instructions, entering all required information accurately and completely, and ensure to attach any necessary supporting documents.

What is the purpose of NE DoR 35K?

The purpose of NE DoR 35K is to collect pertinent financial data for tax assessment, compliance verification, and to ensure proper tax reporting.

What information must be reported on NE DoR 35K?

The report must include income details, deductions, credits, and any other financial information as specified by the tax guidelines associated with NE DoR 35K.

Fill out your NE DoR 35K online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE DoR 35k is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.