Get the free No capital gains tax on contingent payments if neither accrued ...

Show details

21 April 2016Deferred consideration on transfer of shares dependent

upon contingency is not taxable in the year of transfer

since it has not accrued

BackgroundINR27 million received as initial consideration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no capital gains tax

Edit your no capital gains tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no capital gains tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing no capital gains tax online

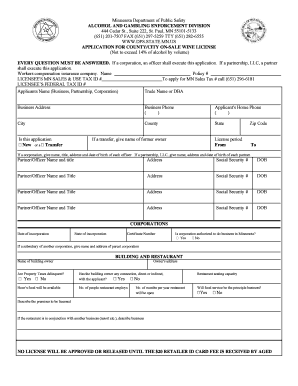

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit no capital gains tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

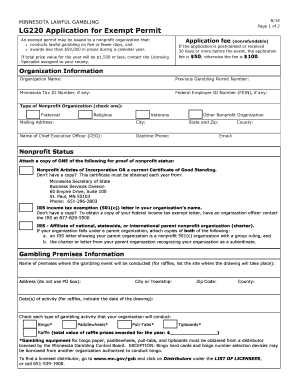

How to fill out no capital gains tax

How to fill out no capital gains tax

01

Understand the tax laws in your country or region to determine if there are any provisions for no capital gains tax.

02

Consult with a tax advisor or professional who can provide guidance on the specific steps and requirements for filling out a no capital gains tax form.

03

Gather all the necessary documents and information, such as investment records, purchase/sale agreements, and any relevant financial statements.

04

Fill out the required forms accurately and completely. Make sure to provide all the requested details and attach any supporting documents as required.

05

Review the completed forms and ensure everything is filled out correctly. Double-check for any errors or missing information.

06

Submit the filled-out forms to the appropriate tax authority or designated entity responsible for processing no capital gains tax claims.

07

Keep copies of all submitted forms and supporting documents for your records.

08

Monitor the progress of your no capital gains tax claim, and be prepared to provide any additional information or documentation if requested.

09

If approved, comply with any further instructions or requirements provided by the tax authority or entity handling your no capital gains tax claim.

10

Keep track of any deadlines or reporting obligations related to your no capital gains tax status to ensure ongoing compliance.

Who needs no capital gains tax?

01

Individuals or entities who have made significant capital investments and want to avoid tax implications on their gains.

02

Investors who have held assets for an extended period and want to take advantage of tax-exempt status on their capital gains.

03

Startups or companies that have received specific tax incentives or exemptions for promoting economic growth or investment in certain industries or regions.

04

Governments or policymakers who aim to attract foreign investment or stimulate local economic activity by offering no capital gains tax benefits.

05

Individuals or businesses residing in jurisdictions that have implemented no capital gains tax laws as part of their tax system.

06

High net worth individuals or corporations seeking to optimize their overall tax strategies by reducing their capital gains tax liabilities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out no capital gains tax using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign no capital gains tax and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit no capital gains tax on an iOS device?

Create, edit, and share no capital gains tax from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I fill out no capital gains tax on an Android device?

Use the pdfFiller app for Android to finish your no capital gains tax. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is no capital gains tax?

No capital gains tax is the tax exemption on the profits from the sale of an asset such as stocks, real estate, or investments.

Who is required to file no capital gains tax?

Individuals or entities who have realized a capital gain and qualify for the tax exemption are required to file no capital gains tax.

How to fill out no capital gains tax?

To fill out no capital gains tax, individuals or entities must accurately report the details of the capital gain, including the date of sale, purchase price, selling price, and any relevant deductions.

What is the purpose of no capital gains tax?

The purpose of no capital gains tax is to promote investment and economic growth by providing tax benefits to individuals or entities who make profits from the sale of assets.

What information must be reported on no capital gains tax?

Information such as the details of the asset sold, purchase price, selling price, and deductions must be reported on no capital gains tax form.

Fill out your no capital gains tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Capital Gains Tax is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.