Get the free Nebraska Refund Claim for Documentary Stamp Tax - revenue nol

Show details

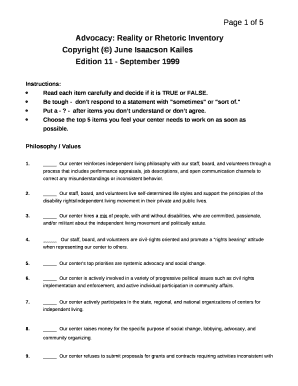

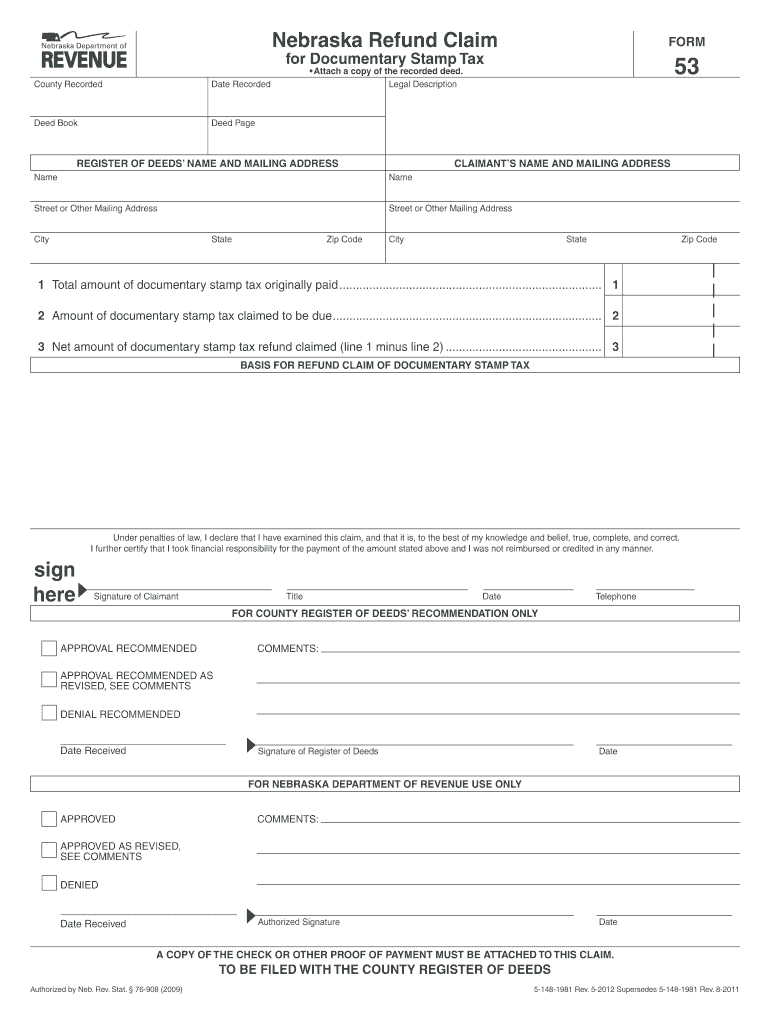

PRINT RESET Nebraska Refund Claim FORM for Documentary Stamp Tax County Recorded Deed Book Attach a copy of the recorded deed* Legal Description Date Recorded Deed Page REGISTER OF DEEDS NAME AND MAILING ADDRESS CLAIMANT S NAME AND MAILING ADDRESS Name Street or Other Mailing Address City State Zip Code 1 Total amount of documentary stamp tax originally paid*. 1 2 Amount of documentary stamp tax claimed to be due. 2 3 Net amount of documentary stamp tax refund claimed line 1 minus line 2....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nebraska refund claim for

Edit your nebraska refund claim for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska refund claim for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nebraska refund claim for online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nebraska refund claim for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nebraska refund claim for

How to fill out Nebraska Refund Claim for Documentary Stamp Tax

01

Obtain the Nebraska Refund Claim for Documentary Stamp Tax form from the Nebraska Department of Revenue website.

02

Fill in your personal details including your name, address, and contact information at the top of the form.

03

Provide information about the transaction for which you are claiming a refund, including the date of the transaction and the amount of tax paid.

04

Clearly explain the reason for the refund request in the designated section, providing any necessary supporting documentation.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form to certify that the information provided is true and correct.

07

Submit the completed form to the Nebraska Department of Revenue either by mail or electronically as instructed.

Who needs Nebraska Refund Claim for Documentary Stamp Tax?

01

Individuals or businesses who have overpaid the documentary stamp tax in Nebraska.

02

Those who have participated in real estate transactions that required the payment of the documentary stamp tax.

03

Taxpayers who believe they qualify for a refund due to an exemption or error in the tax payment process.

Fill

form

: Try Risk Free

People Also Ask about

How to check on Nebraska state refund?

If you do not have access to a computer, you may also contact 1-800-742-7474 or 1-402-471-5729. The Nebraska Department of Revenue's online refund status tool offers a fast way for Nebraska taxpayers to check on the status of their income tax refund. (Please note: this doesn't apply to amended tax returns).

Which party normally pays for documentary stamps on the deed?

In real estate transactions, the state documentary stamp tax is usually paid by the seller if there is no agreement otherwise. However, this responsibility can be negotiated between the buyer and seller.

Are documentary stamp taxes deductible?

Transfer taxes (or stamp taxes). You can't deduct transfer taxes and similar taxes and charges on the sale of a personal home. If you are the buyer and you pay them, include them in the cost basis of the property.

Who pays documentary stamp tax in Nebraska?

Nebraska Documentary Stamp Tax Law The documentary stamp tax is a tax imposed on the grantor executing a deed for the privilege of transferring beneficial interest in or legal title to real estate. The rate of tax is $2.25 for each one thousand dollars value or fraction thereof, of the real estate transferred.

What is the phone number for Nebraska tax refund?

The Lincoln office is open from 7:30 a.m. until 5:00 p.m., Monday through Friday. For assistance at other times of the day, or to make an appointment, call 800‑742‑7474 (NE and IA) or 402‑471‑5729.

How much is the doc stamp tax in Nebraska?

is taxed at the rate of $2.25 for each $1,000 value or fraction thereof.

Who will pay for documentary stamp tax?

In summary: The Documentary Stamp Tax is typically the seller's responsibility, unless otherwise agreed, and must be paid within five days of the end of the month in which the Deed of Sale was signed. The Transfer Tax is the buyer's responsibility and is due within 60 days from the sale.

Who pays documentary taxes?

Who pays for the Documentary Transfer Tax? Either Buyer or Seller or both share. This cost can be negotiated between parties. The County Recorder does not care who pays, as long as it gets paid if it is due.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nebraska Refund Claim for Documentary Stamp Tax?

The Nebraska Refund Claim for Documentary Stamp Tax is a formal request submitted by individuals or entities to recover documentary stamp taxes that were overpaid or erroneously paid.

Who is required to file Nebraska Refund Claim for Documentary Stamp Tax?

Any individual or business that has overpaid the documentary stamp tax and wishes to recover those funds is required to file the Nebraska Refund Claim.

How to fill out Nebraska Refund Claim for Documentary Stamp Tax?

To fill out the Nebraska Refund Claim, you must provide your personal or business information, details of the transactions for which a refund is requested, the amount of tax paid, and the reason for the refund request. Ensure all fields are accurately completed and submit the claim to the appropriate state department.

What is the purpose of Nebraska Refund Claim for Documentary Stamp Tax?

The purpose of the Nebraska Refund Claim for Documentary Stamp Tax is to allow taxpayers to recover amounts paid in excess of tax liabilities or amounts that should not have been paid according to Nebraska tax laws.

What information must be reported on Nebraska Refund Claim for Documentary Stamp Tax?

The information that must be reported on the Nebraska Refund Claim includes the taxpayer's name and contact information, the transaction details, the original amount of documentary stamp tax paid, the specific reason for the refund request, and any supporting documentation that verifies the claim.

Fill out your nebraska refund claim for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Refund Claim For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.