Get the free GUIDELINES FOR ANNUAL AUDIT ON CHILD CARE SUBSIDY CLAIMS

Show details

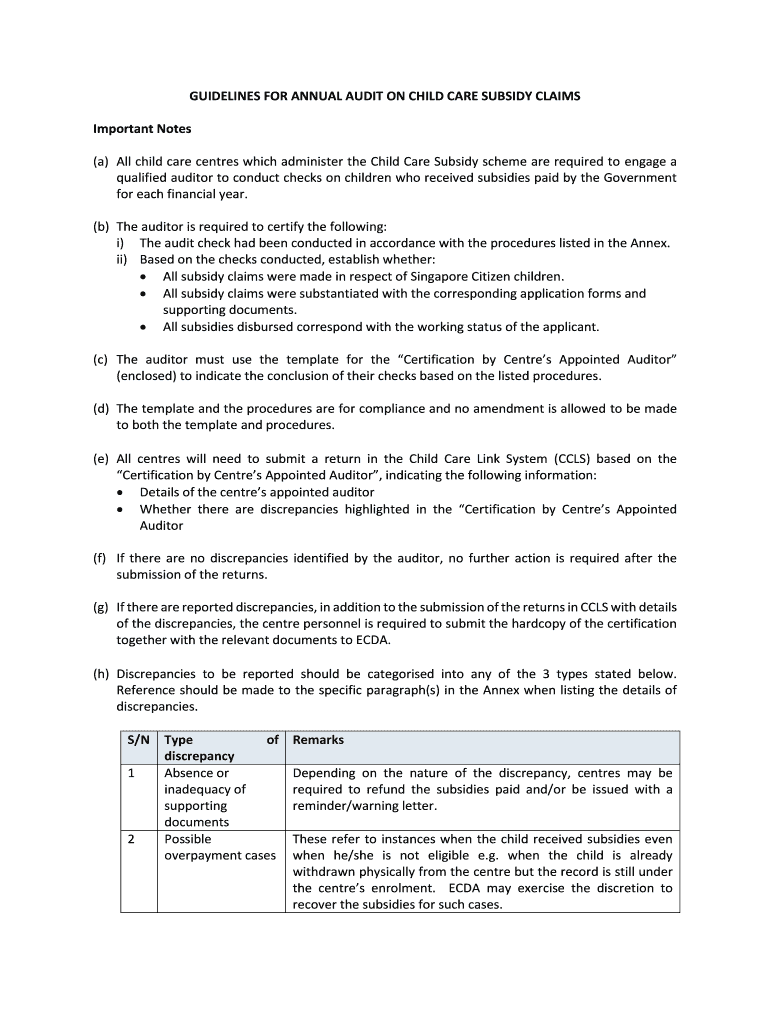

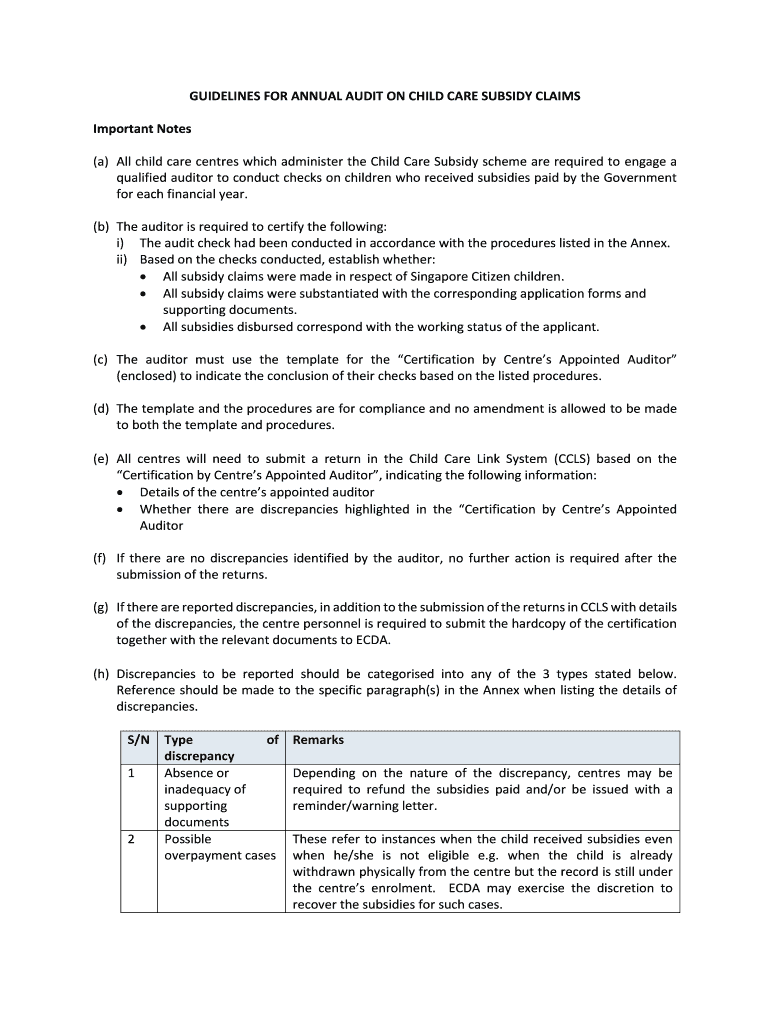

GUIDELINES FOR ANNUAL AUDIT ON CHILD CARE SUBSIDY CLAIMS Important Notes (a) All child care centers which administer the Child Care Subsidy scheme are required to engage a qualified auditor to conduct

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidelines for annual audit

Edit your guidelines for annual audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidelines for annual audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guidelines for annual audit online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit guidelines for annual audit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidelines for annual audit

01

To fill out guidelines for an annual audit, start by gathering all relevant financial documents and records. This may include bank statements, invoices, receipts, and any other supporting documentation.

02

Review the guidelines provided by the auditing firm or regulatory body to ensure you understand the requirements and expectations. This will help you structure your guidelines accordingly.

03

Begin by outlining the objective of the audit. Clearly define what the audit aims to achieve, whether it is ensuring compliance with financial regulations, identifying potential fraud, or assessing the accuracy of financial statements.

04

Break down the guidelines into specific sections or categories. These can include areas such as revenue recognition, expense verification, cash management, internal controls, and risk assessment.

05

Within each section, provide detailed instructions on how to conduct the audit. Outline the specific procedures, tests, or sampling methods that need to be followed to gather evidence and reach conclusions.

06

Include relevant examples or scenarios to help auditors better understand how to apply the guidelines in practice. These examples can act as practical illustrations of the expected audit procedures and can help auditors make informed decisions.

07

Make sure to include any reporting requirements or templates that need to be completed as part of the audit. This will help auditors in organizing their findings and presenting the results in a standardized format.

08

Consider the intended audience of the guidelines and tailor the language and level of detail accordingly. The guidelines may be used by both experienced auditors and individuals with limited knowledge in auditing, so it is important to strike a balance between technical accuracy and accessibility.

Who needs guidelines for an annual audit?

01

Any organization that is subject to a mandatory or voluntary independent audit should have guidelines in place. These guidelines help ensure that auditors have clear instructions on how to conduct the audit and what is expected from them.

02

Audit committees or boards of directors may also need guidelines to provide oversight and direction to the auditors. These guidelines can help establish the scope and objectives of the audit, as well as the level of detail and thoroughness expected.

03

Auditing firms themselves may develop internal guidelines to standardize their procedures and ensure consistency across different audit engagements. These guidelines can act as a reference for auditors within the firm, ensuring a uniform approach to auditing practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify guidelines for annual audit without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your guidelines for annual audit into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the guidelines for annual audit electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your guidelines for annual audit in minutes.

How do I fill out guidelines for annual audit using my mobile device?

Use the pdfFiller mobile app to complete and sign guidelines for annual audit on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is guidelines for annual audit?

Annual audit guidelines are a set of procedures and standards that outline how an organization should conduct its annual financial audit, ensuring transparency, accuracy, and compliance with relevant regulations.

Who is required to file guidelines for annual audit?

Organizations that meet certain criteria, such as being publicly traded or exceeding specific revenue thresholds, are typically required to file guidelines for annual audits, often mandated by regulatory bodies.

How to fill out guidelines for annual audit?

To fill out the guidelines for an annual audit, an organization should gather relevant financial documents, assess compliance with accounting standards, document processes and controls, and report findings according to the established format.

What is the purpose of guidelines for annual audit?

The primary purpose of guidelines for an annual audit is to ensure that financial statements are free from material misstatements, enhance the reliability of financial reporting, and serve the interests of stakeholders.

What information must be reported on guidelines for annual audit?

Information reported in the guidelines for an annual audit typically includes financial statements, auditor's opinions, disclosures of accounting policies, and any identified deficiencies in internal controls.

Fill out your guidelines for annual audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidelines For Annual Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.