Get the free 2019 Property Tax Discount Form - Newport Hospital & Health ...

Show details

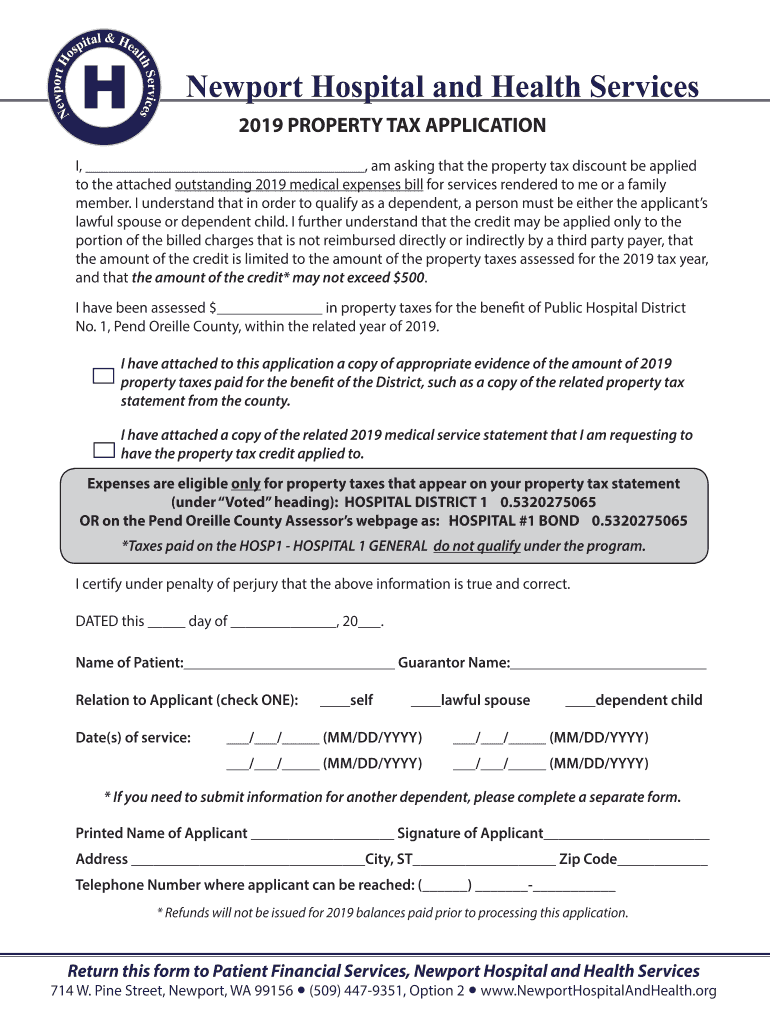

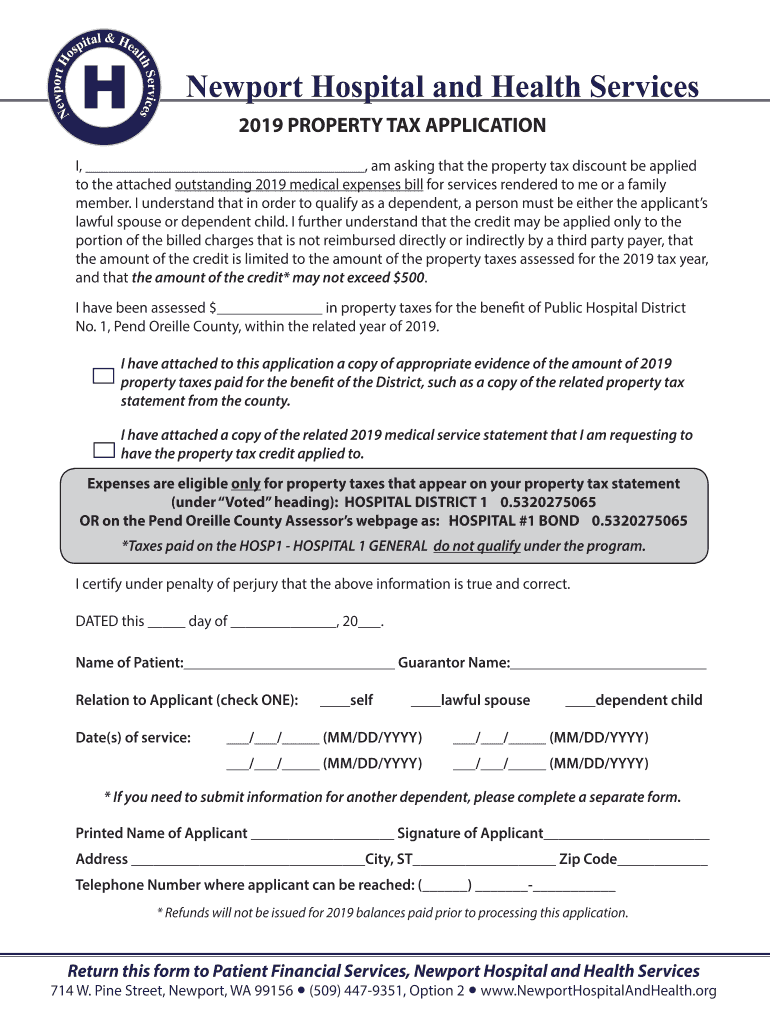

Newport Hospital and Health Services 2019 PROPERTY TAX APPLICATION I, am I asking that the property tax discount be applied to the attached outstanding 2019 medical expenses bill for services rendered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2019 property tax discount

Edit your 2019 property tax discount form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2019 property tax discount form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2019 property tax discount online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2019 property tax discount. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2019 property tax discount

How to fill out 2019 property tax discount

01

Step 1: Gather all the necessary documents such as property tax bills, proof of ownership, and any eligible exemptions or deductions.

02

Step 2: Determine the deadline for filing the property tax discount application. This information can usually be found on the local government website or by contacting the tax assessor's office.

03

Step 3: Complete the application form. Provide accurate and detailed information about the property, ownership, and any exemptions or deductions.

04

Step 4: Attach all the required documents to the application. Make sure to include copies and not original documents.

05

Step 5: Review the completed application and documents for any errors or missing information. Double-check if everything is filled out correctly.

06

Step 6: Submit the application and supporting documents either in person at the tax assessor's office or by mail. If mailing the application, consider using a tracked or certified mail service.

07

Step 7: Keep a copy of the application and supporting documents for your records. This can serve as proof of submission.

08

Step 8: Wait for a response from the tax assessor's office regarding the status of your application. They will inform you if the property tax discount is approved or denied.

09

Step 9: If approved, you may receive a discounted property tax bill or a refund if the tax has already been paid in full. If denied, you may have the option to appeal the decision.

10

Step 10: If the property tax discount is granted, make sure to keep track of future deadlines and requirements to continue receiving the discount in subsequent years.

Who needs 2019 property tax discount?

01

Homeowners who are eligible for property tax discounts based on their local government's criteria.

02

Individuals who want to reduce their financial burden by taking advantage of available property tax discounts.

03

Property owners who meet the requirements for exemptions, deductions, or discounts specified by the local government.

04

Those who wish to save money on their property tax payments by applying for the property tax discount.

05

Individuals who want to ensure they are not overpaying on their property taxes and are willing to invest time in the application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2019 property tax discount directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign 2019 property tax discount and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit 2019 property tax discount online?

The editing procedure is simple with pdfFiller. Open your 2019 property tax discount in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit 2019 property tax discount in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 2019 property tax discount and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is property tax discount form?

It is a form that allows property owners to apply for a discount on their property tax payments.

Who is required to file property tax discount form?

Property owners who meet the criteria for a tax discount must file the form.

How to fill out property tax discount form?

The form can be filled out online or in person, providing all required information and supporting documents.

What is the purpose of property tax discount form?

The purpose is to allow eligible property owners to receive a discount on their property tax payments.

What information must be reported on property tax discount form?

Information such as property ownership details, income verification, and other relevant financial information.

Fill out your 2019 property tax discount online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2019 Property Tax Discount is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.