Get the free Current Overdraft Policy - Together Credit Union

Show details

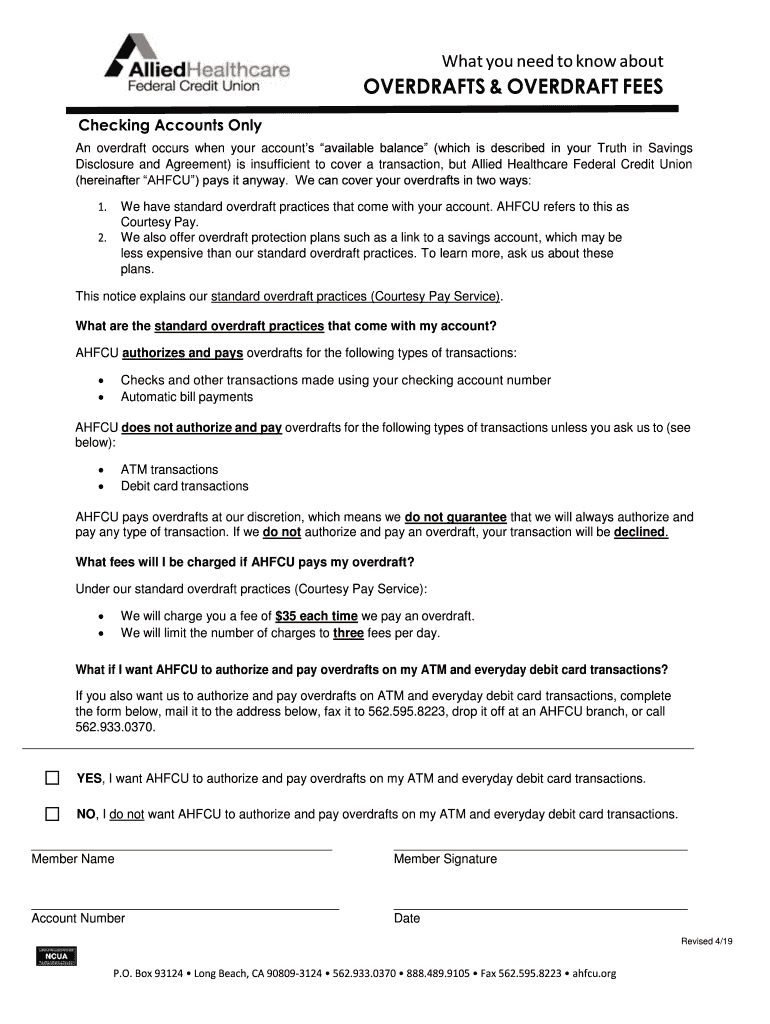

What you need to know aboutOVERDRAFTS & OVERDRAFT FEES Checking Accounts Only An overdraft occurs when your accounts available balance (which is described in your Truth in Savings Disclosure and Agreement)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign current overdraft policy

Edit your current overdraft policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your current overdraft policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing current overdraft policy online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit current overdraft policy. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out current overdraft policy

How to fill out current overdraft policy

01

To fill out the current overdraft policy, follow these steps:

02

Start by reviewing your bank's existing policies and guidelines for overdrafts.

03

Determine the current framework for overdrafts, including the fees, limits, and eligibility criteria.

04

Analyze any recent regulatory changes or industry-specific requirements that may impact the overdraft policy.

05

Consult with relevant departments within the bank, such as risk management, legal, compliance, and operations.

06

Develop a comprehensive policy document that outlines the procedures for initiating, approving, and managing overdrafts.

07

Include clear guidelines on customer communication, fee disclosure, and dispute resolution related to overdrafts.

08

Review and revise the policy based on internal feedback and legal compliance requirements.

09

Obtain necessary approvals from senior management and any regulatory bodies, as applicable.

10

Communicate the new or updated current overdraft policy to all relevant stakeholders, including employees and customers.

11

Conduct periodic reviews and assessments to ensure the policy remains effective and aligned with industry standards.

12

Continuously monitor the impact of the policy on customer satisfaction, risk exposure, and overall banking operations.

13

Update the policy as needed to address changing market conditions, customer needs, or regulatory requirements.

Who needs current overdraft policy?

01

Various entities can benefit from having a current overdraft policy in place, including:

02

- Banks and financial institutions: A policy helps them manage the risks associated with overdrafts and ensure compliance with regulatory guidelines.

03

- Customers: The policy provides transparency and clarity on fees, limits, and dispute resolution, helping them make informed decisions about overdrafts.

04

- Bank employees: They can refer to the policy as a reference guide when assisting customers with overdraft-related inquiries or requests.

05

- Regulators: A well-defined overdraft policy helps regulators assess the bank's compliance with industry standards and protect customer interests.

06

- Investors and stakeholders: A robust policy demonstrates the bank's commitment to effective risk management and governance.

07

- External auditors and consultants: They can evaluate the bank's adherence to the policy during audits and offer recommendations for improvement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get current overdraft policy?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the current overdraft policy in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the current overdraft policy in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your current overdraft policy and you'll be done in minutes.

How do I complete current overdraft policy on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your current overdraft policy. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is current overdraft policy?

Current overdraft policy refers to the guidelines and rules set by a financial institution regarding overdraft protection for their customers.

Who is required to file current overdraft policy?

Financial institutions are required to have and file their current overdraft policies with regulatory authorities.

How to fill out current overdraft policy?

Current overdraft policy can be filled out by outlining the procedures for handling and approving overdraft requests, as well as the fees and limits associated with overdraft protection.

What is the purpose of current overdraft policy?

The purpose of current overdraft policy is to ensure that customers are aware of the fees and procedures associated with overdraft protection, and to establish clear guidelines for how overdraft requests are handled.

What information must be reported on current overdraft policy?

Current overdraft policy must include information on the fees and charges associated with overdraft protection, the process for approving overdraft requests, and the specific limits on overdraft amounts.

Fill out your current overdraft policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Current Overdraft Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.