Get the free Financial Advisory Services Client FormsLPL Financial

Show details

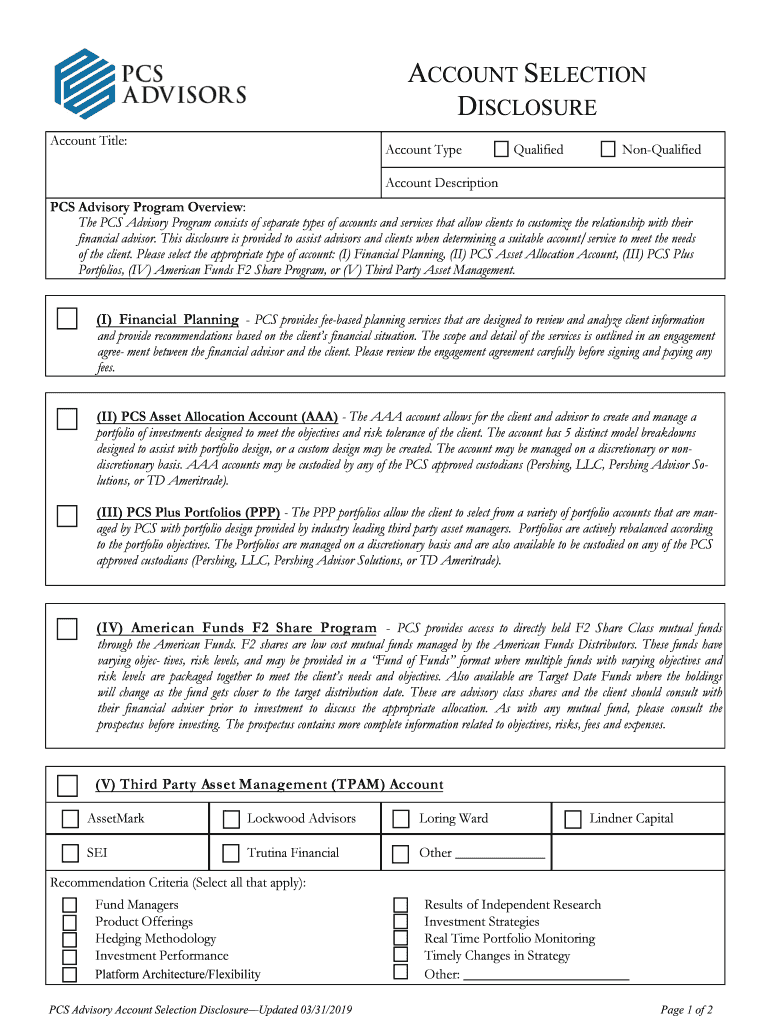

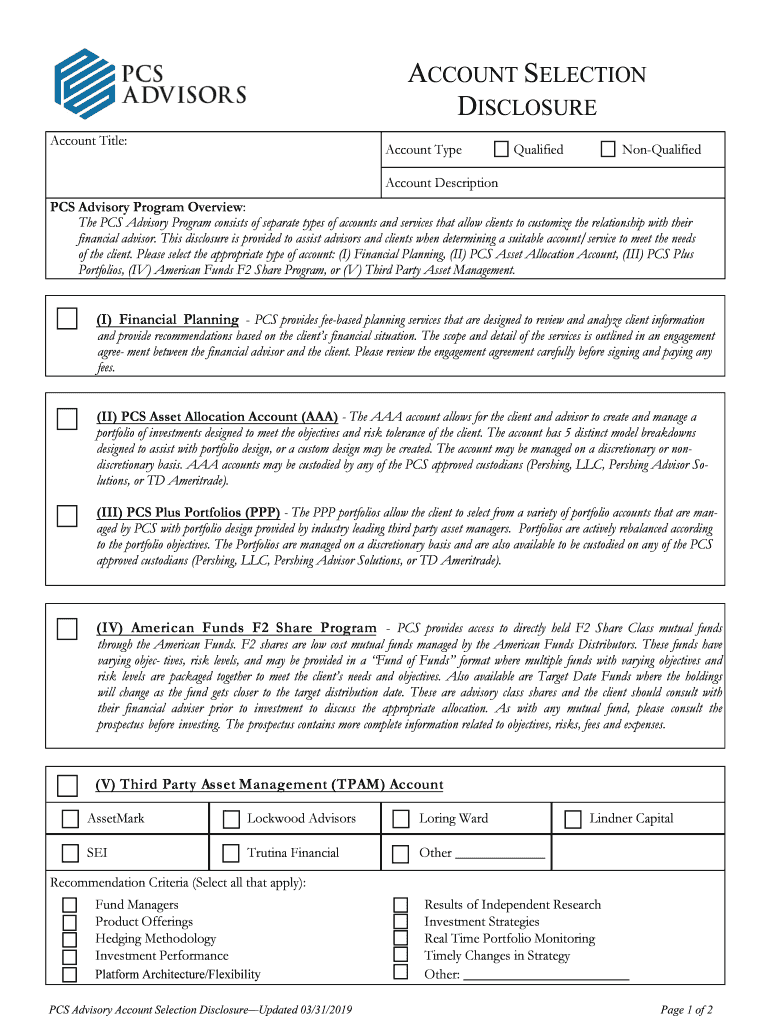

ACCOUNT SELECTION

DISCLOSURE

Account Title:Account TypeQualifiedNonQualifiedAccount Description

PCS Advisory Program Overview:

The PCS Advisory Program consists of separate types of accounts and services

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial advisory services client

Edit your financial advisory services client form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial advisory services client form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial advisory services client online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit financial advisory services client. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial advisory services client

How to fill out financial advisory services client

01

Gather all relevant financial information about the client, including income, assets, debts, and expenses.

02

Assess the client's financial goals and objectives, determining their risk tolerance and investment preferences.

03

Conduct a thorough analysis of the client's current financial situation, identifying any gaps or areas for improvement.

04

Develop a personalized financial plan for the client, taking into account their financial goals, risk tolerance, and time horizon.

05

Present the financial plan to the client, explaining the recommendations and strategies in a clear and understandable manner.

06

Implement the agreed-upon recommendations, assisting the client with opening accounts, transferring assets, and executing investment transactions.

07

Monitor the client's progress towards their financial goals, reviewing the plan regularly and making adjustments as necessary.

08

Provide ongoing support and guidance to the client, answering any questions or concerns they may have along the way.

09

Maintain regular communication with the client, keeping them informed of any changes in the market or their financial situation.

10

Continuously evaluate the client's financial plan and make necessary updates to ensure it remains aligned with their goals and objectives.

Who needs financial advisory services client?

01

Anyone who is seeking professional guidance and assistance in managing their finances can benefit from financial advisory services.

02

Individuals who lack financial knowledge or expertise may need help in making informed decisions about investments, retirement planning, or estate planning.

03

Busy professionals who don't have the time or expertise to manage their finances may seek the services of a financial advisor to take care of their financial affairs.

04

High-net-worth individuals who have complex financial situations and require sophisticated investment strategies may require the expertise of a financial advisor.

05

Business owners who need assistance with financial planning, tax optimization, or business succession planning can benefit from financial advisory services.

06

Individuals experiencing major life events like marriage, divorce, death of a spouse, or inheritance may need help in reviewing and adjusting their financial plans.

07

Young professionals who are just starting their careers and want to establish a solid financial foundation can benefit from the guidance of a financial advisor.

08

Retirees who want to ensure that their savings last throughout their retirement years and need help in managing their income and investments may seek financial advisory services.

09

Families who want to save for their children's education or plan for the future may seek the assistance of a financial advisor.

10

Individuals who want to minimize their tax liability and optimize their financial resources may need the expertise of a financial advisor.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial advisory services client in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your financial advisory services client along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit financial advisory services client straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing financial advisory services client, you can start right away.

Can I edit financial advisory services client on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign financial advisory services client. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is financial advisory services client?

Financial advisory services client refers to a company or individual who seeks advice or guidance on financial matters from a professional financial advisor or service provider.

Who is required to file financial advisory services client?

Any financial advisor or service provider who offers financial advisory services to clients is required to file financial advisory services client.

How to fill out financial advisory services client?

To fill out financial advisory services client, the financial advisor must gather relevant information about the client's financial situation, goals, and risk tolerance, and provide appropriate advice and recommendations.

What is the purpose of financial advisory services client?

The purpose of financial advisory services client is to assist clients in making informed decisions about their finances, investments, and financial goals.

What information must be reported on financial advisory services client?

Information that must be reported on financial advisory services client includes client demographics, financial goals, investment recommendations, and any agreements or contracts between the advisor and client.

Fill out your financial advisory services client online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Advisory Services Client is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.